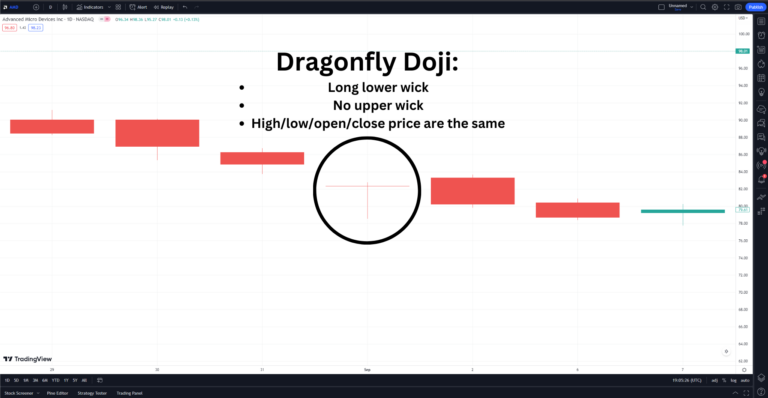

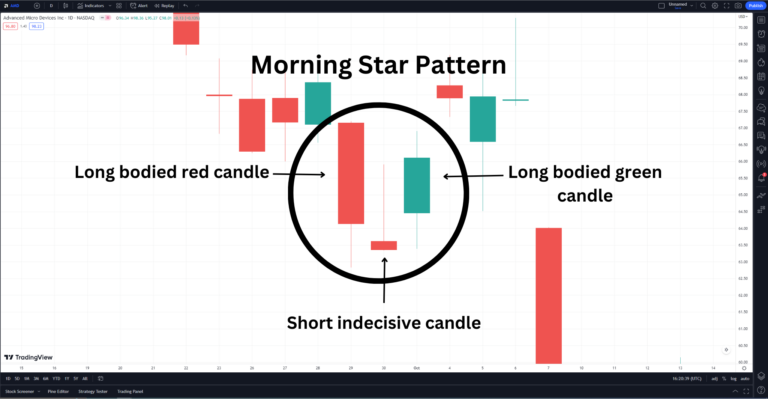

Doji Candle Types: Dragonfly, Gravestone & More

The Doji candlestick pattern is an essential technical analysis tool traders and investors often use to understand market sentiment. This article explores the meanings, types, and trading implications of the Doji pattern. Understanding the Doji Candlestick Pattern The Doji candlestick pattern is characterized by its distinct “cross” shape, where the opening and closing prices of…