Volatility Contraction Pattern: VCP Trading Mastery

The Volatility Contraction Pattern (VCP) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. This pattern, with its high success rate and low-risk nature, presents a unique opportunity for traders to capitalize on explosive price movements.

In this article, we’ll explore the origins of the VCP and shed light on Mark Minervini’s remarkable trading strategy that leverages the VCP.

Tracing the Origins of VCP

The roots of the VCP can be traced back to Richard D. Wyckoff’s “wave pattern,” and it closely resembles the concept of a bull flag.

However, it was Mark Minervini who popularized the VCP through his trading strategy, as detailed in his books and teachings. Minervini’s strategy has been lauded for its ability to capture high-return trades while effectively managing risk.

How to Identify the Volatility Contraction Pattern

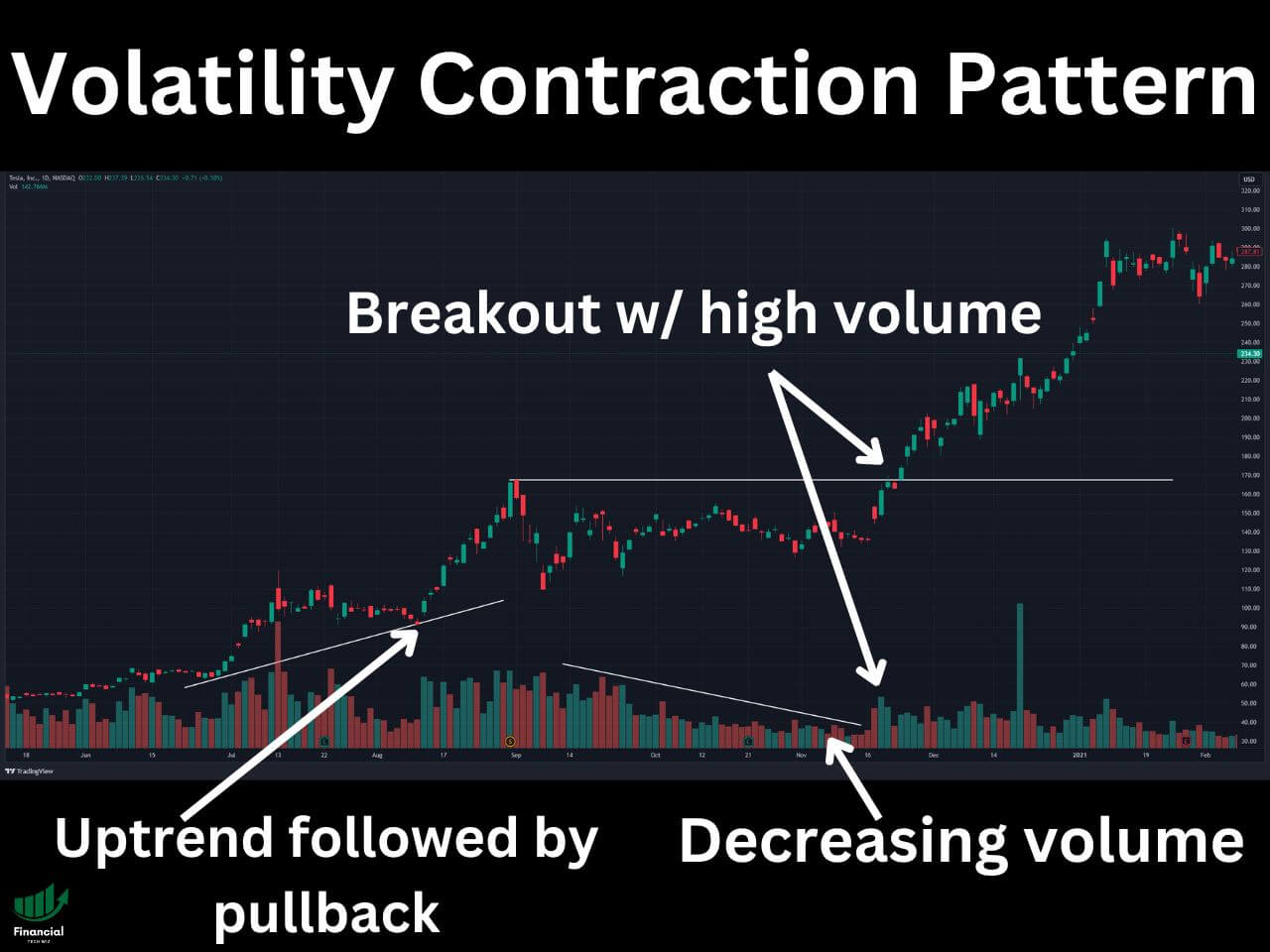

The VCP emerges in the following stages:

- Strong Underlying Demand: A stock exhibiting a strong uptrend with high demand sets the stage for the VCP.

- Recent Overbought/Supply Pressure: After a significant price increase, the stock may experience selling pressure and pull back.

- Diminishing Supply and Decreasing Volatility: The stock’s price action tightens with higher lows, and volume decreases on each pullback, indicating a lack of supply.

- The Breakout: When demand overpowers supply, the stock experiences a breakout marked by a high volume bullish price bar.

Join for FREE: Access tons of free educational material!

Don’t miss out – Join now and start learning!

- Free Educational Material

- Community for Like-Minded Traders

- Personalized Trading Education

Trading Based on the VCP

The proper time to enter a trade using the VCP is when it breaks out with high volume. However, false breakouts can occur, which is when the stock gets immediately rejected after breaking out.

To avoid getting stuck in a false breakout, traders may just a stop loss below the breakout level. If the stock goes back above the breakout level, you can consider getting back in.

Traders can choose to take profit as they wish, but generally, selling into the uptrend and setting stop losses at levels they are happy taking profits is a good way to determine when to sell your position.

Mark Minervini’s VCP Strategy

Mark Minervini’s trading strategy emphasizes the importance of the VCP in identifying low-risk, high-reward trades. A critical factor that makes Mark Minervini’s VCP strategy stand out is his patience.

His approach is characterized by meticulous risk management, a keen understanding of market trends, and the ability to identify VCP setups. The ability to wait for the best trading opportunities is crucial to avoid losing money in the stock market.

Minervini’s success with the VCP is astounding, with claims of making over 33,554% in just five years using primarily this pattern.

Mark Minervini’s Trading Books

Mark Minvervini has written many books about trading that can strengthen your understanding of the VCP:

- Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market

- Think & Trade Like a Champion: The Secrets, Rules & Blunt Truths of a Stock Market Wizard

- Momentum Masters: A Roundtable Interview with Super Traders with Minervini, Ryan, Zanger & Ritchie II

- Mindset Secrets for Winning: How to Bring Personal Power to Everything You Do

TradingView: Your Companion for Technical Analysis

TradingView is a cutting-edge platform for technical analysis and charting, allowing traders to analyze VCP and other patterns with ease. Some of the features and benefits of using TradingView include:

- Comprehensive charting tools and indicators

- Real-time market data and analysis

As a TradingView affiliate, I’m excited to offer you a discount on a premium subscription, and new users can usually get a free trial. Get started with TradingView today and elevate your trading experience!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

Elevating Your Trading Strategy: Final Thoughts

The Volatility Contraction Pattern is more than just a trading pattern; it is a testament to the value of understanding market dynamics, managing risk, and seizing opportunities. Mark Minervini’s trading strategy embodies these principles and has proven to be a blueprint for success.

As you venture into the world of trading, remember to leverage the power of tools like TradingView to enhance your analysis and decision-making. With the right approach and the right tools, the possibilities are endless.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!