TC2000 Review

TC2000 offers a comprehensive trading solution with high-quality charting, scanning, and brokerage capabilities. TC2000 is perfect for those who wish to have a good tool for analyzing and trading markets within one single interface. In this review, we will dissect the features, charges, and overall use of TC2000 and offer traders information to make the decision as to whether or not this platform suits their trading systems.

Exclusive Deal: $25 Off Your First Month

Limited Time Offer – Join TC2000 Today!

- Powerful Charting

- EasyScan Technology

- Custom Indicators

Key Takeaways

- TC2000 is excellent for live market scanning and charting integration with trade execution.

- The platform features tiered pricing structures that are attractive to different levels of trading involvement and needs.

- While it possesses strong technical analysis and trading capabilities, the additional charge for live data and not being able to backtest historically may be unattractive to some.

What is TC2000?

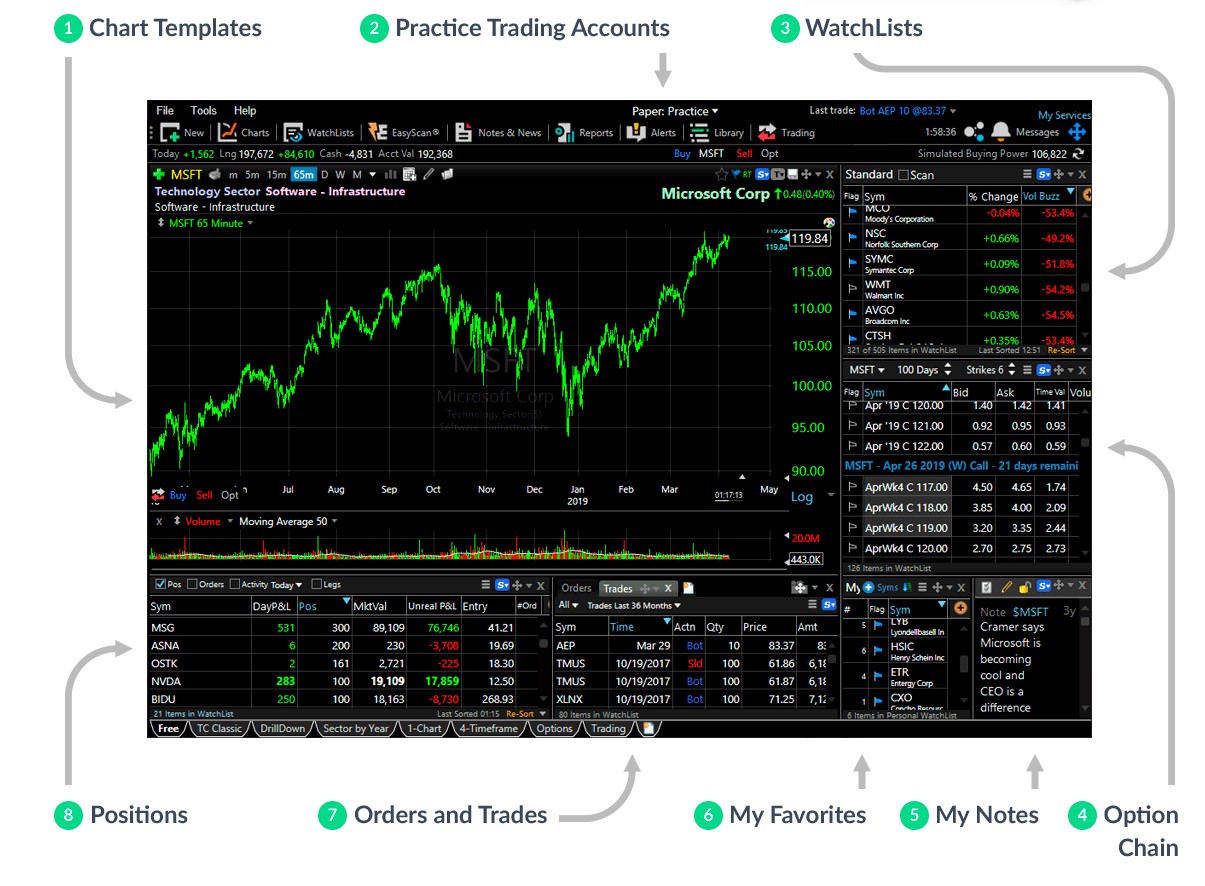

Worden Brothers created TC2000, a trading platform that combines charting, scanning, and brokerage services. It can be accessed via desktop, web, or mobile apps, enabling traders to monitor markets and place trades from anywhere. With these tools consolidated into one platform, it becomes an invaluable resource for traders who need to make fast, well-educated decisions using real-time information.

TC2000 Pricing Overview

TC2000 Software Pricing

| Plan | Monthly | Annual (Effective Monthly Rate) | Key Features |

|---|---|---|---|

| Silver | $9.99 | $8.32/mo | Basic charts, watchlists |

| Gold | $29.99 | $24.99/mo | Charts + EasyScan stock screener + drawing tools |

| Platinum | $59.99 | $49.99/mo | Real-time EasyScan scanning + 1000 alerts |

Optional Real-Time Data Add-ons:

- U.S. Stocks: $14.99/mo

- U.S. Options: $9.99/mo

- U.S. Indexes: $9.99/mo

- Dow Jones (Realtime): $2.50/mo

- MT News: $1/mo

TC2000 Brokerage Pricing

| Plan | Stocks & ETFs | Options | Notes |

|---|---|---|---|

| Small Trader Plan | $1 + $0.005 per share | $1 + $0.65/contract | Default plan |

| Active Trader Plan | $5 + $0.001 per share | $5 + $0.35/contract | For 1000+ shares or 10+ contracts |

Trading Notes:

- 4:1 Intraday buying power

- 2:1 Overnight buying power

- SIPC insured

TC2000 Features Breakdown

Charting

TC2000 is known for its uncluttered, fast-loading charts that support several chart types including candlestick, Heikin Ashi, and bar charts. Traders can customize layouts and take advantage of over 100 technical indicators and drawing tools like trendlines and Fibonacci retracements to enhance their analysis abilities.

EasyScan Stock Screener

The EasyScan feature allows users to scan in real-time and end-of-day, combining technical and fundamental analysis. With pre-defined scans and user-defined formulas, traders can efficiently identify market opportunities.

Options Trading and Analysis

TC2000 supports options trading directly from the charts and offers sophisticated analysis tools like Greeks and built-in strategies, enabling traders to manage and execute options trades with ease.

Watchlists and Alerts

Users are able to create their own watchlists and set up to 1000 real-time alerts to monitor market movement effectively and receive notifications based on pre-defined conditions.

Fundamentals and Sector Analysis

The platform provides tools for fundamental analysis and comparing stocks to sector peers, which is a treasure trove for traders using long-term investment strategies.

Trading Simulator (Paper Trading)

TC2000 comes with a simulator that lets traders hone their methods in a non-risk environment, making it an excellent tool for beginners.

TC2000 vs TradingView

While TC2000 features superior real-time scanning and execution, TradingView has a richer set of charting customizations and Pine Script-based scripting.

Full TC2000 vs TradingView review article

TC2000 vs Thinkorswim (TOS)

TC2000 is simpler to set up scans and is best suited for end-of-day swing trades, whereas Thinkorswim provides more options analysis and is a free option for TD Ameritrade customers.

Complete TC2000 vs Thinkorswim comparison article

TC2000 vs TrendSpider

TC2000 excels at intuitive scanning and real-time alerting, whereas TrendSpider is suited for automated chart pattern recognition and backtesting.

Complete TC2000 vs TrendSpider comparison article

TC2000 vs Interactive Brokers

TC2000 has improved scanning and charting, while Interactive Brokers provides a superior high-volume trader commission model and better asset class coverage.

Full comparison article of TC2000 vs Interactive Brokers

Pros and Cons Summary

Pros

- Blazing-fast execution and scanning

- Smooth trading and chart integration

- Excellent customer service

- Extensively customizable layouts and watchlists

- Real-time EasyScan scanning (Platinum)

Cons

- Levies stocks and options commission

- No complete historical backtesting

- Mac users require Parallels to utilize desktop application

- Real-time data feeds require an extra fee

Final Verdict: Worth TC2000?

TC2000 is ideal for active day and options traders who need instant scanning and in-chart trading features. Although the cost is justified for heavy traders, occasional traders may be better served by cheaper alternatives. Suitable plans are Gold for swing traders and Platinum for day traders who require live alerts.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!