The Triangle Chart Pattern Explained

Even the most enthusiastic value investors know technical analysis is critical to well-informed investing. Major news outlets often tout momentum investing as outperforming value-based strategies over the past decade. Likewise, financial service firms showcase the impact of these technical trading strategies and factors.

This article focuses on a specific technical analysis, the Triangle Chart Pattern. We’ll explain what it is, its different types, and how to best use it.

Special Offer: 30-Day FREE Premium Access to Advanced Charting Tools

Take your technical analysis to the next level. Start using TradingView today!

- Automated Chart Pattern Tools

- Real-Time Data

- Customizable Technical Indicators

What is a triangle pattern?

A triangle pattern is technical analysis tool that signals what’s known as a continuation pattern: an equity or currency’s price movement within a specific range after the trend falls or rises. The triangle pattern is used to identify whether the next move in the security is a breakout higher or a breakdown in pricing towards aligned with a bearish sentiment.

Traders versed in technical analysis use the triangle chart pattern to identify whether the current price movement of a stock or currency is bearish or bullish after substantial volatility and newfound upside or downside. As the triangle pattern forms, traders pause and analyze the signals to assess what may come next.

After range-bound trading, the price movement will often continue the same pattern. If it is an uptrend, it is known as a breakout. However, that pattern can fail, and the pricing trend can suddenly and viciously reverse. This is known as a pricing breakdown. As such, making trading decisions based on triangle patterns requires a nuanced understanding of the rules and knowledge of the different types of triangle patterns.

Understanding Triangle Patterns – What are the rules of triangle patterns?

There are no specific rules for interpreting triangle patterns. Instead, there are general guidelines that traders follow in identifying these patterns. Some of these guidelines include:

- Triangle patterns are often considered continuation patterns. In this case, triangles are used to identify breakouts for profitable trades. This consideration is especially true for smaller patterns and often presents the best trading opportunities.

- Conversely, larger patterns in triangles are considered both a continuation trend pattern and an indicator of a reversal trend.

- Breakout of patterns in either direction is often considered to be confirmed when accompanied by a healthy volume increase.

Type of Triangles

There are three types of triangle chart patterns. These include:

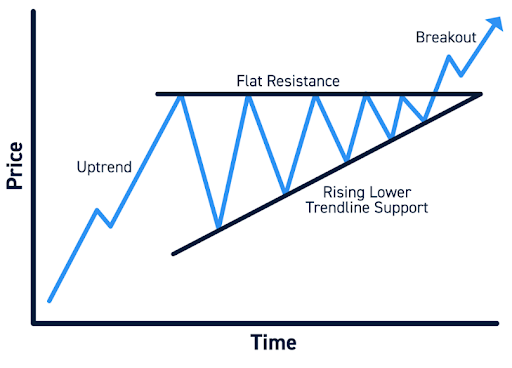

- Ascending Triangle – this is a pricing pattern in which the equity is attempting to make multiple attempts at a new high, but none go above a certain threshold. One can draw a straight horizontal upper trendline across the price chart directly above all those highs. Simultaneously, as the price drops back down from that threshold, the low the price reaches is always higher than the last low that was set. One can draw a straight upward-sloping lower trendline across the price chart directly below all those lows.

This pricing momentum indicates increasing confidence among buyers, slowly increasing their bids to place a rising floor on the price.

This confidence-building transpires slowly and then suddenly as buyers detect the rising trend, and all race to buy at once to avoid missing out on the gains. This manifests a massive breakout higher in price as sufficient buyers have stepped in.

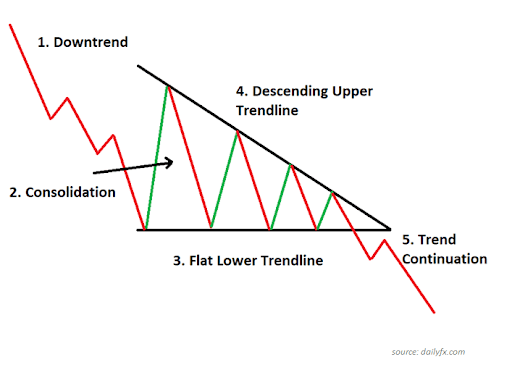

- Descending Triangle – this triangle formation is the inverse of the ascending triangle. In this pricing pattern, the equity or currency makes lower highs at every attempt after an ongoing downward trend before the triangle formation. One can draw a straight downward-sloping trendline across the top of the chart.

This is usually a result of buyers sensing an opportunity to bid after an ongoing downturn, slowly easing back into the trade. At this triangle formation, the pricing trend is usually unsustainable and often continues back towards the downward trend, breaching the lower trendline.

However, it is essential to note that this isn’t a certainty that this will always happen. There is a breakout strategy to be employed depending on the market dynamics and bullishness. As a result, there may be a case for the trend to reverse and break out higher. So it is always important to pay attention to market conditions overall and the narratives driving those trends.

- Symmetrical Triangle – this is a unique triangle formation as the top and bottom trendlines converge to the middle towards one another. It is a tug of war between buyers and sellers where the highs are lower than the prior, and the lows are lower than the earlier lows.

Symmetrical triangle patterns can be tricky as traders must carefully review for the potential of a breakout in prices to move higher or a breakdown of prices where the trend turns bearish. As a result, a symmetrical triangle pattern isn’t sufficient to independently guide pricing movement and must be used in tandem with other types of technical analysis.

How do you use triangle patterns in trading?

Traders can use several triangle formations as signals to find opportunities for breakouts and forecast future price moves. These include:

- The trading opportunity in using triangle patterns is identifying breakouts, that is, when the price of a security exits a continuation pattern and pushes through an upper or lower threshold.

- A breakout higher allows traders to either go long the security or cover their shorts. A breakout lower is an opportunity for traders to open a short position or exit from their long positions.

- Volumes confirm breakouts. It indicates that whatever is driving the price movement has broad appeal among traders.

- Breakouts from symmetrical triangles usually continue the same trend that the security was in before the triangle formed. So, if a stock had been on an upward price trend before entering a consolidation period forming the symmetrical triangle, more often than not, the breakout move would be higher for that stock.

What is the triangle breakout strategy?

The core aim of the triangle chart pattern is to determine a triangle breakout strategy. Traders gauge various triangles that form to determine the direction of the breakout direction, whether it will be an upper or lower threshold that will be breached from the continuation pattern that the price movement may currently be in.

Below are a few triangle breakout strategies to keep in mind as you use triangle patterns in trading:

- Breakouts accompanied by increased trading volume signify a firm conviction among traders, and the breakout is most likely to be successful.

- Conversely, breakouts with low or no volume spikes are likely head fakes and prone to fail. Most breakouts correspond to news or activity around the security, leading to traders jumping into the trade, causing the volume to spike. Absent those spikes in volume connotate, there isn’t sufficient news accompanying the move, thereby unlikely to be sustainable.

- It is essential to note that breakouts accompanied by volume spikes can sometimes fail as well, motivated primarily by short-term trading activity to lock in profits early. However, there are sufficient tactical traders in the market to often sustain the breakouts, given the conditions and activity behind the breakout.

- Most often, the successful breakout strategy is built on triangle patterns observed over several months. A sufficient timeframe is required to build out the cacophony among buyers and sellers that eventually results in the breakout.

Conclusion

Everyone has heard the expression, “the trend is your friend.” Technical analysis is essential in finding profitable market opportunities, especially given the strategy’s outperformance for over a decade.

One form of technical analysis often used by traders as a barometer of great trading opportunities is the triangle chart pattern. This is a continuation pattern or a range-bound price movement for a specific time, and triangle chart patterns can be used to identify which direction the price will trend to next.

Ascending, descending, and symmetrical triangles are the different types of triangles that can form, that traders often identify the potential for bearish or bullish outcomes.

However, the triangle pattern strategy isn’t an all-encompassing panacea, as millions of drivers and narratives can influence pricing action. As such, overall market conditions should be considered, and it is recommended that assessments derived from triangle patterns be used in conjunction with other technical analysis tools.

Triangle Trading Pattern FAQs

Is the triangle pattern bullish or bearish?

Triangle patterns can be used as both bullish and bearish prognostication. Remembering that a triangle pattern indicates consolidation just before a price breakout is essential.

An ascending triangle pattern is a bullish signal as it indicates an upward price breakout, showcasing that buyers are gaining momentum. Conversely, a descending triangle pattern signals bearish sentiment, thereby, a lower breakout based on a rising tide of sellers.

What is the success rate of the triangle pattern?

The success rate of the triangle pattern depends on the trader’s skill level. It can be easier to spot buying opportunities in both ascending and descending triangle patterns, usually after resistance is broken.

However, as good as triangle patterns can be in spotting opportunities, traders must immerse themselves in these patterns’ intricacies and support market conditions to trade on them successfully.

What are the different types of triangles in Forex?

The same type of triangles chart patterns form in Forex as with stocks; ascending, descending, and symmetrical triangles. However, where fundamentals and overall market conditions can impact stocks when reviewing their triangles, it is vital to consider forex chart readings in context to larger narratives regarding countries’ economics and geopolitical situations, given the outsized influence these matters fundamentally exert on currency markets.

What is a triangle pattern in stocks?

A triangle pattern in stocks is a continuation pattern in which the stock price remains range-bound for a specific time. The culminating chart of that stock price form a triangle based on straight lines drawn across the stock price’s upper and lower trends. These triangles form ascending, descending, and symmetrical triangles. Each of these triangle patterns can be used to ascertain the future direction of the stock, whether it’s a higher or lower price breakout.

– Free trading journal template

– Custom indicators, watchlists, & scanners

– Access our free trading community