TradingView vs Finviz: Comparing Key Features

Two of the most popular platforms for technical and fundamental analysis are TradingView and Finviz. In this article, we’ll take a closer look at both platforms’ and I’ll show you why I believe TradingView is the overall best charting and analysis platform.

TradingView vs Finviz at a Glance

- TradingView is much better for charting and technical analysis compared to Finviz.

- Finviz is best for basic stock screening and fundamental analysis.

- TradingView supports all assets, including stocks, crypto, forex, futures, and more, while Finviz only supports stocks.

- TradingView and Finviz both offer free screeners, but TradingView offers them for more assets than just stocks.

- Best charting tools, indicators, and chart types

- Access real-time data for most assets for free

- Screeners available for stocks, crypto, forex, and bonds

- Best for fundamental analysis and basic stock screener

- Does not provide intraday charting for free

- Screeners only available for stocks

TradingView vs Finviz Pros & Cons

TradingView

Pros

- Provides excellent charting with real-time data for free

- Provides screeners for many assets free

- Modern and user friendly charting interface

- Offers advanced charting features like footprint, market profile, and volume profile

- Use up to 8 charts per layout of non-professional plans

Cons

- Advanced features like footprint require highest subscription tier

Finviz

Pros

- Provides basic screeners for free

- Offers auto trendlines for charts

- Fundamental data and ratios are easy to read at a glance

Cons

- Intraday charting is for paid plans only

- Lacks many charting features like drawing tools and indicators compared to TradingView

- More expensive pricing than TradingView

Key Features of TradingView

TradingView stands out as a feature-rich platform that offers a range of tools to assist traders and investors in their decision-making process. Below are some of the platform’s key features:

- Advanced charting and technical analysis tools: TradingView provides interactive and customizable charts with various technical indicators, drawing tools, and chart types.

- Social trading community: One of the unique aspects of TradingView is its vibrant social community, where users can share trading ideas, strategies, and insights with others.

- Customizable stock screener: The platform offers a powerful stock screener with additional filter parameters, allowing users to narrow their search based on specific criteria.

- Screeners for other markets: In addition to stocks, TradingView also provides screeners for forex, cryptocurrency, and other markets.

- Integration with brokerage accounts: Users can link their brokerage accounts to TradingView, enabling them to place trades directly from the platform’s charts.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

Key Features of Finviz

Finviz, on the other hand, is known for its focus on fundamental stock screening and ease of use. Here are some of the notable features of Finviz:

- Fundamental stock screening: Finviz offers a robust stock screener with a range of filter parameters for both technical and fundamental analysis.

- Heatmaps and simple news feed: The platform provides heatmaps for a quick overview of market trends and a simple news feed for keeping up with relevant financial news.

- Ease of use: Finviz is designed with user-friendliness in mind, allowing users to visualize stock market data on a single screen rapidly.

- Lack of a social community: Unlike TradingView, Finviz does not have a social community or forum for users to share ideas and strategies.

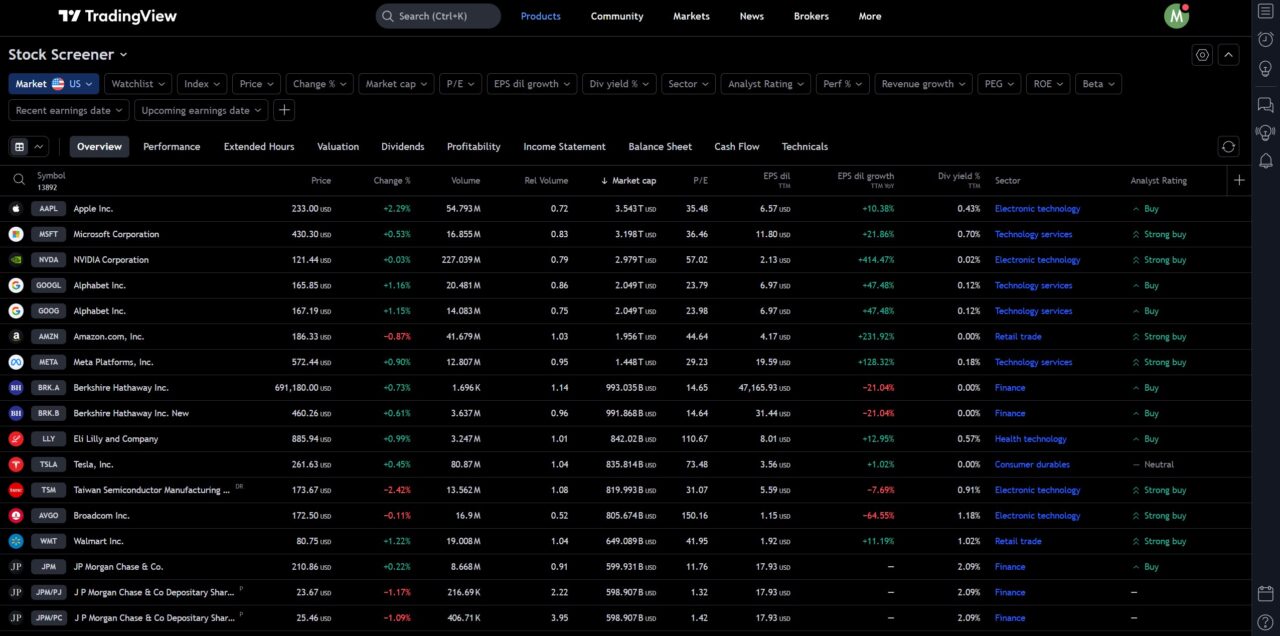

TradingView vs Finviz Screeners Compared

TradingView and Finviz both offer excellent screeners. Finviz offers a great stock screener, while TradingView offers screeners for stocks, bonds, ETFs, crypto, forex, and even DEX pairs.

TradingView’s Screeners

- Stock screener: Scan using multiple metrics like P/E ratios, market cap, sector, analyst ratings, earnings, performance %, and various other fundamental criteria.

- Crypto screener: Scan for crypto pairs in various currencies based on circulating supply, market capperformance, transaction volume, top gainers/losers, new highs/lows, and more.

- Forex screener: Screen for performance, oscillators, new high/lows, rising/falling pairs, most volatile pairs, and more.

- Bond screener: Scan for bonds by maturity date, coupon %, coupon frequency, YTM%, exchange, issuer, bond type, and more.

- DEX pair screener: Scan for pairs based on performance, transaction volume, trading volume, exchange, liquidity, and more.

Overall, TradingView’s screeners are excellent regardless of which asset you are trading. You can also save and share your screening criteria for future use. Few platforms offer screeners for all assets, including crypto, forex, and bonds, giving TradingView a unique edge in screening.

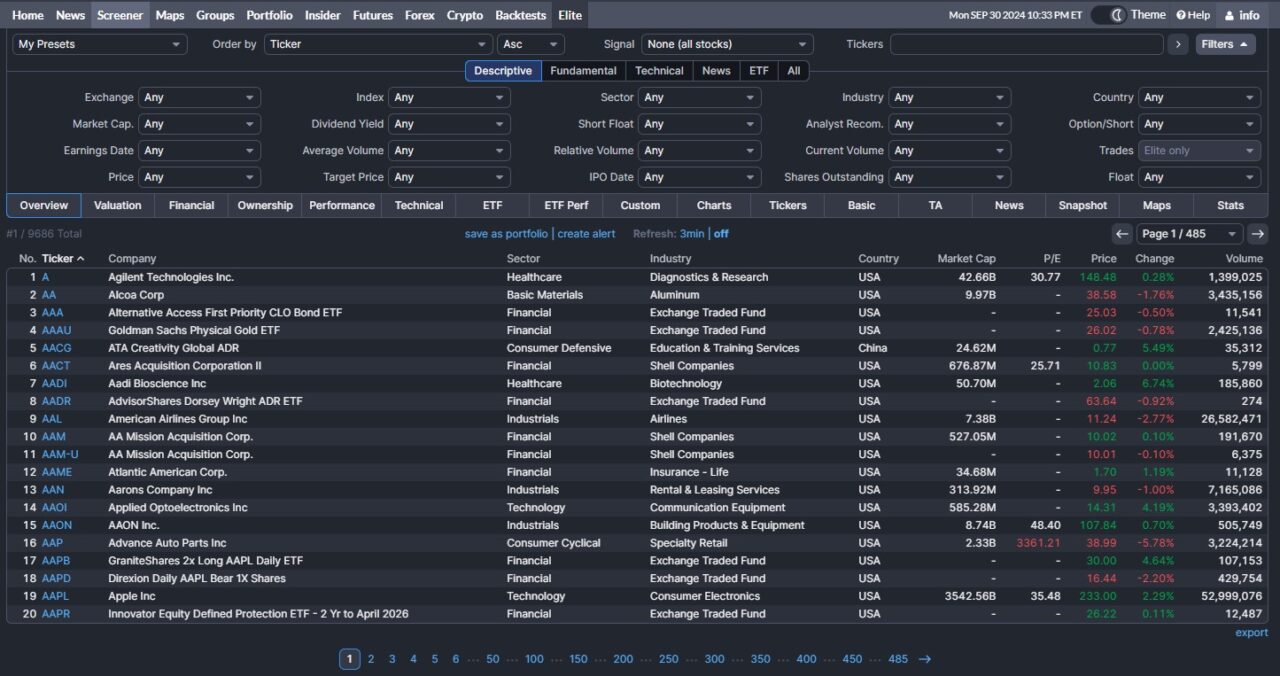

Finviz’s Stock Screener

Finviz only offers a stock screener, but it does a great job. Here is a quick overview of what it can do:

- Stock screener: Quickly find stocks based on market cap, dividend yield, sector, fundamental ratios like P/E, shares outstanding, and more.

- You can also save and share your screen criteria for ease of use.

Strengths and Limitations of TradingView & Finviz

Each platform has its own strengths and limitations that make them suitable for different types of users:

- TradingView’s advantages include advanced charting capabilities, a social trading community for idea sharing, and a more customizable stock screener.

- Finviz’s strengths lie in its focus on fundamental stock screening, simplicity, and rapid visualization of stock market data.

When choosing between the two, it’s important to consider your trading style, investment goals, and preference for community engagement.

Pricing and Subscription Plans

Both TradingView and Finviz offer a range of subscription plans to cater to different user needs:

| Platform | Plan | Monthly Price | Yearly Price | Key Features Summary |

|---|---|---|---|---|

| TradingView | Essential | $12.95 | $155.40 | Basic features with limited charts and alerts. |

| Plus | $24.95 | $299.40 | Enhanced features with more charts and indicators. | |

| Premium | $49.95 | $599.40 | Comprehensive features with extensive charting options. | |

| Finviz | Free | Free | Free | Limited features, delayed quotes, no advanced charts. |

| Registered | Free | Free | Similar to free, with added screening options. | |

| Elite | $39.50 | $299.50 | Real-time quotes, advanced charts, and email alerts. |

- TradingView: Offers free and paid plans, with the paid plans providing additional features and data access. The paid plans include Essential, Plus, and Premium tiers. If you sign up for TradingView using our link, you can get a free trial plus a discount on your subscription.

- Finviz: Provides a free plan with basic features, as well as an Elite subscription plan that offers real-time data, advanced charting, and more. If you plan to sign up for Finviz Elite, consider using our Finviz affiliate link!

Choosing the Right Platform for Your Needs

Here are some factors to consider when choosing between TradingView and Finviz:

- Trading style and investment goals: Are you a day trader, swing trader, or long-term investor? Your trading style and objectives will influence which platform best meets your needs. TradingView is much better for active traders.

- Need for community engagement: If you value the ability to share ideas and strategies with other traders, TradingView’s social community may be a significant advantage.

- Preference for technical vs. fundamental analysis: Depending on whether you prioritize technical chart analysis or fundamental stock screening, you may find one platform more suitable than the other. TradingView is best for technical analysis.

- Ultimately, the decision comes down to your individual preferences and how you plan to use the platform to achieve your trading and investment goals.

TradingView vs. Finviz | Bottom Line

TradingView and Finviz are both powerful platforms, each with its own set of features and strengths. TradingView excels in its charting capabilities, customizable stock screener, and social trading community. On the other hand, Finviz shines with its fundamental stock screening tools, ease of use, and rapid market data visualization.

If you’re looking for the best charting features, TradingView is the clear winner. It is also the most well-rounded platform overall, which is why I believe TradingView is the superior platform for Finviz. However, Finviz is great for a quick fundamental analysis and does have a solid stock screener. I would recommend testing out both platforms, and maybe even using a combination of both! You should also consider my TradingView review article as part of your research.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!