What is a Covered Call: Portfolio Protection

Selling covered calls is a fantastic way to protect your stock investments.

What is a call option?

A call option is a contract that gives the buyer the right to purchase 100 shares of stock at the strike price. For example, if you buy a call option for stock XYZ with a strike price of $100, you will have the right to purchase 100 shares of stock at $100/ share.

- Buying a call will profit when the stock price increases.

The call option buyer must pay a premium to purchase the contract. This premium is constantly changing depending on the stock price and implied volatility.

Traders can also write or sell call options. Selling a call is the opposite of purchasing one, so you will collect the premium for accepting the obligation to sell 100 shares of stock at the strike price.

- Selling a call will profit when the stock price decreases or doesn’t move.

What is a covered call?

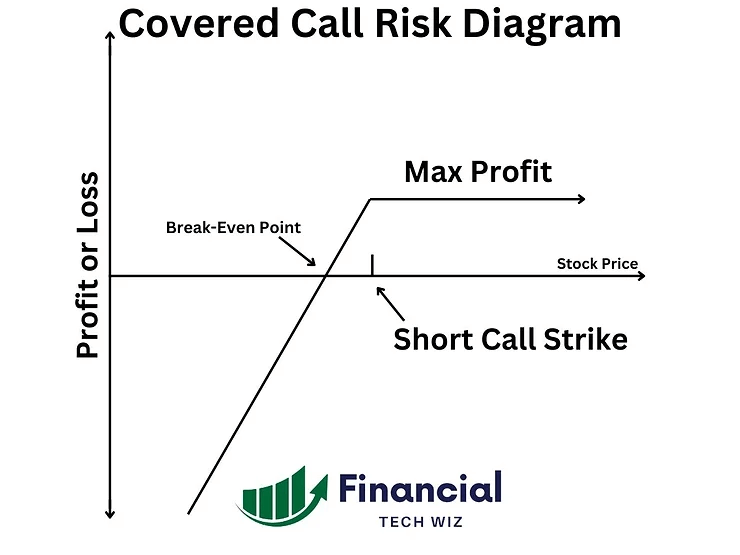

The covered call strategy is when you own 100 shares of a stock and sell a call against those shares. You simply promise to sell your shares and collect the option premium as income. This strategy is a good hedge if you are bullish on the stock long-term but believe it will come down or not move in the short-term.

How does a covered call work?

When you sell a call option, you collect a cash premium in your account, just like a dividend. You can immediately use the premium to purchase more shares or even withdraw it to your bank account.

If the stock price exceeds your strike price, the call might automatically exercise and remove the shares from your account. However, even if they get assigned and the shares get removed from your account, you will still keep the premium as income.

Tips For Selling Covered Calls:

- Pick a strike price you would be okay selling the stock at.

- Use resistance levels to choose strike prices.

- Sell covered calls after the stock price has increased to maximize the premium collected.

- Don’t sell cheap contracts; the risk to reward isn’t worth it.

- Take profit when you collect 50% or more of the premium on the call.

Covered call example

Let’s say that you buy 100 shares of the stock $SPY at $400 per share. If you believe that $SPY will consolidate in the near future, you can sell a covered call with a strike price of $450 to generate some income while holding your shares.

If the shares of $SPY go above your strike price to $480, you must still sell your shares at $450. However, you will still keep the premium if assigned and forced to sell your shares. If the shares are still at or below $450 at expiration, then you will keep your shares and pocket the premium as income.

Note: If you were recently assigned with a cash-secured put, you can complete the wheel strategy by selling a covered call.

What Happens After Selling a Covered Call?

The primary risk involved with this strategy is not the call option; it is the 100 shares of stock. However, a few scenarios can happen after selling a covered call.

1- The stock does not move

It is good when the stock doesn’t move because you make money on the call, and the shares don’t affect you.

2- The stock goes above the strike price

If the stock price exceeds the call’s strike price, you may be obligated to sell them at the strike price. For example, let’s say you bought stock XYZ at $90/ share and sold a covered call with a strike price of $100.

If stock XYZ goes to $110, you will still be obligated to sell the shares at $100. You will still collect the premium, but you will miss out on share price appreciation.

3- The stock decreases in price

When the stock declines in price, the shares lose money, and the call option makes money. The covered call will help hedge your portfolio, but you can incur significant losses if the stock falls hard.

If you own 100 shares of stock, this is 100 deltas of exposure. Many traders sell covered calls with a delta of 30, which will hedge 30 shares of your stock. The 100 shares of the stock are the most prominent risk because they have more delta than the covered call.

If the stock falls, the call’s delta will also drop. Therefore, you will be less hedged when the delta drops as the stock falls. If the call delta gets too low, consider taking profit and selling a new covered call.

The Best Delta for Covered Calls

Traders often use option delta to determine strike prices for covered calls. Ultimately, the best delta to sell depends on each situation.

For example, if you believe the stock has a lot of upside potential, you can sell a lower delta covered call around 10-15 to reduce the chance of your shares being called away.

On the other hand, if you believe the stock will not move much higher, you can sell a call with a delta of 30-50 to collect the most premium and protect against downside movements.

Best Stocks for Selling Covered Calls

Depending on your account size, the best stocks for selling covered calls will differ due to margin requirements. For example, if you have an account of $10,000, you will only be able to trade stocks worth $100 per share or less.

The best stocks for selling covered calls are those you do not mind owning forever. Unlike options, shares of stock don’t expire, so you can hold them all sell calls until your shares get called away.

However, if you pick a stock just because it has a low share price, you do not understand your investment and are more likely to sell it at a loss. You must analyze a stock with technical and fundamental analysis to determine if it’s a good investment.

Bottom Line: What is a covered call?

A covered call is a promise to sell your shares at a specific price, known as the strike price. Regardless of where the stock goes, you collect the option premium as income, making it a consistently profitable strategy.

The main risk is that you must sell your shares at a lower price. However, even in this case, you are still making money, just less profit than you could have made by not selling the covered call.

Therefore, when you sell a call option, you must pick a strike price you are okay with selling your shares. In the worst-case scenario, you miss out on some profit due to a sharp increase in the share price.

Selling covered calls is not about hitting home run trades; instead, it generates consistent income. Additionally, you can buy to close the covered call before it expires to secure profit.

– Free trading journal template

– Custom indicators, watchlists, & scanners

– Access our free trading community