SPX vs. SPY: Key Differences Explained

SPX and SPY both track the S&P 500 index, but these two financial products have significant differences.

The products have different options settlement, contract sizes, and tax treatments.

If you are interested in trading the S&P 500, you must understand the differences between the SPX vs. SPY.

First, What is an Index

A stock index is a basket of stocks that may track the whole stock market or a specific market segment.

For example, the S&P 500 stock index seeks to track the top 500 large companies on the U.S. stock market.

The SPX ticker represents the S&P 500 free-float capitalization-weighted index. A cap-weighted index means the companies with the largest market caps are weighted the highest in the index.

Therefore, companies with the highest market cap will affect the index’s value the most.

What is an Index ETF

An index ETF (exchange-traded fund) is a fund that seeks to track the performance of a stock index, such as the S&P 500.

The SPY ETF is an S&P 500 ETF.

You can purchase shares of SPY to invest in the S&P 500 index, but you cannot buy shares of the SPX index itself. However, you can trade options on the SPX index to bet on its future prices.

What Are Options?

Options contracts are derivatives you can buy and sell to bet on an underlying stock or index price change.

There are two types of options: call options and put options.

Each option represents 100 shares of an underlying stock.

Trading Options on SPX vs. SPY

There are a few notable differences between SPX and SPY options:

- SPX is 10x the size of SPY.

One SPX contract is worth the value of ten SPY contracts.

- SPY options are American style.

- SPX options are European style.

- SPX options provide beneficial tax treatment since they are 1256 contracts.

60% of profits earned on SPX are taxed at the long-term capital gains rate.

- SPY options pay you out in shares, while SPX is cash settled.

- SPY pays a dividend which affects the price of call options.

Since a call option gives the buyer the ability to purchase 100 shares of stock, the dividend payment must be factored into the price of the call.

SPX vs. SPY Value

SPX is 10x the value of SPY. So, for example, if the SPX index is at 3,000, the price of one share of SPY is around $300.

Therefore, one SPY contract at this price is worth $30,000 of notional value, while one contract of SPX is worth $300,000.

Since there is usually a commission to trade options, you may be 10x the commissions trading SPY instead of SPX.

However, SPY is better for small accounts since it is 1/10th the size.

SPY vs. SPX Settlement Differences

SPX options are European style, while SPY options are American style.

European style options

- They can only be exercised at expiration.

- They are cash-settled.

Cash-settled options pay options traders in cash rather than shares of stock. For example, if you buy an SPX 3000 call option, and the index expires at 3,100, you are paid $10,000 cash rather than 100 shares at 3,000.

American Style Options

- They can be exercised anytime on or before expiration.

- They pay in shares of stock rather than cash.

Does SPY Pay a Dividend

The SPY ETF does pay a dividend to shareholders.

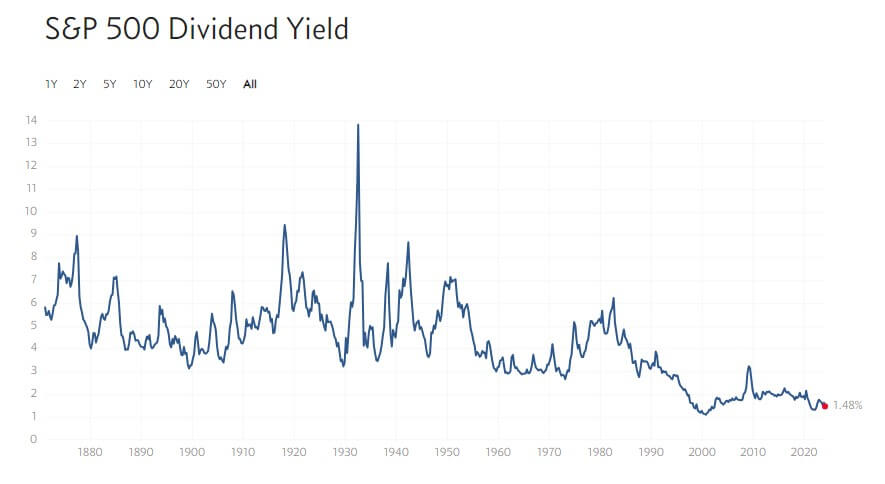

The image below shows that the dividend yield spikes when large market crashes happen, such as Black Tuesday and Black Monday.

The dividend yield spikes at these points because it is negatively correlated with the share price.

When the share price of a company falls, the dividend yield naturally increases.

Does SPX Pay a Dividend

No, you cannot buy shares of the SPX index. Therefore, SPX does not pay a dividend.

SPX vs. SPY Tax Treatment

The SPX options are 1256 contracts, meaning 60% of the profits earned are taxed at your long-term capital gains rate.

Unless you sold a SPY option contract after holding it for one year, the profit is taxed at your short-term capital gains tax rate.

Why Trade SPX vs. SPY

The benefits of trading SPX include no early assignment risk, tax benefits, and fewer commissions.

Some options traders may want to avoid assignment risk if it deviates from their strategy.

However, you must have a large account to trade SPX since it is 10x the size of SPY.

Trading SPY is beneficial if you utilize options to buy shares of stock.

There are various strategies investors utilize, so it depends on your investing goals whether it is better to use SPX or SPY.

How to Learn About SPY and SPX Trading Strategies

Learning how to trade options can be mind-boggling for a beginner.

The most straightforward options trading strategies you can learn are the cash-secured put and the covered call.

A cash-secured put is when you sell a put option and get paid to promise to buy 100 shares of stock.

A covered call is when you own 100 shares of a stock and get a premium in exchange for promising to sell them at the strike price.

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini’s Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading

How to Get a TradingView Free Trial

The Best TradingView Indicators

– Free trading journal template

– Custom indicators, watchlists, & scanners

– Access our free trading community