Initial Margin vs. Maintenance Margin: A Guide for Traders

Margin trading is a vital concept in the world of finance, offering traders the ability to leverage their positions for potentially higher returns.

However, with increased potential comes increased risk, making it crucial to understand the concepts of initial margin and maintenance margin. These terms are fundamental to managing risk and maintaining a healthy trading portfolio.

What is Initial Margin?

Initial margin refers to the minimum amount of equity a trader must provide to open a leveraged position. It’s a form of security deposit, ensuring that the trader has enough skin in the game.

The initial margin requirement, often a percentage of the total trade value, varies based on the asset and the broker’s policies. This upfront investment helps mitigate the risk of loss for the broker.

What is Maintenance Margin?

Maintenance margin comes into play after a position is opened. It’s the minimum amount of equity a trader must maintain in their account to keep a trade open.

If the account’s value falls below this threshold due to losses, the trader receives a margin call, requiring them to deposit more funds or close positions.

This mechanism is designed to prevent excessive losses that could affect both the trader and the broker.

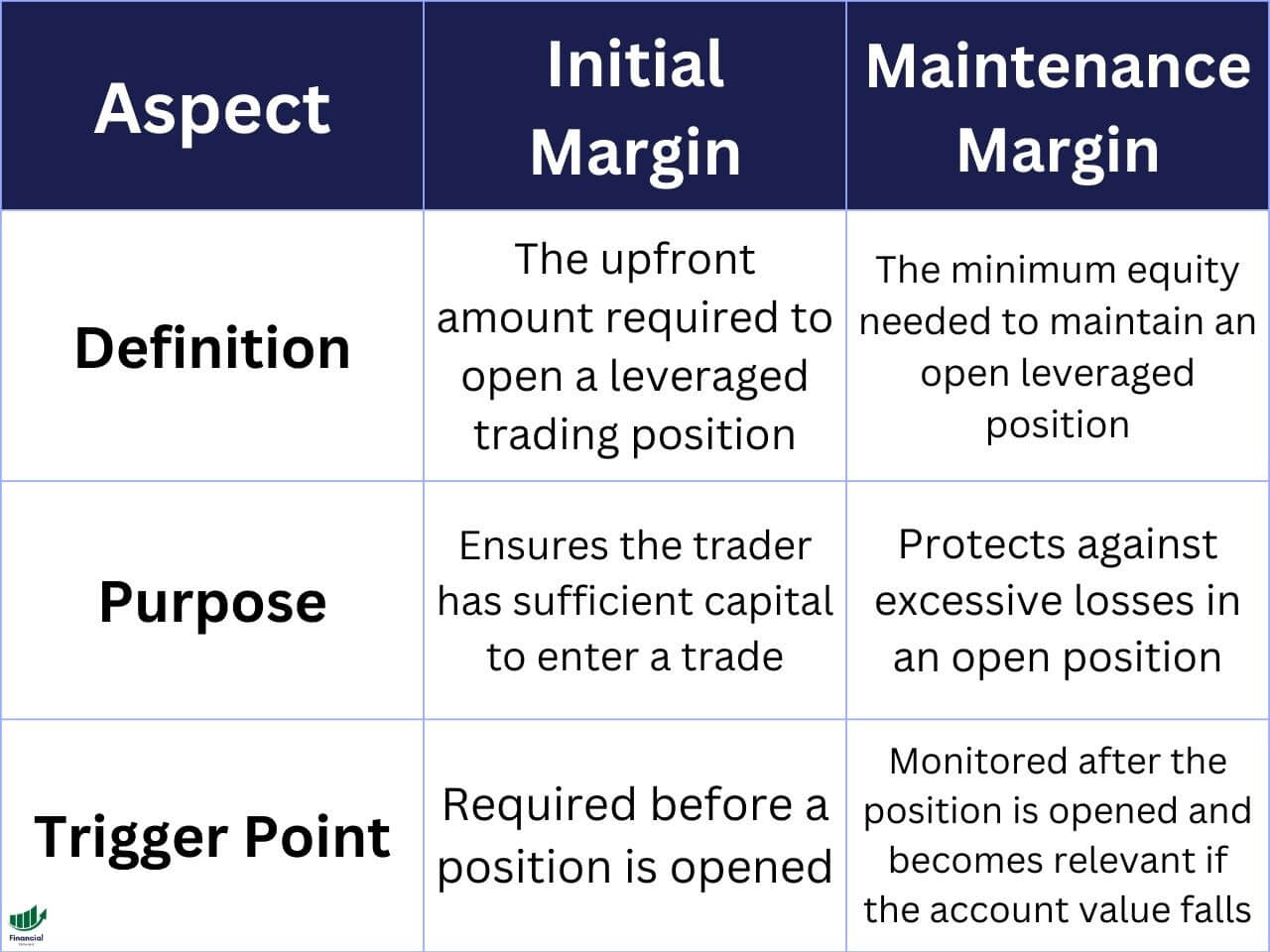

Key Differences Between Initial Margin and Maintenance Margin

- Purpose:

- Initial Margin: Required to open a leveraged position; acts as a security deposit.

- Maintenance Margin: Ensures ongoing solvency of the position after it is opened.

- Timing:

- Initial Margin: Calculated and required at the time of opening a trade.

- Maintenance Margin: Monitored continuously after the trade is opened.

- Function:

- Initial Margin: Determines the maximum leverage a trader can use.

- Maintenance Margin: Protects against excessive losses from leveraged positions.

- Response to Market Movements:

- Initial Margin: Remains constant once the position is opened.

- Maintenance Margin: Can trigger a margin call if the account value falls below a certain level due to market losses.

- Calculation Basis:

- Initial Margin: Percentage of the total trade value, set by the broker or regulatory authority.

- Maintenance Margin: Typically a lower percentage than initial margin, reflecting ongoing risk.

- Implications for Traders:

- Initial Margin: Higher initial margin means lower leverage and potentially lower risk.

- Maintenance Margin: Falling below maintenance margin can lead to forced liquidation of positions if additional funds are not added.

While both initial and maintenance margins are related to leverage and risk management, they serve different purposes. The initial margin is about starting a trade and ensuring enough capital is put down.

In contrast, the maintenance margin is about sustaining a trade and ensuring ongoing solvency. Understanding these differences is key to effective margin management.

Real-World Scenarios: Margin Calls and Trading

Consider a futures trader who has a $500 account. The dynamics of initial and maintenance margin in this context would unfold as follows:

- Choosing a Contract:

- The trader opts to trade a futures contract where the total contract value is $5,000.

- The initial margin requirement for this contract is 10%, which amounts to $500.

- Utilizing the Entire Account for Margin:

- To meet the initial margin requirement, the trader commits their entire account balance of $500.

- This is a high-risk move as the entire account value is used to open a single position.

- Market Moves Against the Trader:

- After entering the contract, the market moves unfavorably, and the value of the futures position declines.

- A 5% market drop reduces the contract value by $250, lowering the equity in the trader’s account to $250.

- Triggering a Margin Call:

- The maintenance margin requirement is 5% of the contract value, which is $250 in this case.

- Since the account balance has fallen to the maintenance margin level due to the market decline, the trader faces an immediate margin call.

- Critical Decision Point:

- The trader must now either deposit additional funds to maintain the position or close the position to meet the margin call.

- If the trader is unable to add funds, the broker might liquidate the position, potentially resulting in a loss.

This example illustrates the significant risks involved in using a high proportion of an account’s balance to meet margin requirements, especially in volatile markets.

It underscores the importance of understanding margin requirements and the potential impacts of market movements on trading positions.

Regulatory Aspects of Margin Requirements

Margin requirements are not just broker-imposed but are also subject to regulatory oversight.

Bodies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) set guidelines to ensure market stability and trader protection.

These regulations have evolved, especially in response to financial crises, to further safeguard market integrity.

Conclusion

Understanding the nuances of initial margin and maintenance margin is imperative for any trader engaged in margin trading.

These concepts are not just financial requirements but tools for risk management and strategic planning.

Awareness and adherence to these margins can make the difference between a successful trading career and a costly lesson in market dynamics.

Related Articles

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!