What is the Keltner Channel on TradingView? A Complete Guide

Are you looking for a reliable indicator that can help you identify price trends, volatility levels, and potential trading opportunities? If so, you might want to check out the Keltner Channel on TradingView.

The Keltner Channel is a banded indicator that shows you the range of price movement around a moving average. It can help you spot overbought and oversold conditions, breakouts, trend reversals, and more.

In this guide, you’ll learn everything you need to know about the Keltner Channel on TradingView, including:

- What is the Keltner Channel and why should you use it?

- How to set up the Keltner Channel on TradingView

- How to trade with the Keltner Channel on TradingView

- How to combine the Keltner Channel with other indicators or chart patterns

By the end of this guide, you’ll be able to use the Keltner Channel on TradingView to improve your trading performance and make better trading decisions.

What is the Keltner Channel, and Why Should You Use It?

The Keltner Channel was created by Chester Keltner, a commodity trader and financial analyst, in his 1960 book How to Make Money in Commodities. Since then, it has been modified and improved by various traders and analysts, most notably Linda Bradford Raschke.

The Keltner Channel consists of three lines:

- The Upper Envelope, which is a moving average plus a multiple of the average true range (ATR)

- The Middle Line, which is a moving average of price (usually an exponential moving average)

- The Lower Envelope, which is a moving average minus a multiple of the ATR

The ATR is a measure of price volatility that takes into account the high, low, and close of each candlestick. The multiple of the ATR determines the width of the envelopes. The higher the multiple, the wider the envelopes.

Here’s how the Keltner Channel looks like on TradingView:

The Keltner Channel has several advantages over other banded indicators, such as Bollinger Bands or Moving Average Envelopes. Some of these advantages are:

- The Keltner Channel is less prone to false signals or whipsaws, as it uses the ATR instead of the standard deviation to measure volatility. The ATR is more stable and consistent than the standard deviation, which can fluctuate wildly depending on the price action.

- The Keltner Channel can adapt to different market conditions, as it expands and contracts with the ATR. This means that the envelopes can adjust to the changing volatility and price range of the market, giving you more accurate signals.

- The Keltner Channel can help you identify price trends, as it shows you the direction and strength of the moving average. When the price is above the middle line, it indicates an uptrend. When the price is below the middle line, it indicates a downtrend. The steeper the slope of the middle line, the stronger the trend.

How to Set Up the Keltner Channel on TradingView

Setting up the Keltner Channel on TradingView is easy and straightforward. Here are the steps you need to follow:

- Open any chart on TradingView and click on the Indicators button at the top of the screen.

- Type “Keltner Channel” in the search box and select the indicator from the list.

- The Keltner Channel will appear on your chart with the default settings. You can customize these settings by clicking on the Settings icon next to the indicator name.

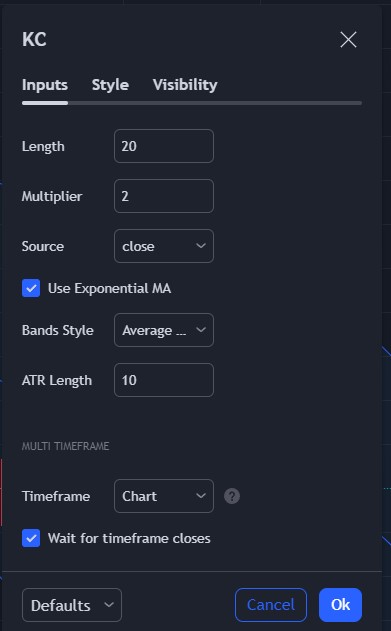

- In the settings window, you can change various parameters of the Keltner Channel, such as:

- Indicator Timeframe: Specifies the timeframe that the indicator is calculated on. This option allows calculating KC based on data from another timeframe, e.g., having KC calculated on 1H chart be displayed on a 5m chart.

- Length: The time period to be used in calculating the MA which creates the base for the Upper and Lower Envelopes (20 is the default).

- Multiplier: The multiplier to be applied to the bands.

- Source: Determines what data from each bar will be used in calculations. Close is the default.

- Use Exponential MA: Determines if a simple or exponential moving average will be used for the basis.

- Bands Style: Determines if high/low range or average true range will be used for the bands.

- ATR Length: The time period to be used in calculating the Average True Range.

- Style: Allows you to change the color, thickness, and style of the Upper, Middle, and Lower lines. You can also toggle the visibility of a background color within the bands.

Once you’re happy with your settings, click on OK to apply them to your chart.

How to Trade with the Keltner Channel on TradingView

Now that you have the Keltner Channel on your chart, how do you use it to trade? There are several ways to trade with the Keltner Channel, depending on your trading style and objectives. Here are some of the most common and effective strategies:

Breakout Trading

One of the simplest and most popular ways to trade with the Keltner Channel is to look for breakouts above or below the envelopes. A breakout occurs when the price closes outside of the envelopes, indicating a strong price movement in that direction.

A breakout above the upper envelope signals a bullish breakout, meaning that the price is likely to continue rising. A breakout below the lower envelope signals a bearish breakout, meaning that the price is likely to continue falling.

To trade breakouts with the Keltner Channel, you can use the following rules:

- Wait for a candlestick to close above or below the envelopes.

- Enter a long position if the breakout is above the upper envelope, or a short position if the breakout is below the lower envelope.

- Place a stop-loss order below or above the opposite envelope, or use a trailing stop to lock in profits as the price moves in your favor.

- Exit your position when the price reaches your target, or when it reverses and closes back inside the envelopes.

Trend Following

Another way to trade with the Keltner Channel is to use it as a trend following indicator. This means that you trade in the direction of the prevailing trend, as indicated by the position and slope of the middle line.

When the price is above the middle line and the middle line is sloping upward, it indicates an uptrend. When the price is below the middle line and the middle line is sloping downward, it indicates a downtrend.

To trade trend following with the Keltner Channel, you can use the following rules:

- Identify the direction and strength of the trend by looking at the position and slope of the middle line.

- Enter a long position if the price is above the middle line and the middle line is sloping upward, or a short position if the price is below the middle line and the middle line is sloping downward.

- Place a stop-loss order below or above the opposite envelope, or use a trailing stop to lock in profits as the price moves in your favor.

- Exit your position when the trend changes, or when it reaches your target.

Mean Reversion

A third way to trade with the Keltner Channel is to use it as a mean reversion indicator. This means that you trade against the prevailing trend, expecting that the price will revert to the mean, which is the middle line.

When the price is above the upper envelope, it indicates that the price is overbought and likely to fall. When the price is below the lower envelope, it indicates that the price is oversold and likely to rise.

To trade mean reversion with the Keltner Channel, you can use the following rules:

- Wait for the price to reach or cross the upper or lower envelope.

- Enter a short position if the price is above the upper envelope, or a long position if the price is below the lower envelope.

- Place a stop-loss order above or below the opposite envelope, or use a trailing stop to lock in profits as the price moves in your favor.

- Exit your position when the price reaches or crosses the middle line, or when it reaches your target.

How to Combine the Keltner Channel with Other Indicators or Chart Patterns

The Keltner Channel can be a powerful indicator on its own, but it can also be combined with other indicators or chart patterns to confirm or enhance your signals. Here are some of the most common and effective combinations:

- Moving Averages: You can use moving averages to filter out noise and identify the long-term trend. For example, you can use a 50-period simple moving average (SMA) to determine the trend direction, and only trade in that direction with the Keltner Channel. Alternatively, you can use a faster moving average, such as a 10-period exponential moving average (EMA), to act as a dynamic support or resistance level, and trade with the Keltner Channel when the price bounces off or breaks through the EMA.

- Oscillators: You can use oscillators, such as the Relative Strength Index (RSI) or the Stochastic Oscillator, to measure the momentum and strength of the price movement. For example, you can use the RSI to confirm overbought and oversold conditions with the Keltner Channel, and look for divergences or convergences between the price and the RSI. Alternatively, you can use the Stochastic Oscillator to identify potential trend reversals with the Keltner Channel, and look for bullish or bearish crossovers between the %K and %D lines.

- Candlestick Patterns: You can use candlestick patterns, such as doji, hammer, engulfing, or shooting star, to indicate the sentiment and psychology of the market participants. For example, you can use a doji candlestick to signal indecision or uncertainty with the Keltner Channel, and look for a confirmation candlestick in the next period. Alternatively, you can use a hammer or shooting star candlestick to signal a possible reversal with the Keltner Channel, and look for a confirmation candlestick in the opposite direction.

Conclusion

The Keltner Channel is a versatile and effective indicator that can help you identify price trends, volatility levels, and potential trading opportunities on TradingView. You can use it to trade breakouts, trend following, mean reversion, or any combination of these strategies. You can also combine it with other indicators or chart patterns to confirm or enhance your signals.

The Keltner Channel is easy to set up and customize on TradingView, and you can experiment with different settings and strategies to find what works best for you. If you want to learn more about the Keltner Channel or other TradingView indicators, check out our other articles on VWAP TradingView, Best TradingView Indicators, and TradingView Moving Average.

We hope you enjoyed this guide on how to use the Keltner Channel on TradingView. If you’d like to get a discount on your premium subscription, feel free to use our affiliate link!

– Free trading journal template

– Custom indicators, watchlists, & scanners

– Access our free trading community