VTSAX vs. VFIAX | Which is Best For You?

If you are looking for a low-cost and diversified way to invest in the U.S. stock market, you may have come across two popular index funds from Vanguard: VTSAX and VFIAX.

Both of these funds offer broad exposure to the U.S. equity market, but they have some key differences that you should be aware of before choosing which one to invest in.

Overview of VTSAX and VFIAX

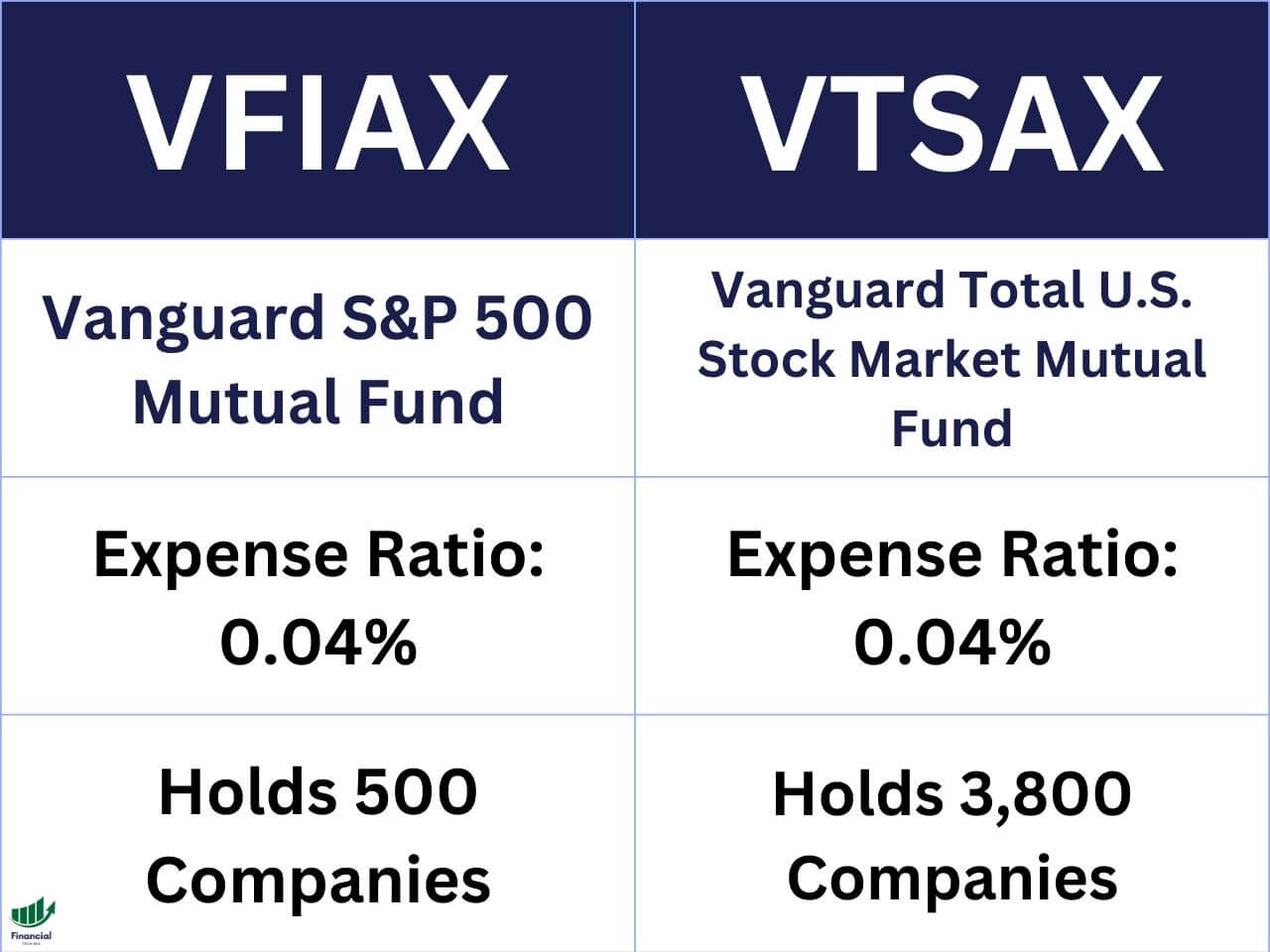

VTSAX (Vanguard Total Stock Market Index Fund Admiral Shares) is a total stock market index fund, meaning that it holds a slice of every publicly traded company in the U.S. stock market.

This makes it the most diversified fund available, as it holds about 3,800 stocks across all sectors and market capitalizations. VTSAX aims to track the performance of the CRSP US Total Market Index, which covers 100% of the investable U.S. equity market.

VFIAX (Vanguard 500 Index Fund Admiral Shares) is an S&P 500 index fund, meaning that it holds the 500 largest companies in the U.S. stock market.

This makes it still diversified, but less so than VTSAX, as it holds only about 13% of the total U.S. equity market. VFIAX aims to track the performance of the S&P 500 Index, which is widely regarded as the best single gauge of the U.S. equity market.

Both VTSAX and VFIAX are passively managed, meaning that they do not try to beat the market but rather match its performance. They also have very low expense ratios, which means that they charge very little fees to investors.

Both funds are suitable for long-term investors who want to capture the growth of the U.S. stock market, but they have different risk and return profiles that you should consider.

VTSAX vs. VFIAX Returns Comparison

One of the most important factors to consider when comparing VTSAX vs. VFIAX is their historical returns. How have these funds performed over time, and which one has delivered higher returns for investors?

The answer is that over the long term, VFIAX has slightly outperformed VTSAX by a small margin. VFIAX generated a bit more return than VTSAX over the past decade, but the difference was not very significant.

The reason why VFIAX has slightly outperformed VTSAX is that it is less diversified and, therefore, more concentrated in the large-cap segment of the market.

Large-cap stocks are generally more stable and profitable than small-cap and mid-cap stocks, and they have performed better in the past decade.

However, this does not mean that VFIAX will always outperform VTSAX, as there may be periods when small-cap and mid-cap stocks outperform large-cap stocks.

Comparing ETFs With TradingView

When comparing ETFs, it is crucial that you are comparing the total return to include dividend payments. TradingView allows you to compare several stocks and ETFs at once on a single chart adjusted for dividends.

You can simply sign up for a free TradingView account and type the stock ticker you want to compare. Next, click the plus sign next to the ticker at the top left of the chart to add symbols to compare.

Finally, ensure you click the ‘ADJ’ at the bottom to adjust the returns for dividends!

As you can see in the TradingView chart below, you can compare multiple funds and ETFs on a single chart, making your research much easier. Feel free to compare any ETFs you’d like using the widget.

VTSAX vs. VFIAX Dividend Yield Compared

| Fund | Dividend Yield |

| VTSAX | 1.58% |

| VFIAX | 1.59% |

Another factor to consider when comparing VTSAX vs. VFIAX is their dividend yield.

Both VTSAX and VFIAX pay dividends quarterly, and they have very similar dividend yields. The dividend yield for VTSAX is 1.58%, while the dividend yield for VFIAX is around 1.59%.

This means that both funds pay about the same amount of dividends to their investors, and they are not a major factor when comparing them.

VTSAX vs. VFIAX Expense Ratio Comparison

| Fund | Expense Ratio |

| VTSAX | 0.04% |

| VFIAX | 0.04% |

Another factor to consider when comparing VTSAX vs. VFIAX is their expense ratio. The expense ratio is the percentage of a fund’s assets that are used to cover its operating expenses, such as management fees, administrative costs, and marketing expenses.

The expense ratio is important because it reduces the fund’s net return to investors, and it can have a significant impact on the fund’s performance over time.

Both VTSAX and VFIAX have very low expense ratios, which is one of their main advantages over other funds. The expense ratio for both VTSAX and VFIAX is 0.04%.

This means that for every $10,000 invested in either fund, you would pay only $4 in annual fees. This is much lower than the average expense ratio of 0.82% for U.S. equity funds, and it makes both funds very cost-efficient.

VTSAX vs. VFIAX Holdings Comparison

Another factor to consider when comparing VTSAX vs. VFIAX is their holdings. Their holdings are important because they affect the fund’s risk and return characteristics, as well as its diversification and correlation with the market.

VTSAX is a total stock market fund, and it holds around 3,800 companies across all sectors and market capitalizations.

VFIAX is an S&P 500 fund, and it holds around 500 companies that represent the largest and most influential companies in the U.S. stock market.

Both VTSAX and VFIAX have similar top holdings, as they are mostly composed of the same large-cap companies. However, VTSAX also holds many more small-cap and mid-cap companies, which gives it more exposure to different sectors and industries.

Both VTSAX and VFIAX are diversified enough to be a core investment holding, but VTSAX will be a bit less volatile than VFIAX, as it holds more companies.

The Financial Tech Wiz ETF Comparison Tool

You can use the ETF comparison tool below to compare over 2,000 ETFs and mutual funds with data I manually collected:

VTSAX vs. VFIAX Minimum Investment

Both VTSAX and VFIAX have a minimum investment of $3,000, which means that you need to have at least that amount of money to invest in either fund.

This can be a barrier for some investors who want to start investing with a smaller amount of money or who want to diversify their portfolio with multiple funds.

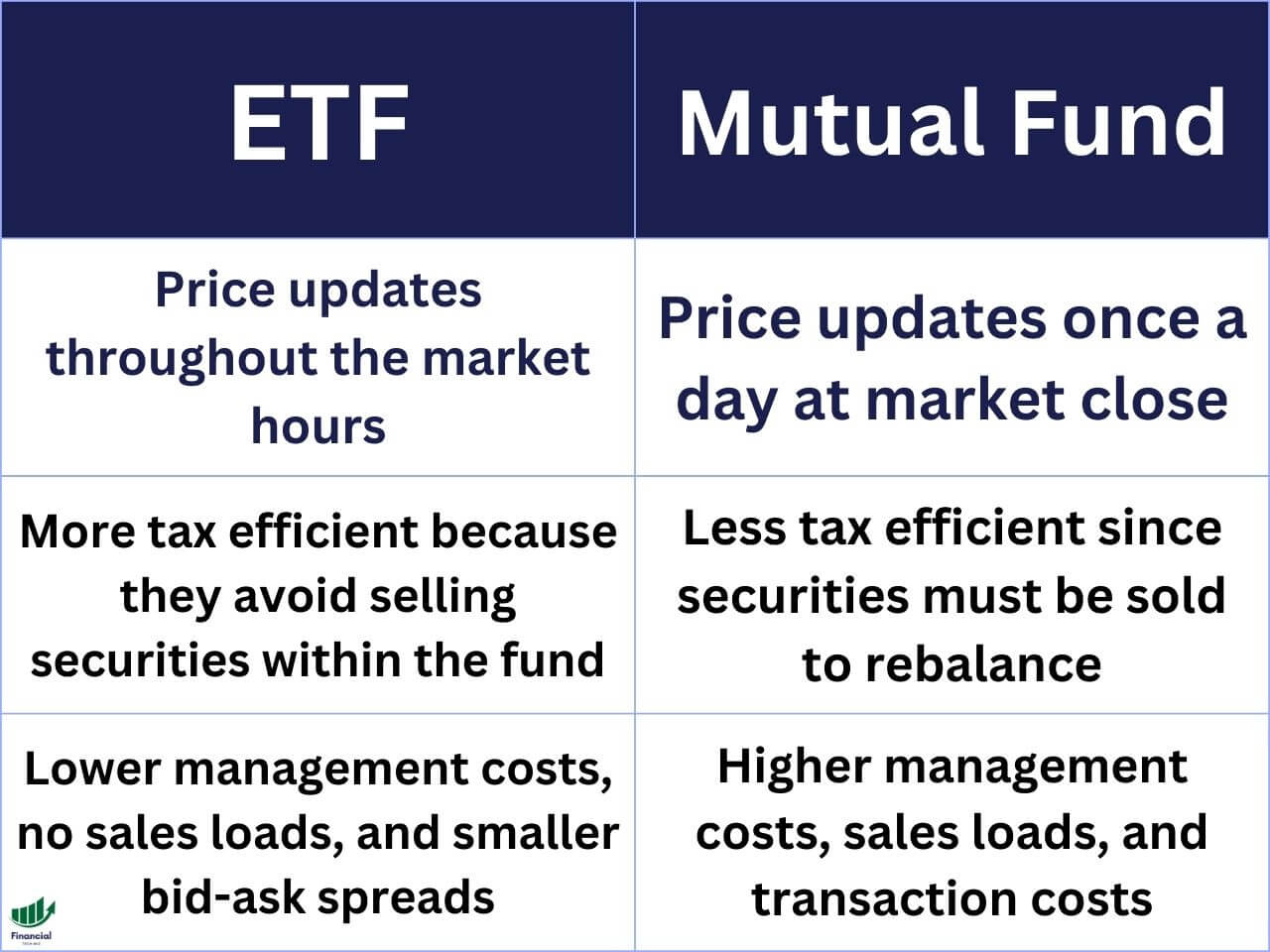

However, there is a way to invest in VTSAX and VFIAX with as little as a few dollars, and that is by using their ETF versions.

VTSAX vs. VFIAX ETF Versions

An ETF, or exchange-traded fund, is a type of fund that trades on an exchange like a stock and that tracks the performance of an underlying index or asset. ETFs have many advantages over mutual funds, such as lower fees, higher liquidity, and more tax efficiency.

VTI (Vanguard Total Stock Market ETF) is the ETF version of VTSAX, and it aims to track the same index as VTSAX.

VOO (Vanguard S&P 500 ETF) is the ETF version of VFIAX, and it aims to track the same index as VFIAX, the S&P 500 Index.

Both VTI and VOO have the same holdings, returns, dividends, and risk profiles as their mutual fund counterparts, VTSAX and VFIAX.

However, one difference is that VTI and VOO have slightly lower expense ratios than VTSAX and VFIAX. The expense ratio for both VTI and VOO was 0.03%, while the expense ratio for both VTSAX and VFIAX was 0.04%.

This means that for every $10,000 invested in either ETF, you would pay only $3 in annual fees, which is $1 less than the mutual fund versions.

Another difference is that VTI and VOO have no minimum investment, unlike VTSAX and VFIAX, which have a minimum investment of $3,000.

The most significant difference is that VTI and VOO can be purchased with fractional shares, which means that you can buy a fraction of a share of either ETF, such as 0.1 or 0.01.

Fractional shares allow you to invest any amount of money that you want, regardless of the share price of the ETF. This makes it even more accessible and flexible for investors who want to invest in VTSAX and VFIAX.

Fractional shares are not available for all brokers, but one of the best ones that offer this feature is tastytrade. Additionally, tastytrade usually offers a cash sign-up when you open a new account. You can check out this tastytrade referral code article for more information!

VTSAX vs. VFIAX - Determine Which One is Best For You!

Now that you have learned about the differences and similarities between VTSAX and VFIAX and their ETF versions, VTI and VOO, you may be wondering which one is best for you.

Ultimately, both VTSAX and VFIAX are excellent funds that offer low-cost and diversified exposure to the U.S. stock market. They are both suitable for long-term investors who want to capture the growth of the U.S. economy, and they have both delivered impressive returns over time.

However, if you have to choose one, you may want to consider the following factors:

- If you prefer more diversification and more exposure to small-cap and mid-cap stocks, you may want to choose VTSAX, as it holds more companies and covers more sectors and industries than VFIAX.

- If you prefer more exposure to large-cap stocks, you may want to choose VFIAX, as it holds fewer companies and is more concentrated in the large-cap segment of the market than VTSAX.

- If you prefer more flexibility and more accessibility, you may want to choose VTI or VOO, as they have slightly lower fees, no minimum investment, and fractional shares than VTSAX and VFIAX.

Whatever you choose, you can’t go wrong with either VTSAX or VFIAX or their ETF versions, VTI or VOO. They are all great funds that can help you achieve your financial goals and grow your wealth over time.

Related Articles

Russell 1000 vs. 2000 vs. 3000

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!