tastytrade Review: The tastytrade Options Strategy

tastylive is excellent for beginners to learn, but their strategies may not always be great in practice.

tastytrade review

tastylive produces a lot of content, and their general recommendations about trading options are relatively straightforward. The best thing about tastylive is that their data is based on backtests and qualitative data. Additionally, the tastytrade platform is amazing for beginners.

Tom Sosnoff, the founder and CEO of tastylive, sold the Thinkorswim platform to TD Ameritrade before creating tastyworks (formerly tastytrade).

tastytrade usually offers an excellent sign-up bonus of up to $5,000, so consider signing up for a tastytrade brokerage account!

Trading criteria tastylive follows:

- Sell options when IV is high.

- Use the expiration closest to 45 DTE.

- Sell options with a 30 delta.

- Take profit when you collect 50% of the premium.

- Roll forward and don’t change the strike price at 21 DTE to reduce gamma risk.

- Trade small and often.

You can learn from the most experienced derivative traders by reading these books. If you trade options, you are doing yourself a disservice for not reading them.

However, we must discover if tastylive is legit, so let’s review their trading mechanics.

The problem with these mechanics

Sell options when IV is high:

Generally, selling options when implied volatility is high is a good idea. Options are more expensive, and you can get paid more premium. However, blindly trading options on stocks just because of their high IV is not a good way to select stocks to trade.

Let’s take the Russian ETF RSX, for example. When the Russia and Ukraine war started, the IV of RSX skyrocketed. Tom Sosnoff of tastylive sold put options on RSX and got obliterated.

High IV can continue higher! Eventually, it will likely contract, but this doesn’t mean your strike price will go back OTM. If you sold a put that went far ITM, you could be rolling this option out for years, collecting minimal premium.

If you were also selling calls, your risk would be mitigated a tiny bit, but not nearly enough to make you profitable on the trade overall. Additionally, if you keep taking profit and rolling your call down, you can easily get whipsawed and lose to the upside.

Use the expiration closest to 45 DTE:

There is nothing inherently wrong with selling options that expire in 45 days. However, if tastylive is so concerned about gamma risk, trading 60+ DTE options would be better.

Gamma risk, in basic terms, is the risk that your option will rapidly move ITM. Gamma risk is higher with shorter expirations because your strike price is closer to the spot price when using the same delta.

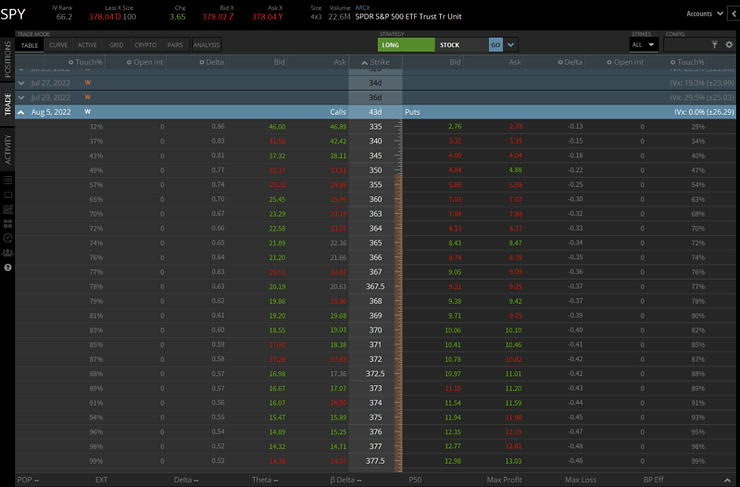

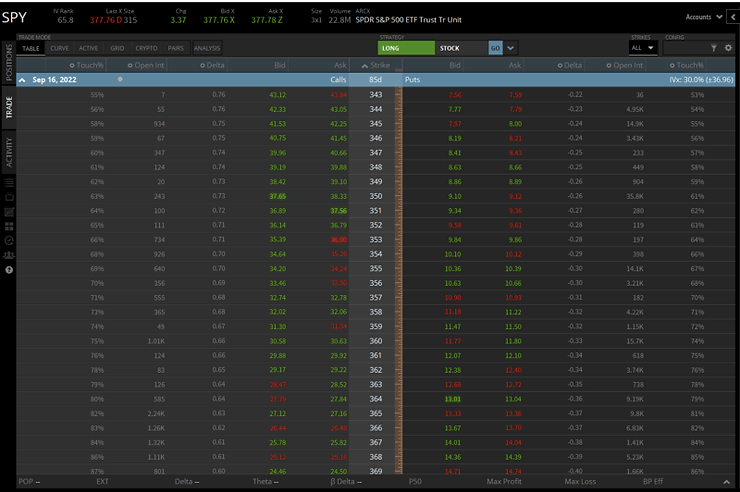

For example, the 45 DTE 30 delta put option right now on SPY is the 360 strike price.

The 90 DTE 30 delta put option on SPY is the 355 strike.

Therefore, your strike price is naturally lower with further dated expirations, giving you a larger buffer. A common rebuttal is that selling further dated options comes with a greater vega (volatility) risk.

However, looking into the concept of weighted vega proves this is false. You can learn more about weighted vega with this video.

There are advantages and disadvantages to trading 45 DTE options and 60–90 DTE options. You can take profit or loss sooner with 45 DTE, but you have a higher gamma risk.

Sell options with a 30 delta:

Selling 30 delta options is honestly a great delta to use. You collect a good premium and still have a theoretical 70% chance of your option expiring worthless at expiration.

Your risk is higher than if you were selling 15 delta, but you can also make more. Delta selection entirely depends on your risk tolerance and trading goals.

The main risk for option sellers is overnight gaps and significant quick moves in the stocks you are trading. The best way to reduce getting obliterated with an overnight gap is to sell lower strike prices to negate the gamma risk.

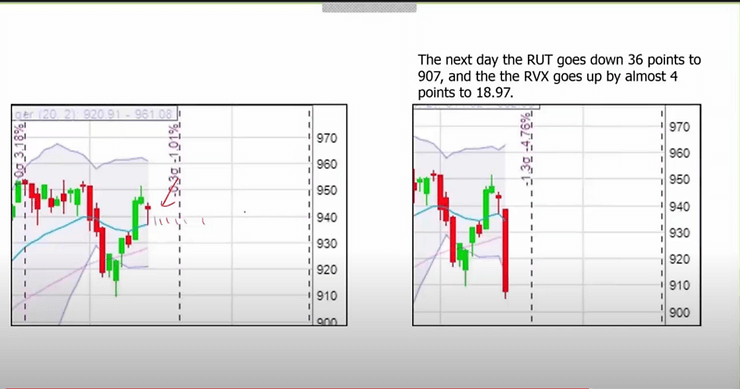

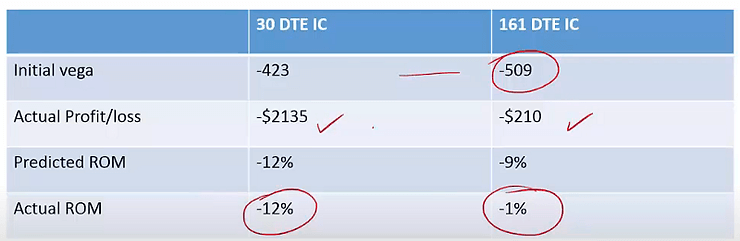

The weighted vega video compares the P/L of an iron condor with expirations of 30 and 161 DTE and short strikes at a 10 delta. The day after the trade is placed, the underlying drops sharply, and IV increases.

According to the picture below, the 161 DTE iron condor performed much better. This is because the 161 DTE strikes were much further from the underlying spot price. The stock price does not affect the longer-dated 10 delta options as much since they are so far OTM.

The 30 DTE iron condor lost $2,135, while the 161 DTE iron condor only lost $210. The 30 DTE 10 delta strikes were probably getting tested, while the 161 DTE 10 delta strikes stayed further OTM.

Take profit when you collect 50% of the premium:

Taking profit at 50% is a great idea. There is not much benefit to holding monthly options until expiration.

Roll forward and don’t change the strike price at 21 DTE to reduce gamma risk:

This tastylive mechanic is almost perfect. When one of your positions gets tested, there is no promise that your option will go back OTM if you keep rolling it.

This is not a terrible way to manage your trades, but remember that you may be rolling positions for years for little to no premium. I think it is much better to use a stop loss and enter a new 15–30 delta position rather than rolling an ITM option for years. This way, you keep your option OTM and your delta exposure under control.

Trade small and trade often:

This is excellent advice. Make sure you aren’t collecting pennies for the contracts you are selling to make the risk to reward worth it. However, keeping your trade size small is essential as an options trader.

tastylive Criticism: Is tastylive Legit?

While tastylive gets a lot of criticism, I would argue that tastylive is legit since they provide tons of free research and data for retail traders. Their strategies may not be the best to trade, but they are a great resource to learn from.

If you are looking for a better broker, consider signing up for a tastytrade account!

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini’s Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading

How to Get a TradingView Free Trial

The Best TradingView Indicators

The Best Keyboards For Trading

Disclosure: This article contains my tastytrade referral link. If you sign up for a tastytrade account with it and fund it I may be compensated at no extra cost to you.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!