Evening Doji Star Pattern: Decoding the Reversal Pattern

Introduction to the Evening Star Pattern

Candlestick patterns are a powerful tool in the world of technical analysis, providing traders with valuable insights into potential price movements. Among these patterns, the Evening Doji Star stands out as a strong bearish reversal pattern that technical analysts often rely on to predict potential downtrends.

In this article, we’ll explore the Evening Doji Star pattern, discuss its implications, and provide practical guidance on how to trade this pattern effectively.

Description of the Evening Doji Star Pattern

Significance of Bearish Reversal Patterns

Bearish reversal patterns are crucial in technical analysis as they indicate a potential change in the price trend from bullish to bearish. Identifying such patterns can allow traders to capitalize on the forthcoming downtrend.

Formation of the Evening Doji Star Pattern

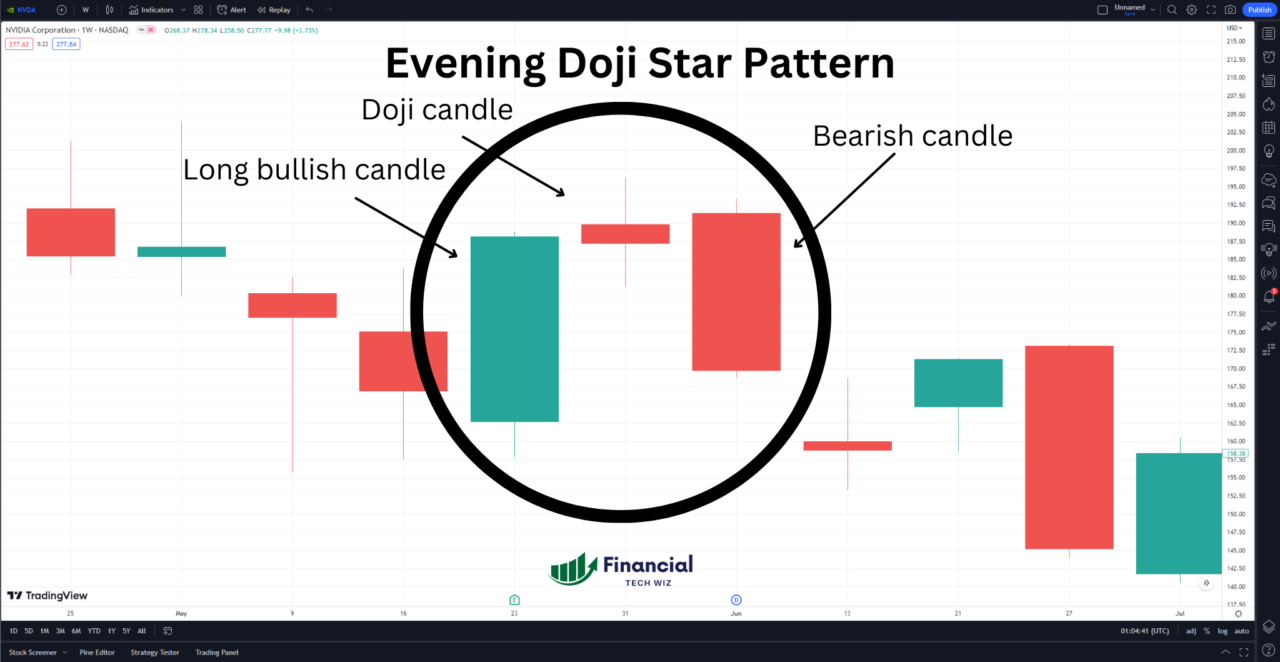

The Evening Doji Star pattern consists of three candles and is formed as follows:

- First candle: A long bullish candle in an uptrend.

- Second candle: A doji candle that gaps above the body of the first candle.

- Third candle: A bearish candle that closes below the midpoint of the first candle.

Common Questions About the Evening Doji Star

- Is Evening Star bullish or bearish? The Evening Doji Star is a bearish reversal pattern.

- What does the evening star pattern indicate? The pattern indicates a potential reversal from an uptrend to a downtrend.

- What is the difference between the abandoned baby and evening star patterns? The abandoned baby pattern also has three candles, but the second candle is entirely gapped above the first and third candles.

- What is the success rate of the evening star pattern? While the success rate can vary, the pattern is considered a strong bearish reversal signal.

- How does the evening star pattern compare to the morning star pattern? The morning star is a bullish reversal pattern, while the evening star is a bearish reversal pattern.

Understanding the Implications of the Pattern

The Evening Doji Star pattern signals a strong bearish reversal, indicating that the uptrend may be nearing its end. When the pattern appears at the top of an uptrend, a downward breakout occurs as the price closes below the bottom of the pattern.

It’s important to note that the Evening Doji Star pattern is relatively rare, making its appearance even more significant. However, traders should use additional technical indicators to confirm the occurrence and effectiveness of the pattern.

How to Trade the Evening Doji Star Pattern

Trading the Evening Doji Star pattern involves several best practices:

- Identify the pattern: Look for the three-candle formation that characterizes the Evening Doji Star.

- Seek confirmation: Use additional technical indicators, such as support levels or trendlines, to confirm the pattern.

- Consider market context: Assess the overall market context and other factors influencing price movements.

- Avoid over-reliance: Be cautious not to rely solely on a single pattern without considering other market dynamics.

TradingView: The Ideal Charting Platform for Technical Analysis

Introduction to TradingView

TradingView is a powerful charting platform that offers a wide range of features for technical analysis. It’s an ideal tool for traders looking to analyze and trade patterns like the Evening Doji Star.

Key Features of TradingView

TradingView boasts several key features, including real-time data, customizable charts, and a wide range of technical indicators.

Analyzing the Evening Doji Star on TradingView

With TradingView, traders can easily identify and analyze the Evening Doji Star pattern using its comprehensive charting tools.

TradingView Free Trial and Discount

For those interested in trying out TradingView, the platform offers a free trial for new users, allowing them to explore its features and capabilities.

Additionally, as a special offer for our readers, you can receive a discount on your TradingView subscription. Take advantage of this opportunity to enhance your technical analysis skills and make informed trading decisions.

The Evening Doji Star Pattern

In summary, the Evening Doji Star is a valuable tool for traders to identify potential trend reversals. Its bearish nature and strong reversal signal make it a pattern worth paying attention to. By using advanced charting platforms like TradingView, traders can effectively analyze and trade the Evening Doji Star pattern, adding it to their arsenal of technical analysis tools.

We encourage you to explore more candlestick patterns and continue expanding your trading knowledge. Remember, successful trading involves careful analysis, risk management, and a well-rounded strategy. Additionally, consider using the fair value gap as part of your strategy.

This article contains affiliate links I may be compensated for if you click them,

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!