TradingView vs thinkorswim: Which Platform is Better?

TradingView and thinkorswim are two of the best charting software for stocks, but depending on what assets and broker you trade with determines which is best for you. The main difference is that TradingView is a standalone charting software that anybody can use. On the other hand, thinkorswim is only available for traders with Schwab accounts.

TradingView also supports cryptocurrencies, while thinkorswim does not. Continue reading to learn more about the pros and cons of each platform in terms of technical analysis tools and features.

Key Differences: TradingView vs thinkorswim

- thinkorswim is free to use with a funded Charles Schwab or TD Ameritrade brokerage account.

- TradingView is free to use globally, regardless of your broker.

- You can connect various brokers with TradingView, including Webull, Interactive Brokers, TradeStation, and more.

- Both TradingView and thinkorswim support coding custom indicators and studies.

- TradingView has a cleaner user experience and is less laggy compared to thinkorswim.

- TradingView offers paid plans with advanced features like multiple charts per layout, footprint charts, automated technical analysis tools, and more.

I personally prefer to use a combination of TradingView for charting and either Schwab, Robinhood, or tastytrade to place my trades.

TradingView

- Chart all assets for free on a single platform

- Use footprint, volume profile, and market profile (TPO) charts

- Access to screeners, economic calendars, watchlists, heatmaps, and more

- Access community-made custom indicators built with Pine Script

- Paid plans range from $12-$60 per month for additional features

thinkorswim

- Get free real-time data if you have a funded Schwab account

- Create custom indicators and studies with thinkscript

- Place trades on the platform through your Schwab account

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

TradingView vs thinkorswim – Charting Features

When it comes to charting features, TradingView and thinkorswim both offer plenty of features and customizability, but TradingView offers more advanced charting features like automated trendlines and footprint charts.

thinkorswim allows you to use tons of indicators and create custom ones with thinkscript. TradingView also allows you to use thousands of indicators and even use community-made custom indicators built with its proprietary Pine Script language.

Overall, TradingView wins when it comes to charting features. It allows you to use advanced charting features like volume footprint and TPO charts, which most charting platforms lack. However, thinkorswim allows you to add many more charts per layout compared to TradingView. If you like to have 8+ charts on a single monitor, thinkorswim will be your best option.

It is easier to navigate and manipulate charts on TradingView, as you can zoom in and out with your scroll wheel, while on thinkorswim, you have to click and drag areas to zoom in. TradingView also runs a lot smoother, while thinkorswim can be laggy and slow at times.

TradingView vs. thinkorswim Screeners

Both TradingView and thinkorswim offer screeners, but they support different assets and functions.

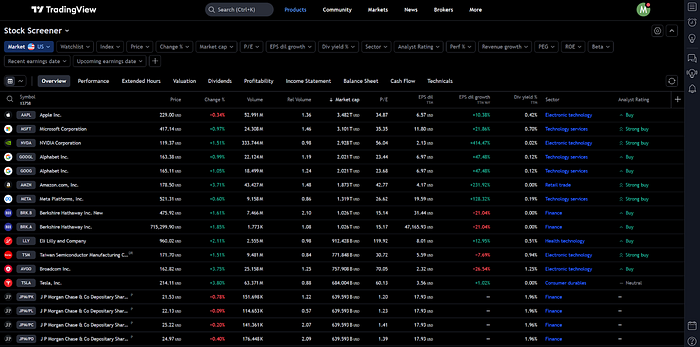

TradingView Screeners

TradingView offers screeners for stocks, ETFs, crypto, forex, and bonds. You can scan for tons of metrics like P/E ratios, dividend yields. beta, volume, and many more for stocks and ETFs.

The crypto scanner allows you to filter for metrics like Tx volume, stablecoins, smart contract platforms, and much more.

thinkorswim Screeners

thinkorswim offers stock hacker and option hacker screeners, which allow you to screen for stocks, ETFs, and options. You can use various metrics, including fundamental data like P/E ratios, market cap, dividend yield, and many more.

TradingView vs. thinkorswim Performance & UX Compared

When it comes to performance and UX TradingView is easily the winner. thinkorswim was made back in the ’90s and has hardly been updated since. thinkorswim is laggy and has a much more dated UX when compared to TradingView.

I practically never experience lag on TradingView, and the user interface is great. However, that is not to say that thinkorswim is not a great charting platform. thinkorswim is still just as customizable as TradingView, but the lack of updates throughout the years definitely shows.

TradingView vs. thinkorswim Accessibility & Pricing

TradingView is accessible to everybody, while thinkorswim is only accessible to those with a Charles Schwab brokerage account. If you have a funded Schwab account, you will also get real-time data for free.

TradingView provides real-time data wherever possible for free, which is available on most popular assets down to the 1-minute charts. You can also opt to purchase additional real-time data directly from the exchanges if the free data source TradingView provides isn’t cutting it for you.

TradingView is completely free to use, but it does offer various paid plans with additional features. Pricing for these plans ranges from $12-$60 per month, depending on which plan you pick.

What Assets do TradingView & thinkorswim Support?

TradingView and thinkorswim support a wide range of assets, including stocks, ETFs, crypto, forex, futures, and more. thinkorswim allows you to trade all of its supported assets through your Schwab account.

TradingView allows you to analyze and chart all of its supported assets, but to trade directly from TradingView, your connected broker must support them. Here is a list of the supported assets of each platform:

TradingView Supported Assets

TradingView supports the following assets:

- Stocks

- ETFs

- Futures

- Options

- Crypto

- Stock Indexes

- Forex

- Bonds

thinkorswim Supported Assets

thinkorswim supports the following assets:

- Stocks

- ETFs

- Futures

- Options

- Futures options

- Crypto futures

- Forex

- Bonds

Both platforms support all of the popular asset classes, but depending on what you’re interested in trading will determine which is best for you. For example, thinkorswim doesn’t allow you to chart or trade cryptocurrencies directly as TradingView does.

How TradingView and thinkorswim Differ

TradingView is a freemium service that provides you with charting, news, stock screeners, advanced indicators, and many more features. It also integrates with various brokers and offers trading for most asset classes, including cryptocurrencies. Many people use TradingView for charting, and place their trades on a separate brokerage account. TradingView is not a brokerage, but a software traders use for charting and other tools.

- Full TradingView Review: Read my full review of TradingView

thinkorswim is also a charting platform, but it is owned by the brokerage Schwab, meaning you must have an funded Schwab or TD Ameritrade account to use the platform. thinkorswim is a free platform that only works with Schwab and TD Ameritrade and offers trading for stocks, options, bonds, futures, currencies, and Bitcoin futures.

| Platform | Compatible Brokers | Assets Offered | Options Trading | Pricing |

|---|---|---|---|---|

| TradingView | Various brokers, including Interactive Brokers, Tradovate, AMP Global, OANDA, Forex.com, and Gemini | Stocks, bonds, commodity futures, currencies, and cryptocurrencies | Analyze nearly live options chains and risk diagrams | Freemium service with different plans ranging from $12.95 to $59.95 per month. |

| thinkorswim | Only TD Ameritrade & Schwab | Stocks, bonds, commodity futures, currencies, and Bitcoin futures | Supported with options chain data and P&L charts | Free platform for TD Ameritrade & Schwab customers. |

TradingView vs thinkorswim Pros & Cons

TradingView

Pros

- View free charts with nearly real-time data for stocks, futures, crypto, and forex

- Supports trading for stocks, bonds, commodity futures, currencies, and cryptocurrencies

- Integrates with a variety of brokers, such as Interactive Brokers, Tradovate, AMP Global, OANDA, Forex.com, and Gemini

- Allows you to trade directly from the charts or use paper trading to practice without risking real money

Cons

- The level of integration may vary depending on the broker and the asset class

- Does not support options trading, but does provide options analysis tools

- Requires a paid subscription to access advanced features and services

thinkorswim

Pros

- Supports trading for stocks, options, bonds, commodity futures, currencies, and Bitcoin futures

- Fully integrated with Schwab or TD Ameritrade’s brokerage services and account management

- Supports options trading and includes options chain data and risk diagrams for multi-leg options strategies

Cons

- Only works with Schwab (formerly TD Ameritrade) and requires a TD Ameritrade or Schwab account to use the platform

- Does not support cryptocurrency trading or provide cryptocurrency price data

- May have higher commissions and fees than some other brokers

TradingView vs. thinkorswim: Which Trading Platform Is Better for You?

Overall, TradingView is the better platform since it offers more features and the user interface is much more modern. It also offers tons of features for crypto, while thinkorswim only supports the charting of crypto futures.

thinkorswim is great if you already have a funded Schwab account, since you will be able to access real-time stock and futures data for free. You can also place trades directly through the thinkorswim platform, which routes through your Schwab account.

Ultimately, I recommend you try out both platforms to determine which suits your needs better.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

FAQ: TradingView vs thinkorswim

Is TradingView compatible with TD Ameritrade?

No, TradingView is not compatible with TD Ameritrade. TradingView works with a variety of different brokers, but TD Ameritrade is not one of them. On the contrary, Thinkorswim is exclusive to TD Ameritrade and Schwab clients and only allows trading through a TD Ameritrade or Schwab account.

Is TradingView the best charting tool?

TradingView is widely regarded as one of the best charting tools available online. Technical analysts favor it for its wide range of technical indicators, drawing tools, and charting features that can be customized. It also supports the automation of trading strategies through its Pine Script programming language.

Can I trade directly from TradingView?

Yes, you can trade directly from TradingView if you have an account with one of the supported brokers. TradingView integrates with brokers such as Interactive Brokers, Tradovate, AMP Global, OANDA, Forex.com, and Gemini. You can also use paper trading to practice your skills without risking real money.

How much is TradingView a month?

TradingView offers both free and paid subscription plans. The free version provides access to basic features, while the paid plans unlock additional features and data. The paid plans range from $14.95 to $59.95 per month, depending on the level of service and billing frequency. If you use my link, you can get a discount on your premium subscription!

Do I need a broker for TradingView?

No, you can use TradingView’s charting features without a broker. However, if you want to place trades, you will need a brokereage account, which TradingView does not provide. TradingView does not provide brokerage services itself but rather connects you with various brokers that offer different asset classes and trading conditions

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!