VOO vs. SPY – Which is Best for You?

The S&P 500 is widely regarded as one of the best benchmarks for the health of the stock market and the economy, and it has historically delivered strong returns over the long term.

But which S&P 500 ETF should you choose? There are many options available, but two of the most popular and widely traded ones are VOO and SPY. Both of these ETFs aim to mimic the returns of the S&P 500 index by holding the same stocks in the same proportions as the index.

However, they’d also have some differences that might affect your decision.

Overview of VOO and SPY

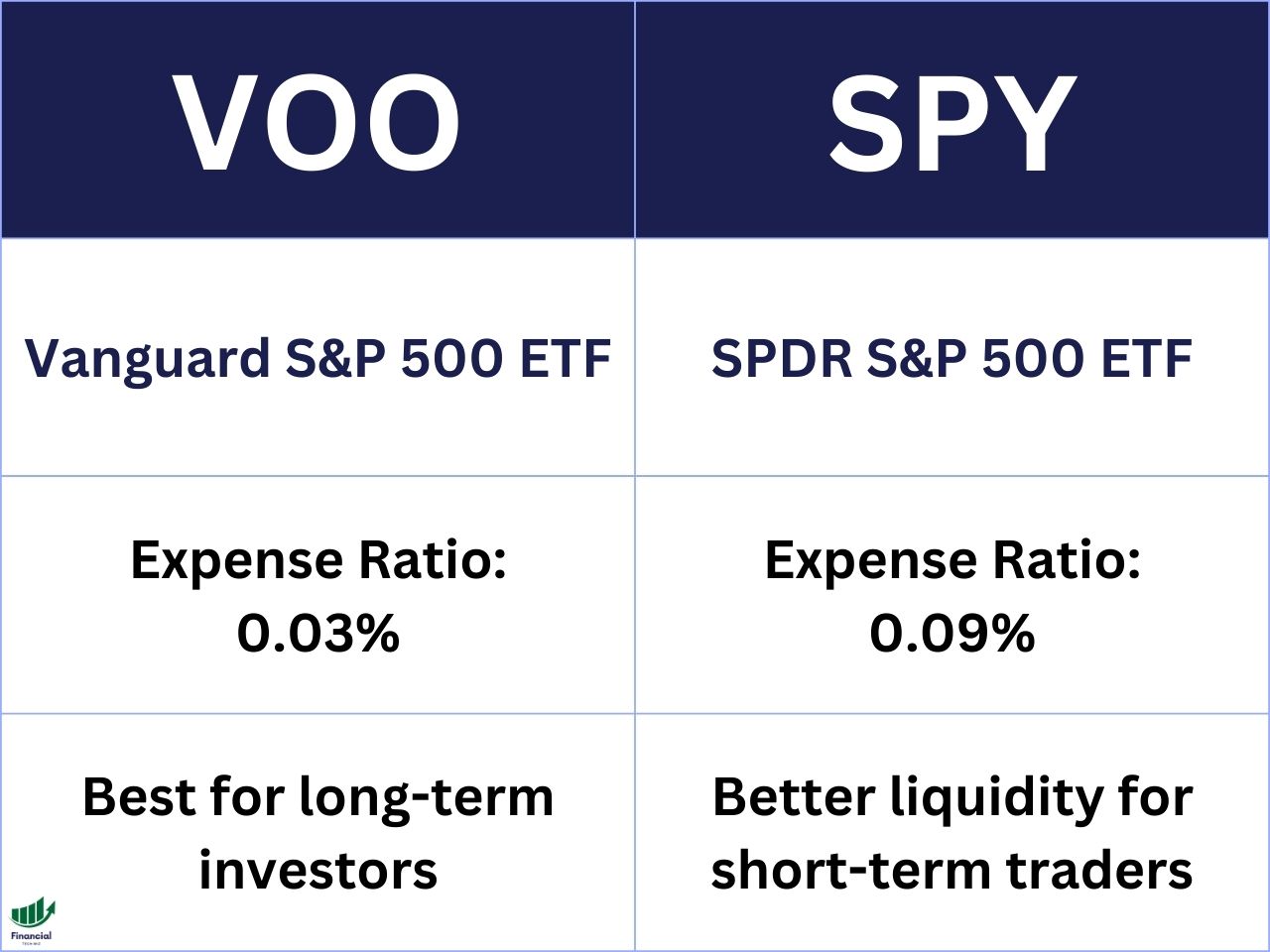

VOO and SPY will essentially have the same performance, as you can see in the chart above. However, which product you choose depends on whether you are an active trader or an investor.

SPY is the best for active traders, while VOO has the lowest expense ratio making it cheaper for investors to hold.

VOO vs. SPY Dividend Yield

One factor that might influence your choice of ETF is the dividend yield. Both VOO and SPY pay quarterly dividends to their shareholders based on the dividends received from the underlying stocks in the S&P 500 index.

| ETF | Dividend Yield |

| VOO | 1.56% |

| SPY | 1.49% |

As you can see, VOO has a slightly higher dividend yield than SPY, but this is not a significant difference and may change over time.

VOO vs. SPY Expense Ratio

Another factor that might affect your choice of ETF is the expense ratio. The expense ratio reduces the net return of the fund to its investors, so a lower expense ratio means more money in your pocket.

Both VOO and SPY have very low expense ratios compared to other funds, but there is a noticeable difference between them, as shown in the table below.

| ETF | Expense Ratio |

| VOO | 0.03% |

| SPY | 0.09% |

As you can see, VOO has a much lower expense ratio than SPY, which means it charges less fees than SPY. This gives VOO an edge over SPY in terms of cost efficiency and long-term investors.

For example, if you invested $10,000 in each fund for 10 years and they both had an annual return of 10%, you would end up with $25,937 in VOO and $25,518 in SPY, a difference of $419 due to the expense ratio.

The Biggest Difference Between VOO and SPY

While both VOO and SPY track the same index and have similar returns, there is one major difference between them that might matter to some investors: liquidity.

Liquidity refers to how easily and quickly you can buy or sell a security without affecting its price or incurring significant transaction costs. Liquidity is important for investors who want to trade frequently, take advantage of market opportunities, or hedge their positions with options.

SPY has a much higher liquidity than VOO, as evidenced by its higher trading volume and lower bid-ask spread. The bid-ask spread is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept for a security. A lower bid-ask spread means less friction and more efficiency in the market.

SPY has an average daily trading volume of about 80 million shares, while VOO has an average daily trading volume of about 3.6 million shares. This means that SPY is more popular and more widely traded than VOO, and it has more buyers and sellers available at any given time.

Moreover, SPY had an average bid-ask spread of about $0.01, while VOO had an average bid-ask spread of about $0.04. This means that SPY has a lower trading cost per share than VOO, and it is easier to buy or sell SPY at a fair price without moving the market.

SPY has the most liquid options market in the world, with hundreds of thousands of contracts traded every day across various strike prices and expiration dates. This means that there are more options contracts available for SPY than for VOO. VOO also has options available, but they are much less liquid and have lower volume and wider spreads than SPY’s options.

If you need a broker that allows you to invest in ETFs or trade options efficiently, consider checking out the tastytrade brokerage. tastytrade offers fractional shares for investors and low fees for active traders, making it one of the best brokerages available.

Therefore, if you are an active trader or an options trader, you might prefer SPY over VOO because of its higher liquidity and lower trading costs. However, if you are a passive investor or a long-term investor, you might prefer VOO over SPY because of its lower expense ratio and slightly higher dividend yield.

VOO vs. SPY vs. QQQ

VOO and SPY are not the only ETFs that track the U.S. stock market. There are many other ETFs that track different segments or sectors of the market, such as QQQ.

The main difference between QQQ and VOO/SPY is that QQQ is more concentrated and more volatile than VOO/SPY. QQQ holds only 100 stocks compared to 500 stocks in VOO/SPY, and it has a higher exposure to growth-oriented sectors that tend to have higher risk and higher reward than value-oriented sectors.

As a result, QQQ has outperformed VOO/SPY in terms of returns over the past decade, but it has also experienced larger drawdowns and fluctuations along the way.

Therefore, if you are looking for a higher growth potential and you are comfortable with higher risk and volatility, you might prefer QQQ over VOO/SPY. However, if you are looking for a more diversified and balanced exposure to the U.S. stock market, you might prefer VOO/SPY over QQQ.

VOO vs. SPY vs. VTI

Another ETF that tracks the U.S. stock market is VTI.

The main difference between VTI and VOO/SPY is that VTI is more diversified and more inclusive than VOO/SPY. VTI holds about 3,600 stocks compared to 500 stocks in VOO/SPY, and it covers the entire U.S. stock market, including small-cap and mid-cap stocks that are not part of the S&P 500 index.

As a result, VTI has a lower concentration risk and a lower exposure to any single sector or company than VOO/SPY. Moreover, VTI had a higher exposure to sectors such as industrials, financials, and real estate than VOO/SPY, which had a higher exposure to sectors such as information technology and communication services.

However, VTI and VOO/SPY have very similar returns over the long term, as they both capture the overall performance of the U.S. stock market.

Therefore, if you are looking for more diversified and comprehensive exposure to the U.S. stock market, you might prefer VTI over VOO/SPY. However, if you are looking for a more focused and liquid exposure to the large-cap segment of the market, you might prefer VOO/SPY over VTI.

Comparing ETFs With TradingView

When comparing ETFs, it is crucial that you are comparing the total return to include dividend payments. TradingView allows you to compare several stocks and ETFs at once on a single chart adjusted for dividends.

You can simply sign up for a free TradingView account and type the stock ticker you want to compare. Next, click the plus sign next to the ticker at the top left of the chart to add symbols to compare.

Finally, ensure you click the ‘ADJ’ at the bottom to adjust the returns for dividends!

As you can see in the TradingView chart below, you can compare multiple funds and ETFs on a single chart, making your research much easier. Feel free to compare any ETFs you’d like using the widget.

SPY vs. VOO | Bottom Line

VOO and SPY are both excellent ETFs that track the performance of the S&P 500 index, which is one of the best proxies for the U.S. stock market and the economy. They have similar holdings, returns, and dividend yields, but they differ in their expense ratios, liquidity, and options volume.

VOO has a lower expense ratio than SPY, which means it charges less fees and has a slight edge in terms of cost efficiency and long-term returns. However, SPY has a higher liquidity than VOO, which means it has a lower trading cost and a higher options volume, making it more suitable for active traders and options traders.

Ultimately, the best ETF for your portfolio depends on your investment goals, risk tolerance, time horizon, and personal preference. Consider our article on VUG vs. VOO as part of your research as well.

If you want to become more profitable on the stock market, you should join the HaiKhuu Trading Community!

HaiKhuu offers daily morning reports and gives you access to an amazing community of experienced traders.

FAQ

What is the difference between VOO and SPY?

VOO and SPY are both ETFs that track the performance of the S&P 500 index, which comprises the 500 largest publicly traded companies in the United States. They have similar holdings, returns, and dividend yields, but they differ in their expense ratios, liquidity, and options volume.

VOO has a lower expense ratio than SPY, which means it charges less fees and has a slight edge in terms of cost efficiency and long-term returns. However, SPY has higher liquidity than VOO, which means it has a lower trading cost and a higher options volume, making it more suitable for active traders and options traders.

Should I invest in QQQ or VOO?

QQQ has higher growth potential and volatility than VOO, as it has outperformed it in terms of returns over the past decade, but it has also experienced larger fluctuations and drawdowns along the way. QQQ is heavily weighted towards the technology and innovation sectors, while VOO is more diversified and balanced across all sectors.

Therefore, if you are looking for higher growth potential and you are comfortable with higher risk and volatility, you might prefer QQQ over VOO. However, if you are looking for a more diversified and balanced exposure to the U.S. stock market, you might prefer VOO over QQQ.

Is SPY the most popular ETF?

SPY is one of the most popular and widely traded ETFs in the world. It was the first ETF ever launched, and it remains one of the largest and most liquid ones in the market.

SPY is popular among investors of all kinds because it provides a simple and low-cost way to invest in the U.S. stock market by tracking the performance of the S&P 500 index. It also has a very liquid options market, which attracts active traders and options traders who want to hedge or speculate on the movement of the index.

Is the SPY ETF safe?

No investment is completely safe or risk-free, and SPY is no exception. SPY is subject to market risk, which means that its value can fluctuate depending on the performance of the underlying stocks in the S&P 500 index. If the stock market declines, so will SPY.

However, SPY is relatively safer than some other investments because it provides diversification by holding 500 stocks across all sectors of the economy. This reduces its concentration risk and exposure to any single sector or company. Moreover, SPY tracks a well-established and reputable index that has historically delivered strong returns over the long term.

Is SPY an active or passive ETF?

SPY is a passive ETF, which means that it does not try to beat or outperform its benchmark index (the S&P 500), but rather tries to match or replicate its performance as closely as possible. SPY does this by holding the same stocks in the same proportions as the index.

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini’s Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading

How to Get a TradingView Free Trial

The Best TradingView Indicators

– Download our free trading journal template

– Access our custom scanners and watchlists

– Access our free trading course and community!