Bearish Engulfing Pattern: Spotting and Trading Tips

Understanding chart patterns forms the backbone of technical analysis for traders and investors. One such intriguing pattern is the bearish engulfing pattern, a key tool in predicting potential price reversals.

This article will shed light on this pattern, comparing it to its bullish counterpart and exploring its practical implications in the trading world.

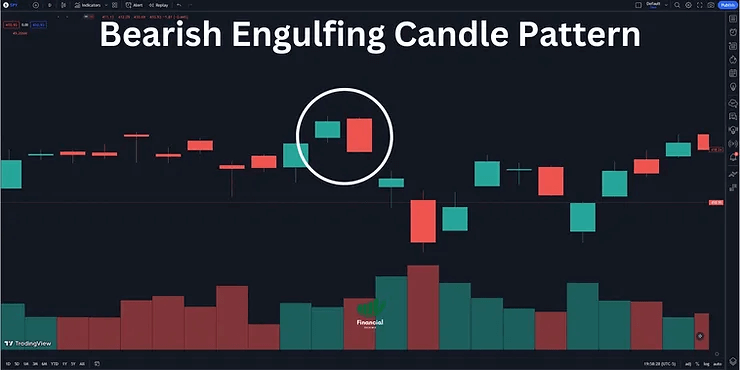

What is a Bearish Engulfing Candle Pattern?

The bearish engulfing pattern is a technical chart pattern that signals lower prices may be on the horizon. It consists of a rising (depicted in white or green) candlestick that is subsequently overshadowed or “engulfed” by a larger descending (represented in black or red) candlestick.

If you need a refresher on various candle types, you might want to check out our article on Doji Candle Types.

The Importance of Pattern Context

The bearish engulfing pattern can occur anywhere, but its significance heightens if it forms after a price advance, either an uptrend or a pullback to the upside within a larger downtrend. Ideally, both candles are substantial in size compared to the price bars around them.

To understand how different these patterns can be in bullish scenarios, take a look at our piece on the Bullish Green Hammer Candle.

Interpreting the Message of the Bearish Engulfing Pattern

When deciphering a bearish engulfing pattern, it’s crucial to consider the relationship between the open price of the engulfing candle and the close of the first candle. The pattern is more reliable when it follows a clean upward price move.

Traders typically wait for the second candle to close before taking action, which could include selling a long position or entering a short position. However, it’s important to consider the overall market trend before acting on this pattern.

Bullish vs. Bearish: Understanding the Difference

Contrary to the bearish engulfing pattern, a bullish engulfing pattern indicates higher prices to come. It starts with a down candle, followed by a larger up candle that fully engulfs the down one.

If you’re interested in exploring more bearish patterns, don’t miss our article on the Hanging Man Candle.

Evaluating the Limits of the Pattern

Despite its usefulness, the bearish engulfing pattern has limitations. It is most significant following a clean upward price move. If the price action is choppy, the pattern’s relevance diminishes. Additionally, the second candle in the pattern can be disproportionately large, possibly leading to a larger stop loss for traders.

Traders often use other methods, such as trend analysis or indicators, to complement their strategy. Check out our list of Best TradingView Indicators to enhance your technical analysis toolkit.

The Bearish Engulfing Pattern in Action

Let’s look at a practical example to understand the bearish engulfing pattern better. On Day 1, the market closes near the day’s high, indicating bullish sentiment. Day 2 opens higher, but the bulls run out of steam, and prices fall, closing near the day’s lows and lower than Day 1’s lows. This creates a bearish engulfing pattern.

Trading Tips for Navigating the Bearish Engulfing Candle

Here are three methodologies for selling using the Bearish Engulfing Pattern:

- Selling at the close of Day 2: If there is a substantial increase in volume accompanying the large downward price move, it might signal a stronger indication to sell.

- Selling the day after the pattern occurs: By waiting until the next day, a trader verifies that the bearish reversal pattern is genuine and not a one-day occurrence.

- Waiting for other signals: Often, traders wait for other signals, such as a price break below the upward support line, before entering a sell order.

Remember, while patterns like the bearish engulfing provide valuable insights, they aren’t foolproof. Always complement your technical analysis with other trading tools and stay updated with market trends.

This article contains affiliate links I may be compensated for if you click them.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!