Iron Condor vs. Iron Butterfly: What is the Difference?

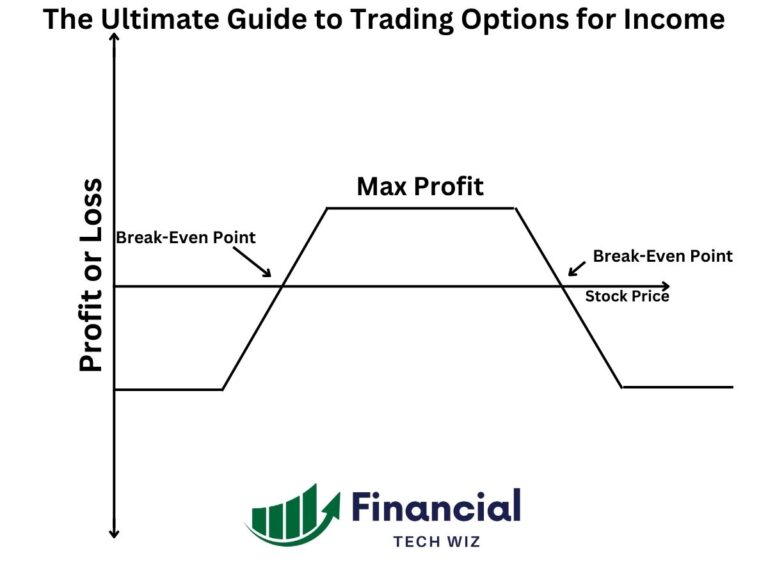

If you are learning about selling options and are unsure whether the iron condor or iron butterfly is best, you have come to the right place. Both of these strategies are similar, but there are some differences you must understand before deciding which one you should employ. What Are Iron Condors and Iron Butterflies? Iron…