Green Hammer Candle: A Bullish Hammer Candle Pattern

This article will explore the characteristics, interpretation, and importance of the green hammer candle and other related candlestick patterns.

Understanding Candlestick Patterns

To comprehend the green hammer candle, it is essential to have a good grasp of candlestick charts and their components. Candlestick charts display price movements over a specific time period, presenting a visual representation of market sentiment. Each candlestick consists of a body and wick, with the body representing the opening and closing prices and the wick indicating the high and low prices during that period.

Candlestick patterns form based on the interaction between the opening, closing, high, and low prices. These patterns can provide insights into the balance of power between buyers and sellers in the market.

What is a Green Hammer Candlestick Pattern?

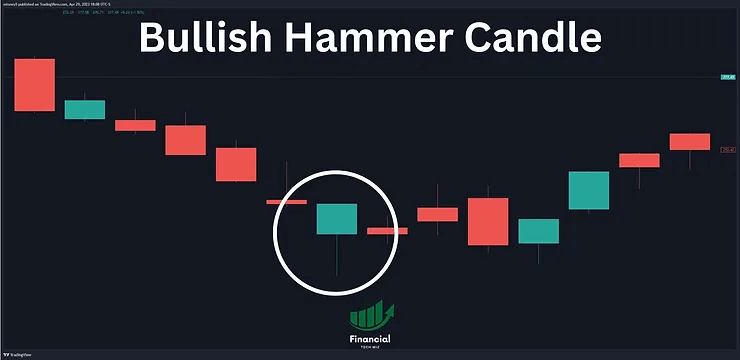

The green hammer candlestick pattern is characterized by a short body and a long lower wick. It typically appears at the bottom of a downward trend, signaling a potential reversal. The pattern suggests that despite selling pressures during the trading session, a strong buying pressure emerged, driving the price back up.

The color of the hammer’s body may vary, with different shades representing various market conditions. However, green hammers often suggest a more robust bull market compared to their red hammer candlestick counterparts. The bullish nature of the green hammer candle implies a potential shift in market sentiment, favoring buyers.

Other Bullish Candlestick Patterns

To better understand the green hammer candle, it is beneficial to explore other bullish candlestick patterns that provide complementary insights. Let’s briefly discuss some of these patterns:

- Hanging Man Candlestick Pattern: The hanging man pattern, the bearish counterpart of the hammer, forms at the end of an uptrend, indicating potential weakness in the market.

- Inverted Hammer Candlestick Pattern: Similar to the hammer, the inverted hammer has a long upper wick and a short lower wick. It suggests buying pressure followed by selling pressure that wasn’t strong enough to drive the market price down.

- Morning Star Pattern: The morning star pattern is a bullish reversal signal. It consists of a short candle sandwiched between a long red candle and a long green candle, indicating the subsiding selling pressure and the potential for a bull market.

- Doji Candle Types: Doji candles have short to non-existent bodies and varying lengths of wicks. They represent a struggle between buyers and sellers, signaling indecision in the market. Doji candles are often present in reversal patterns, including the bullish morning star and the bearish evening star.

These candlestick patterns, along with the green hammer candle, provide valuable insights into potential market reversals and shifts in sentiment.

Bearish Candlestick Patterns for Contrast

While our main emphasis lies on the green hammer candle and other bullish patterns, it is equally important to remain cognizant of bearish candlestick patterns in order to gain a comprehensive understanding of market dynamics. Here are a few bearish patterns to consider:

- Evening Star Pattern: The evening star is a bearish reversal pattern. It consists of a long green candle, a short candle, and a large red candlestick. This pattern suggests a reversal in an uptrend, where the third candle negates the gains achieved in the first candle.

- Shooting Star: The shooting star pattern emerges during an uptrend and is characterized by a small lower body and a long upper wick. It suggests a potential reversal in the market, as the price gaps higher on opening, rallies to an intra-day high, and closes just above the open.

- Bearish Engulfing: The bearish engulfing pattern occurs at the end of an uptrend. It consists of a small green body that is engulfed by a subsequent long red candle. This pattern signifies a peak or slowdown in price movement and indicates an impending market downturn.

- Three Black Crows: The three black crows pattern consists of three consecutive long red candles that have either short or non-existent wicks. Each candle within the three black crows pattern opens at a similar price to the previous day but encounters selling pressures that gradually drive the price lower with each subsequent close. This pattern is often regarded as an indication of the beginning of a bearish downtrend, as sellers gain control over three consecutive trading days, surpassing the influence of buyers.

Understanding these bearish candlestick patterns provides a contrasting perspective and enhances your ability to identify potential market trends and reversals.

Importance of the Green Hammer Candle

The green hammer candle holds particular importance for traders due to its indications of a strong bull market. When a green hammer pattern forms, it suggests that buying pressure has successfully overcome selling pressure, leading to a potential upward movement in price. Traders often view green hammers as a bullish signal, indicating a favorable market environment for buyers.

Applying the Bullish Hammer Candle in Trading

Incorporating the green hammer candle into your trading strategy can be valuable. Here are a few considerations:

- Confirmation: While the green hammer candle can provide insights, it’s important to confirm the signal with other technical analysis tools. Look for additional indicators or chart patterns that align with the bullish signal of the green hammer.

- Risk Management: Implement appropriate risk management techniques, such as setting stop-loss orders, to protect against potential adverse price movements. Consider the overall market conditions and other factors that may impact the reliability of the green hammer signal.

By integrating the green hammer candle into your trading decisions and combining it with other technical analysis tools, you can enhance your trading strategies and make more informed decisions.

Bullish Hammer Candle | Bottom Line

The green hammer candle is a powerful bullish pattern that signifies a potential reversal in the market. By understanding the characteristics and interpretations of candlestick patterns, such as the green hammer, traders can gain valuable insights into market trends and make more informed trading decisions.

This article explored the green hammer candle’s significance in technical analysis and its distinction from other bullish and bearish candlestick patterns. By recognizing the importance of the green hammer and applying it alongside other technical analysis tools, traders can enhance their ability to identify favorable trading opportunities and manage risks effectively.

TradingView: A Reliable Charting Platform

When it comes to technical analysis and charting, having access to a reliable platform is crucial. One such platform that traders often turn to is TradingView. With its robust features and user-friendly interface, TradingView has gained popularity among traders of all levels of experience.

TradingView offers various charting tools, indicators, and drawing capabilities, allowing traders to analyze price movements and identify potential trading opportunities. Whether you are a beginner or an experienced trader, TradingView provides the tools necessary to conduct in-depth technical analysis.

This article contains affiliate links I may be compensated for if you click them.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!