Discover how to use the TradingView stock screener to find hidden trading opportunities.

Where is the stock screener in TradingView?

You can find the TradingView stock screener at the bottom of the homepage, or under Products > Screeners. They have a stock screener, a forex screener, a crypto pairs screener, and a crypto coins screener.

Is TradingView stock screener free?

Many of the features of the TradingView stock screener are free. However, intraday screeners are only available with a premium subscription.

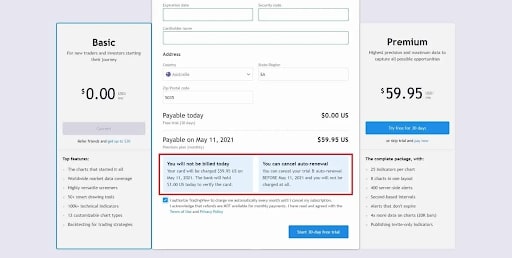

If you want to test the premium TradingView stock screeners for free, TradingView usually offers a 30-day free trial for new users.

How to Use the TradingView Stock Screener

There are several ways to use the TradingView stock screener. For example, you can search for companies with low P/E ratios, determine stock trends, view financial data, and more.

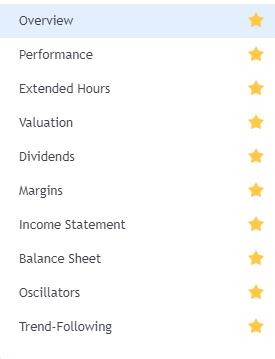

TradingView Stock Screener Column Options

The column options of the screener allow you to view specific data about the stocks that populate based on your screener settings. We will cover the screener options in the next section.

Overview

The overview column will show you basic information such as a stock’s market cap, price, and volume.

Performance

The performance column will show you how a stock has been performing over several time periods.

Extended Hours

The extended hours column will give you data such as a stock’s pre-market and post-market change and close prices.

Valuation

The valuation column shows a stock’s P/E ratio, market cap, EPS, EV, and more.

Dividends

The dividend column shows a stock’s dividend yield, dividend per share, and current price.

Margins

The margins tab shows fundamental margins such as gross, operating, and pretax margins.

Income Statement

The income statement column portrays an overview of a company’s income statement with metrics like revenue, EPS, and EBITDA.

Balance Sheet

The balance sheet column shows you fundamental data such as the current ratio, debt/equity, quick ratio, and net debt.

Oscillators

The oscillators will show you some technical signals, such as the ATR, MACD level, and the oscillator’s rating.

Trend-Following

The trend-following column will give you weak to strong buy/sell signals based on moving averages and technical trends.

TradingView Stock Screener Screen Options

The screener options allow you to filter through companies with several data points, such as the following. Once you filter to see the right stocks, you can use the column options we reviewed to view specific data about the companies that populate.

Most capitalized

The most capitalized screener will show you the stocks with the highest market capitalizations.

Volume leaders

The volume leaders will populate stocks with the highest trading volume for a particular day.

Top gainers

The top gainers screener will show you the stocks increasing the most that day.

Top losers

The top losers screener will show the stocks decreasing the most that day.

All-time high

The all-time high screener will find stocks that recently hit their all-time high.

All-time low

The all-time low screener will find stocks that are hitting their all-time lows.

High-dividend

The high-dividend screener will find stocks that pay the highest dividend yields.

New 52-week high

The new 52-week high screener finds stocks hitting their highest price of the last 52 weeks (year).

New 52-week low

The new 52-week low screener finds stocks hitting their lowest price in the last 52 weeks (year).

New monthly high

The new monthly high screener finds stocks hitting their high of the month.

New monthly low

The new monthly low screener finds stocks hitting their low of the month.

Most volatile

The most volatile screener finds stocks that fluctuate the most in either direction.

Unusual volume

The unusual volume screener finds stocks that have more volume than usual.

Overbought

The overbought screener finds stocks that are technically overbought (overpriced) based on various metrics.

Oversold

The oversold screener finds oversold (discounted) stocks based on various metrics.

Outperforming SMA50

This screener finds stocks above their 50-day moving average.

Underperforming SMA50

This screener finds stocks trading below their 50-day moving average.

Earnings this week

Discover stocks that have earnings in the current week using this screener.

TradingView Stock Screener Filters

The filters allow you to filter out stocks that don’t meet certain criteria like the following:

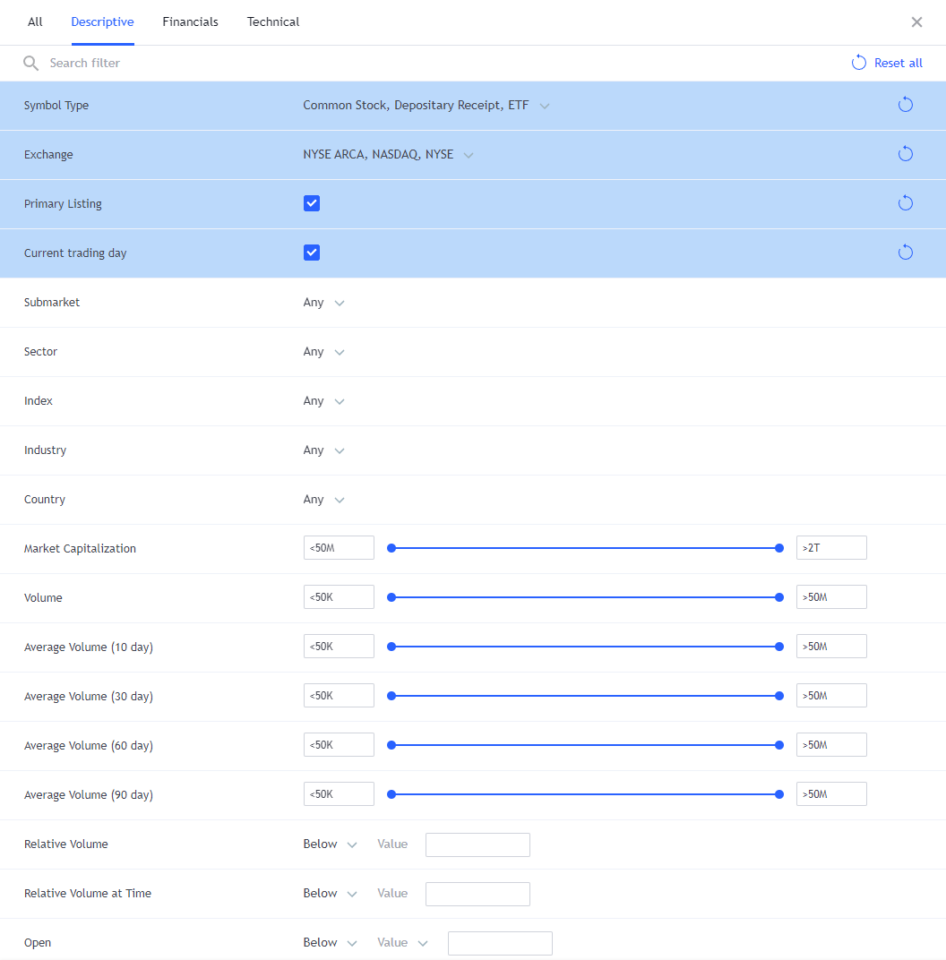

Descriptive filters

Descriptive filters allow you to filter stocks by sector, index, country, and more.

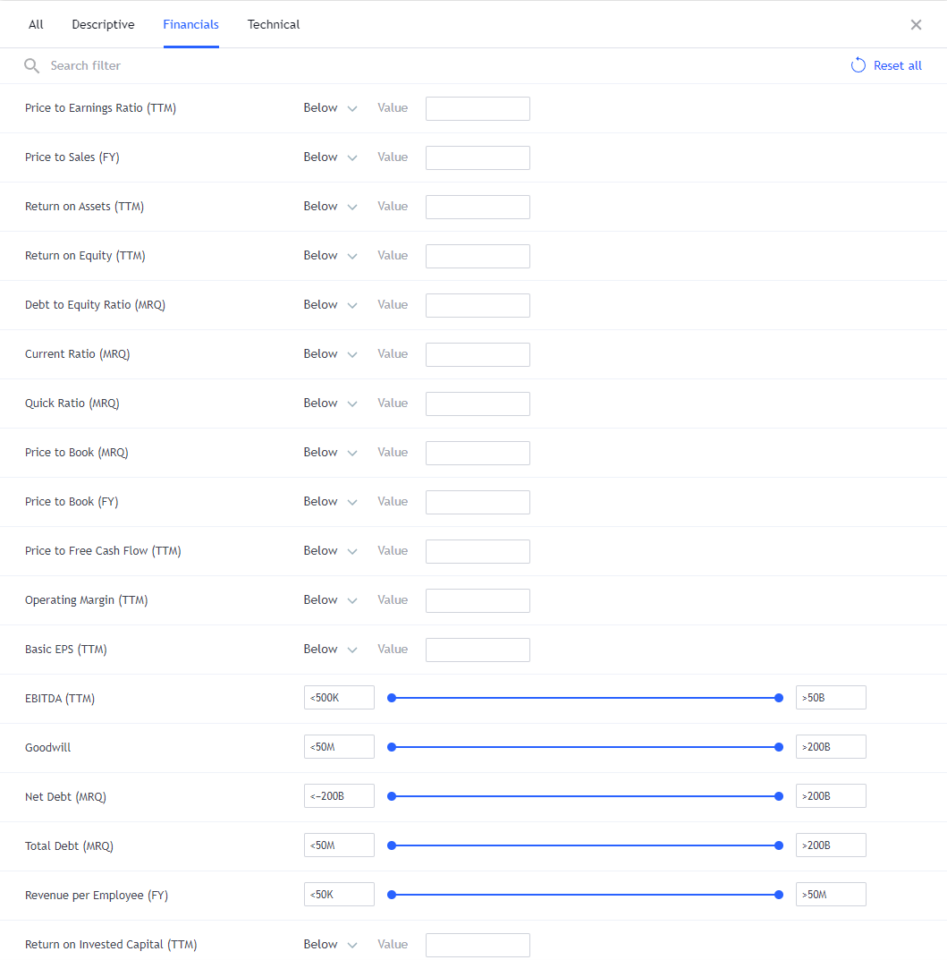

Financial filters

The financial filters allow you to filter out stocks based on fundamental data such as P/E ratios, price to book, current ratio, and more.

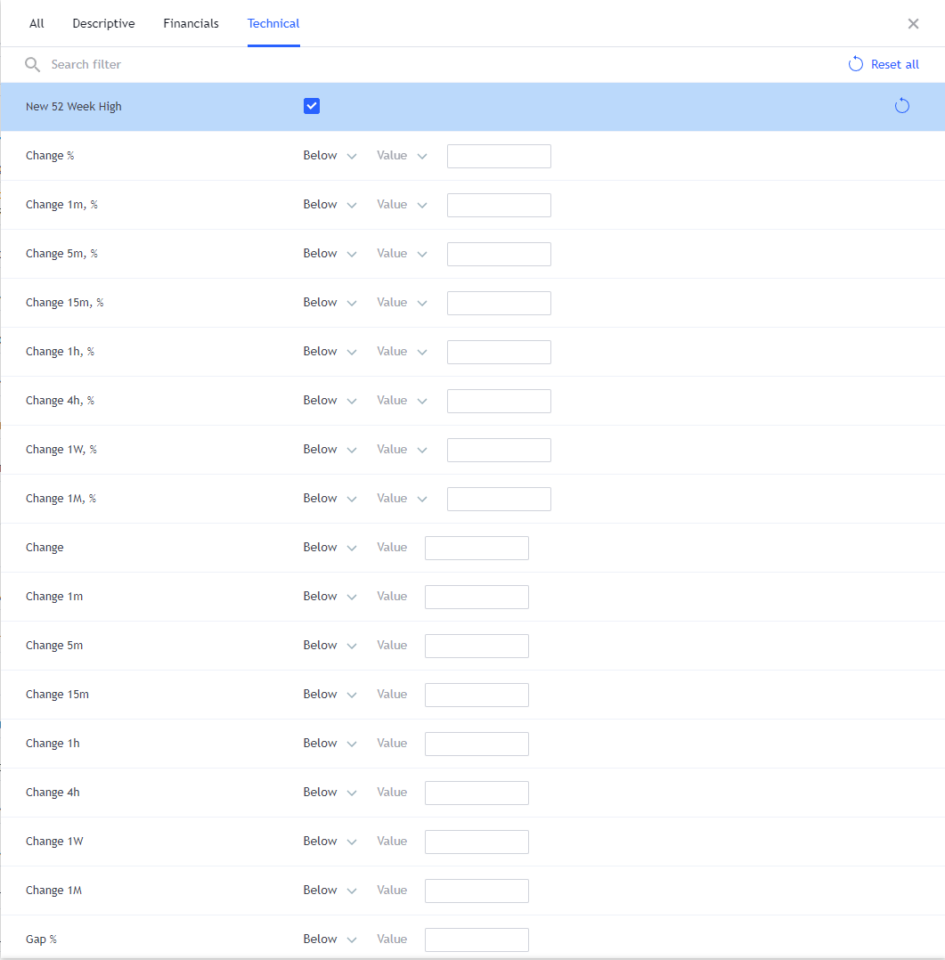

Technical filters

The technical filters allow you to discover stocks with various percent changes, gap moves, relative strength indexes, and more.

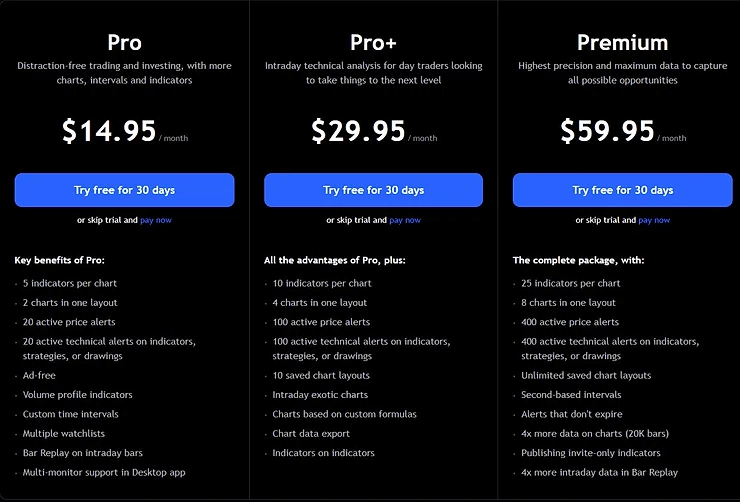

How Much Does TradingView Cost per Month?

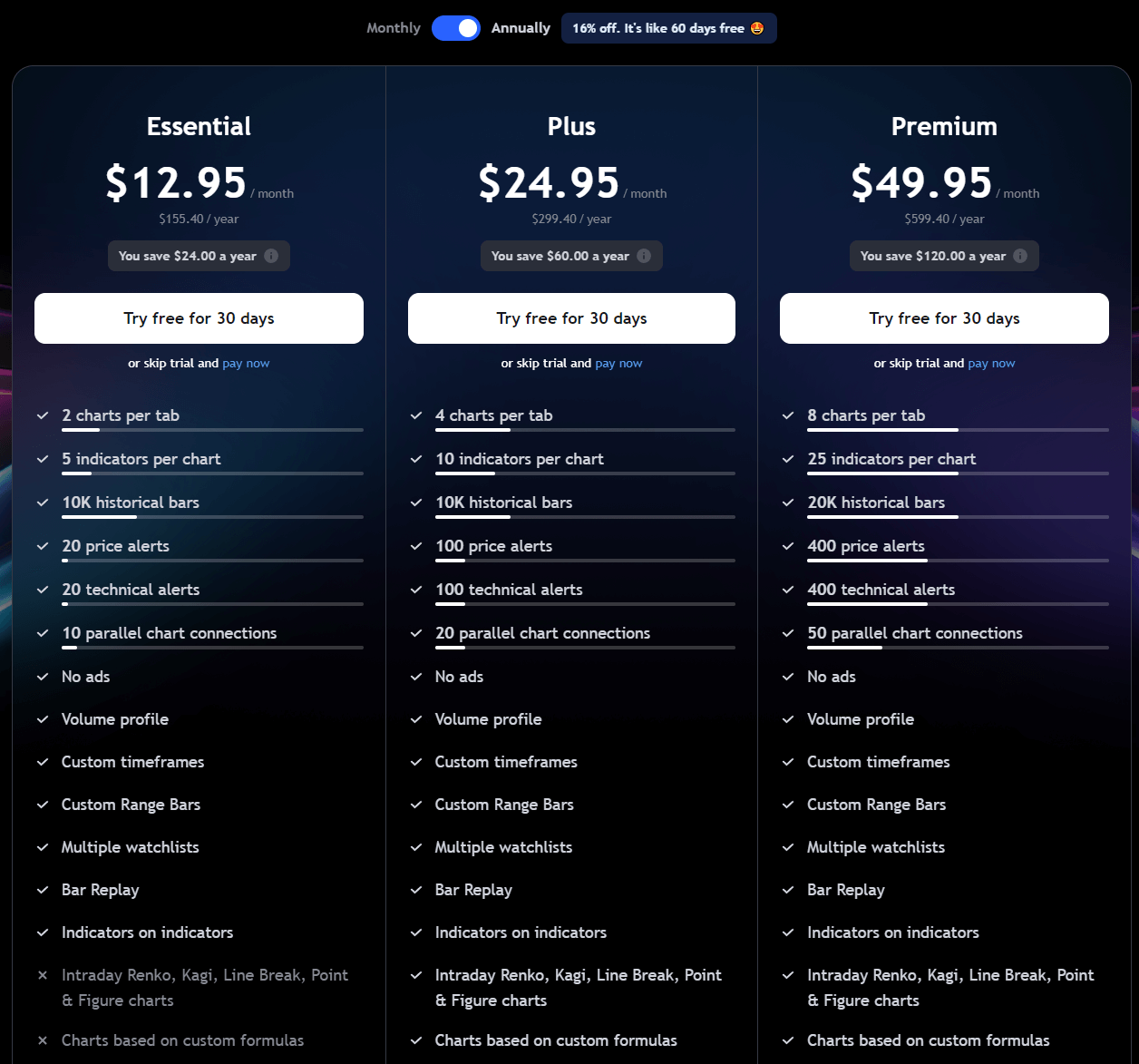

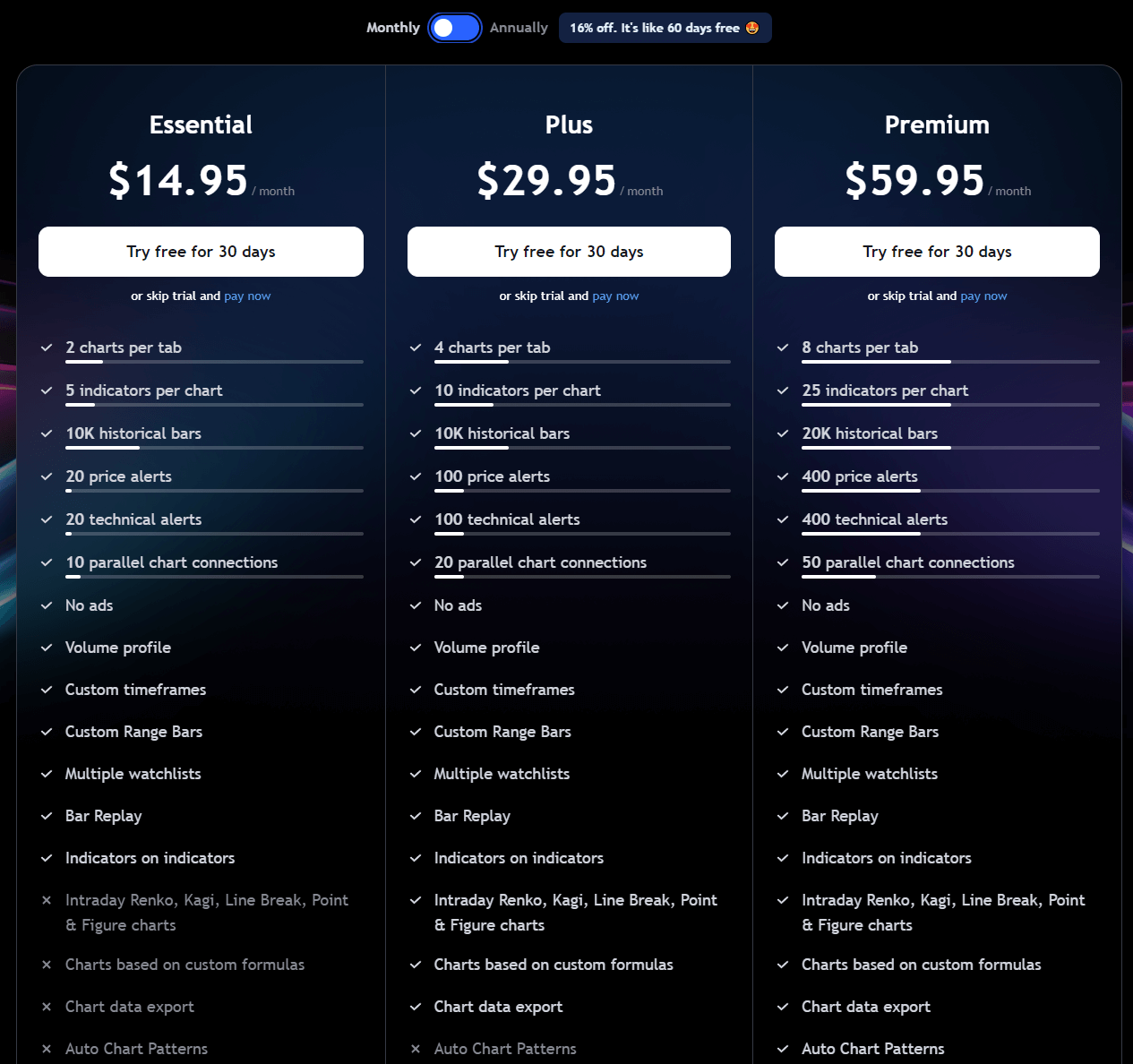

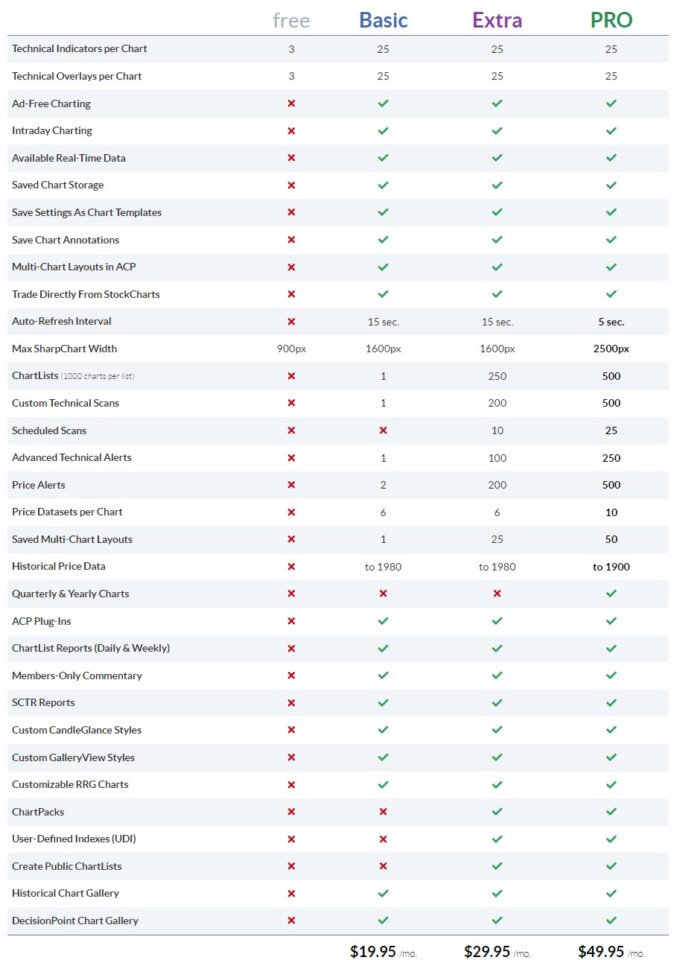

TradingView has several packages ranging from $12.95/ month ($14.95 billed monthly) to $49.95/ month ($59.95 billed monthly.

If you want to test out TradingView before purchasing a premium plan, new users can usually get a free TradingView free trial.

Before you go

If you want to keep educating yourself about personal finance, you must check out these posts as well:

What is the Most Successful Options Strategy

Options Trading for Income: The Complete Guide

Mark Minervini’s Trading Strategy: 8 Key Takeaways

The Best Options Trading Books

The Best Laptops and Computers for Trading

How to Get a TradingView Free Trial

The Best TradingView Indicators

The Best Keyboards For Trading

This article contains affiliate links I may be compensated for if you click them.