How to Backtest on TradingView – A Simple Guide

Backtesting is a critical step in the development and evaluation of trading strategies. By simulating trades based on historical data, traders can assess how a strategy would have performed in the past.

This provides valuable insights into its potential future performance. Among various platforms available for backtesting, TradingView stands out as a popular choice. In this article, we’ll explore how you can backtest trading strategies on TradingView, including manual and deep backtesting options. If you are an options trader, consider looking for an options backtesting software.

Can You Backtest on TradingView?

Yes, TradingView offers robust tools for backtesting trading strategies. The platform provides two primary methods for backtesting:

- Manual Backtesting: Using the Bar Replay function, traders can manually simulate trades based on historical price data.

- Automated Backtesting: Using the Strategy Tester, traders can run automated strategies programmed in Pine Script, TradingView’s programming language.

Both methods offer unique advantages and are suitable for different trading styles and requirements.

Can You Backtest for Free on TradingView?

Yes, you can backtest for free on TradingView using the platform’s Bar Replay and Strategy Tester features. However, it’s important to note that the free BASIC subscription on TradingView limits users to daily chart data for backtesting. Unfortunately, intraday data, which is essential for day traders, is not available for free users.

To gain access to intraday data for backtesting purposes, users need to upgrade to a premium subscription. With a premium subscription, traders can backtest their strategies using intraday data across various timeframes, making it more suitable for day traders and those who trade on shorter timeframes.

The good news is that TradingView usually offers a 30-day free trial for new users, allowing you to test out the platform’s backtesting features, including access to intraday data, without any cost. This trial period is a great opportunity to explore the benefits of premium features and make an informed decision about upgrading your subscription.

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

How Do I Manually Backtest on TradingView for Free?

To manually backtest on TradingView for free, you can use the Bar Replay function. However, with the free BASIC subscription, you will only have access to daily chart data. Here’s how to manually backtest using the Bar Replay function with daily data:

- Open a TradingView chart and select the instrument and daily timeframe you want to backtest.

- Click on the ‘Replay’ icon in the top menu bar of the chart.

- Set the start date and time for the replay by clicking on the chart.

- Control bar playback using the ‘Play’ or ‘Forward’ functions.

- Begin backtesting by progressing through the daily bars until your strategy’s trade setup parameters are satisfied.

- Set up trades using the ‘Buy or Sell Position tool’ and record results in your trading journal.

- Repeat the process with as much daily data as possible to get reliable backtest results.

Keep in mind that daily chart data may not be suitable for day traders. To access intraday data for more precise backtesting, consider upgrading to a premium subscription.

Backtesting Using the Strategy Tester

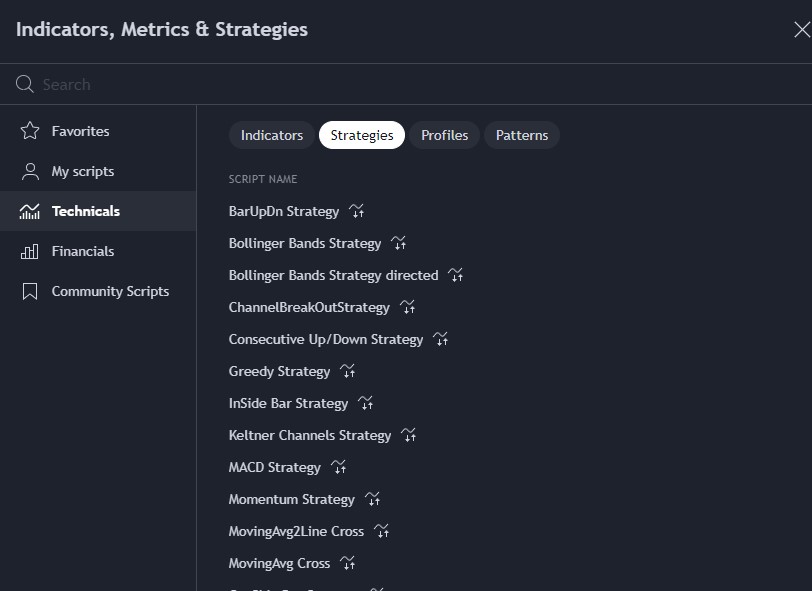

TradingView has plenty of premade strategies that you can use for backtesting in the strategy tester. Alternatively, you can write your own script.

To backtest using the strategy tester on TradingView, follow these steps:

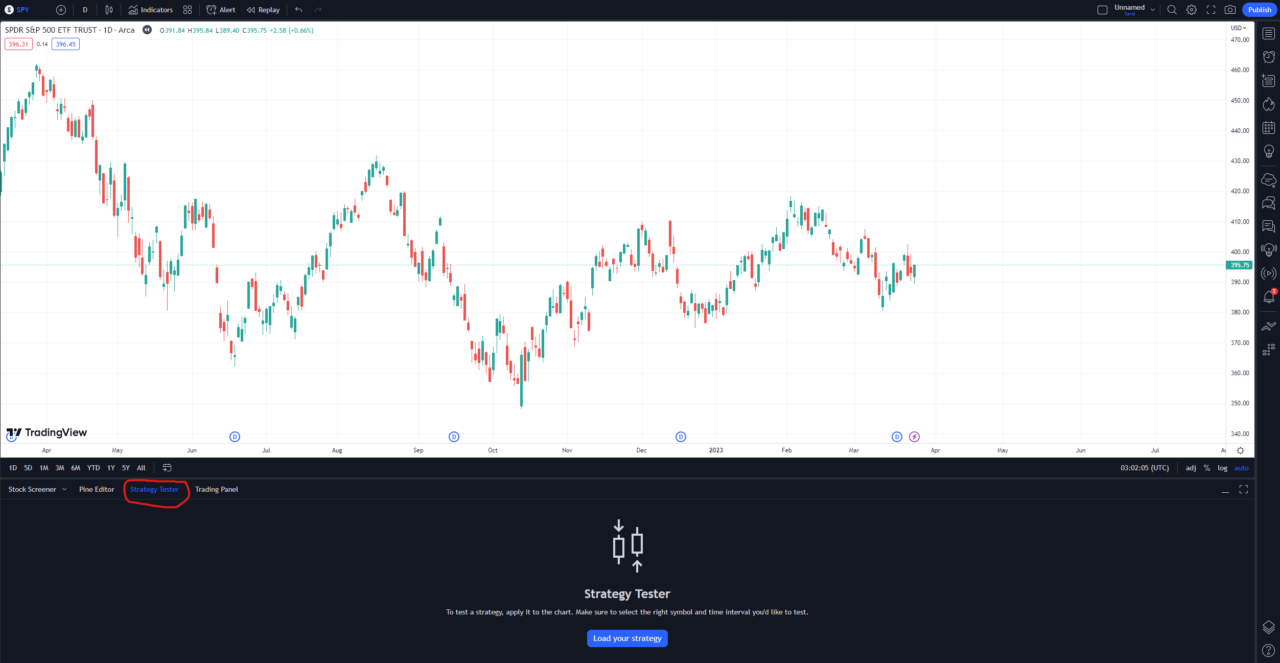

- Click strategy tester at the bottom of the chart

- Click load your strategy

- Select a strategy from the list of premade strategies, or use your own

- Analyze the performance by looking at entries and exits on the chart and viewing the list of trades at the bottom of the screen

What is Deep Backtesting TradingView?

Deep backtesting on TradingView refers to the ability to backtest trading strategies using all available historical data for the selected instrument.

Unlike regular backtesting, which may be limited by the amount of historical data loaded on the chart, deep backtesting provides access to the entire dataset, including intraday data.

The advantages of deep backtesting include:

- Comprehensive Analysis: Test strategies over a larger range of historical data, including intraday data, for enhanced reliability.

- Detailed Insights: Identify patterns and trends that may not be evident in a smaller dataset.

- Greater Accuracy: Improve the precision of your backtesting by considering a broader market context.

How to Get a TradingView Discount

If you’re interested in exploring TradingView’s advanced features, you’ll be pleased to know that the platform usually offers free trials for its upgraded plans. When you use my link, you will also get a discount for your subscription.

TradingView Limited Time Offer!

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

FAQs

What is backtesting in trading, and why is it important?

- A: Backtesting is a method used by traders to assess the performance of a trading strategy using historical data. It allows traders to evaluate how a strategy would have performed in the past before risking real capital. Backtesting helps traders gain confidence in their strategies, identify potential weaknesses, and make informed decisions based on historical simulations.

Q: Can I backtest custom strategies on TradingView?

- A: Yes, TradingView allows users to backtest custom strategies using its proprietary scripting language called Pine Script. Traders can develop and test their unique trading strategies by coding the entry and exit rules, implementing indicators, and incorporating specific conditions. TradingView’s Pine Script offers a powerful and flexible environment for creating and backtesting custom strategies.

Q: How far back can I backtest on TradingView?

- A: The availability of historical data for backtesting on TradingView may vary depending on the specific market and instrument. Generally, TradingView provides a substantial amount of historical data, allowing traders to analyze performance over extended periods. However, it’s essential to check the data availability for the particular asset or market you are interested in before conducting backtests.

Q: Can I backtest multiple time frames using TradingView?

- A: Yes, TradingView’s Strategy Tester allows traders to backtest strategies on multiple time frames. This feature enables traders to analyze strategy performance across different time intervals, from shorter intraday time frames to longer-term charts. Backtesting on multiple time frames can provide a comprehensive understanding of how a strategy behaves in different market conditions.

Q: How can I optimize my trading strategies through backtesting?

- A: Backtesting offers an opportunity to optimize trading strategies. Traders can adjust various parameters, such as entry and exit rules, indicator settings, and risk management techniques, based on backtesting results. By iteratively testing and refining strategies, traders can enhance performance, minimize risks, and identify the optimal parameters for their trading approach.

Q: What are the common pitfalls to watch out for in backtesting?

- A: Traders should be aware of common pitfalls in backtesting, such as overfitting or curve-fitting strategies to historical data, unrealistic assumptions, and ignoring transaction costs and slippage.

Before you go

If you want to keep educating yourself about trading, you must check out these posts as well:

TradingView Paper Trading Tutorial

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini’s Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading

How to Get a TradingView Free Trial

The Best TradingView Indicators

The Best Keyboards For Trading

This article contains affiliate links I may be compensated for if you click them.

– Free trading journal template & cheat sheet PDFs

– Custom scanners, watchlists, & market commentary

– Access our free trading course and community