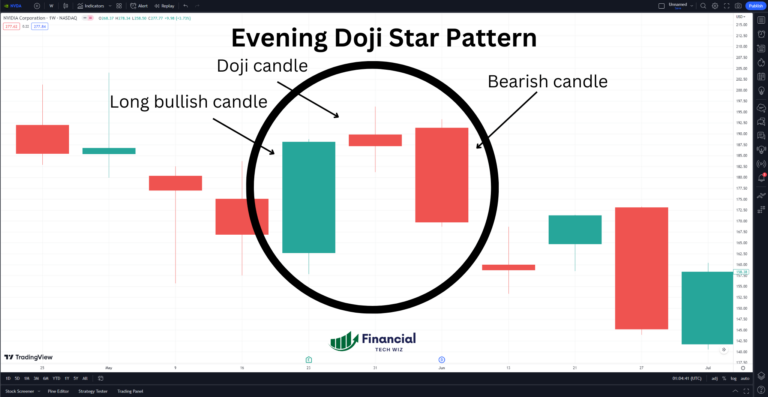

Evening Doji Star Pattern: Decoding the Reversal Pattern

Introduction to the Evening Star Pattern Candlestick patterns are a powerful tool in the world of technical analysis, providing traders with valuable insights into potential price movements. Among these patterns, the Evening Doji Star stands out as a strong bearish reversal pattern that technical analysts often rely on to predict potential downtrends. In this article,…