VOO vs. SCHD: Which is Better for Your Portfolio?

VOO vs. SCHD Overview

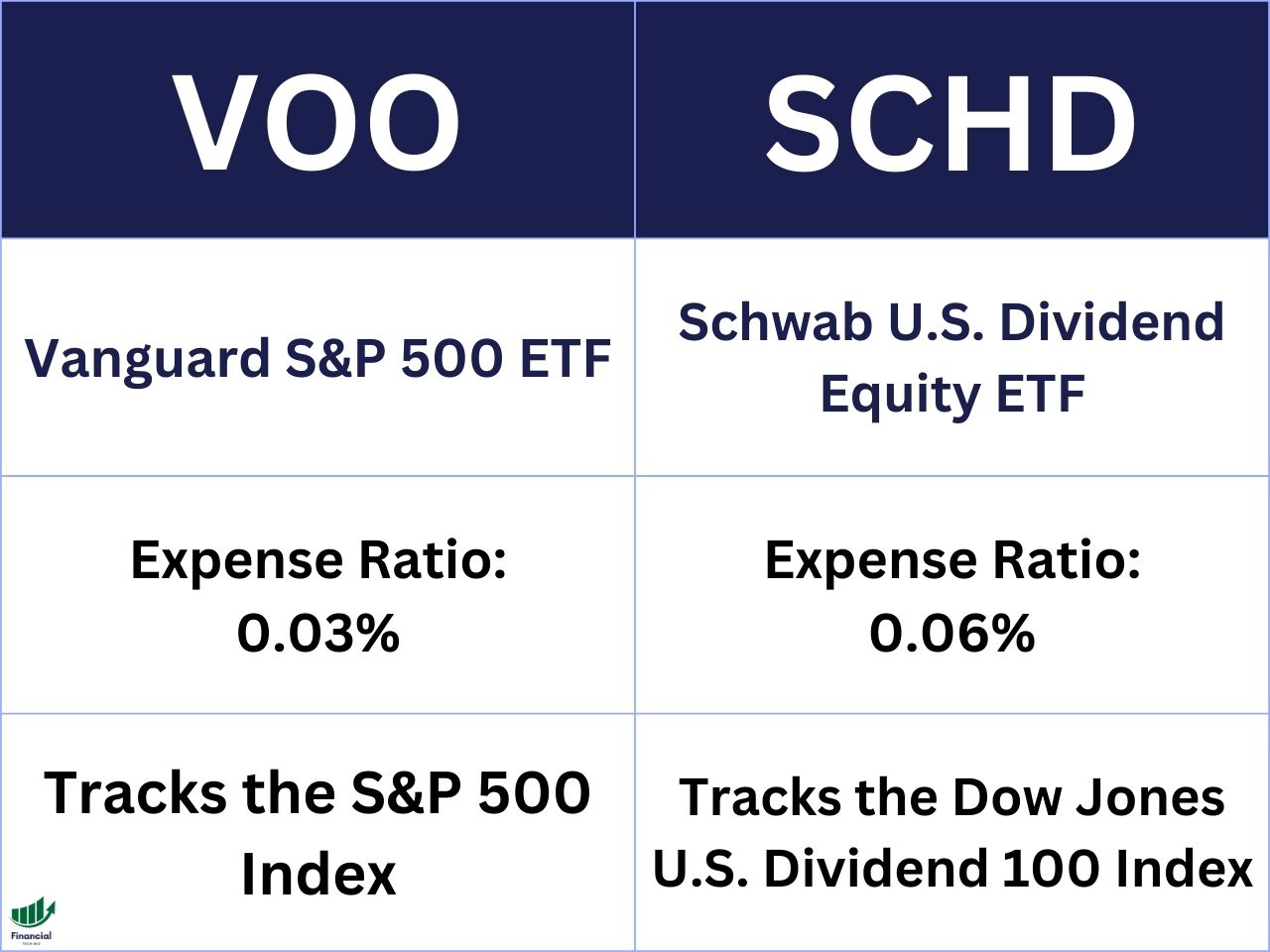

VOO and SCHD are popular exchange-traded funds (ETFs) that provide exposure to the U.S. stock market. This article compares their performance and discusses the difference between these ETFs.

VOO: Vanguard S&P 500 ETF

VOO is a passively managed ETF designed to track the performance of the S&P 500 Index, which represents the 500 largest publicly traded companies in the U.S. The fund was launched in September 2010 and has gained popularity due to its low expense ratio of 0.03%.

SCHD: Schwab U.S. Dividend Equity ETF

SCHD is a passively managed ETF that tracks the Dow Jones U.S. Dividend 100 Index. It focuses on dividend-paying stocks and offers a higher dividend yield compared to VOO. SCHD was launched in October 2011 and has attracted investors seeking dividend optimization. The expense ratio of SCHD is 0.06%, which is slightly higher than VOO.

Performance Comparison

Total Return Comparison from February 2012

- VOO has achieved a total return of 516% since February 2012.

- SCHD has delivered a total return of 392% during the same period

Over long periods these ETFs have provided essentially the same return. Therefore, your choice should depend on your overall investment goals and risk tolerance.

Those who want a higher dividend should opt for SCHD, while those looking for overall market exposure should opt for VOO.

YTD Performance Comparison

- SCHD is up 12% year-to-date (YTD)

- VOO is up 29% YTD

The S&P 500 (VOO) is outperforming in 2024 since it capitalizes on share price growth more than SCHD. The market has increased in 2024, but in years when the market is not so bullish, SCHD will likely outperform.

Join for FREE: Access tons of free educational material!

Don’t miss out – Join now and start learning!

- Free Educational Material

- Community for Like-Minded Traders

- Personalized Trading Education

Comparing ETFs With TradingView

When comparing ETFs, it is crucial that you are comparing the total return to include dividend payments. TradingView allows you to compare several stocks and ETFs at once on a single chart adjusted for dividends.

You can simply sign up for a free TradingView account and type the stock ticker you want to compare. Next, click the plus sign next to the ticker at the top left of the chart to add symbols to compare.

Finally, ensure you click the ‘ADJ’ at the bottom to adjust the returns for dividends!

As you can see in the TradingView chart below, you can compare multiple funds and ETFs on a single chart, making your research much easier. Feel free to compare any ETFs you’d like using the widget.

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

Characteristics and Differences

Diversification and Holdings

- VOO provides broad exposure to the overall U.S. stock market through the S&P 500 Index.

- SCHD focuses on dividend-paying stocks, contributing to its performance during the selected timeframes.

Focus on Dividends and Share Growth

- SCHD’s emphasis on dividend-paying stocks has attracted investors seeking dividend optimization.

- VOO’s broader exposure to the overall U.S. stock market makes it a suitable choice for those seeking share growth from the broader market

VOO vs. SCHD | Bottom Line

When comparing the performance of VOO and SCHD, we can observe that from February 2012, VOO has achieved a slightly higher total return of 516% compared to SCHD’s 392%. However, YTD performance shows SCHD with an increase of 12%, while VOO has gained 29%.

Considering the different characteristics and objectives of VOO and SCHD, investors should carefully evaluate their investment goals and risk tolerance. SCHD’s focus on dividend-paying stocks makes it an attractive option for those prioritizing dividends and share growth. On the other hand, VOO provides broader exposure to the U.S. stock market, appealing to investors seeking overall market share growth.

For a visual representation of the performance and further analysis, you can refer to the TradingView chart comparing VOO and SCHD performance.

The Financial Tech Wiz ETF Comparison Tool

You can use the ETF comparison tool below to compare over 2,000 ETFs and mutual funds with data I manually collected:

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini's Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading

How to Get a TradingView Free Trial

The Best TradingView Indicators

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!