Apex Trader Funding Review

What is Apex Trader Funding?

Apex Trader Funding offers futures traders access to substantial capital through a single-step evaluation process. The platform supports a wide range of futures contracts and popular trading software like NinjaTrader and Tradovate.

With no daily loss limits, high profit splits (100% of the first $25,000, 90% thereafter), and the ability to manage up to 20 funded accounts, Apex provides a flexible environment for traders to scale their activities.

The firm’s trader-friendly features, including allowance for news trading (with an explanation) and frequent payouts, make it an attractive option for both novice and experienced futures traders looking to grow their trading careers without risking personal capital. Continue reading my Apex Trader Funding review to help you determine if its the best funded trader platform for you!

Apex Trader Funding Key Takeaways

- Generous profit sharing: Keep 100% of the first $25,000 and 90% thereafter.

- Access substantial trading capital through a simple evaluation process.

- Flexible pricing: Choose from monthly or lifetime fee structures.

- Manage up to 20 funded accounts across different platforms.

- No daily loss limits: Risk managed via a trailing drawdown system.

- Compatible with NinjaTrader, Tradovate, Rithmic, and more.

Exclusive Offer: Get 80% off with coupon code ZBCLJSEH or use my affiliate link below!

Click Here to Get 80% Off!Pros and Cons of Apex Trader Funding

Apex Trader Funding

Pros

- 100% profit split up to $25k

- One-time lifetime fee option for long-term cost savings

- Up to 20 funded accounts

Cons

- Complex trailing drawdown

- 10-day trading requirement between payouts

- Strict payout request windows (1st-5th and 15th-20th)

Apex Trader Funding Pricing Structure

Apex Trader Funding offers a range of account options to suit different trading styles and capital requirements, with pricing varying based on account type, size, and platform choice.

Whether you’re considering a Rithmic or Tradovate account, Apex provides both evaluation and performance account options with flexible monthly or lifetime fee structures. It’s important to note that Apex Trader Funding also implements an $80 reset fee, allowing traders to restart their accounts if needed.

Let’s break down the pricing details for both Rithmic and Tradovate accounts, including evaluation accounts, static accounts, and performance accounts, to help you make an informed decision on which option best fits your trading goals and budget.

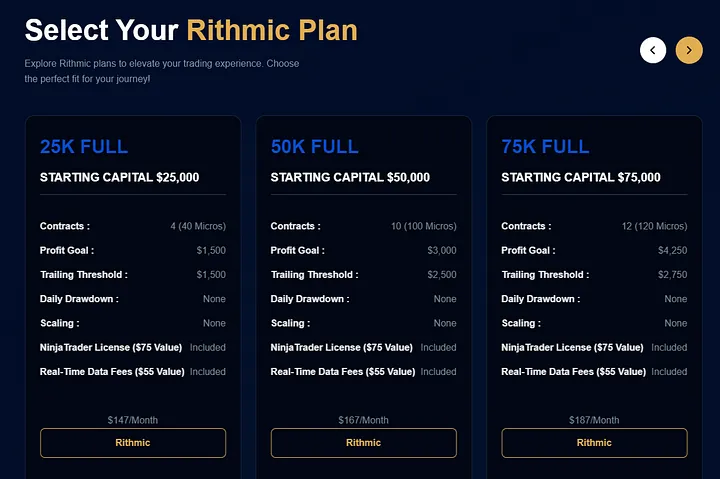

Apex Trader Funding Rithmic Account Pricing

A Rithmic evaluation account at Apex Trader Funding costs $27.40-$131.40 per month, depending on the account size you choose. Here is a table comparing all of the Rithmic pricing options:

| Account Type | Account Size | Monthly Fee |

|---|---|---|

| Rithmic Evaluation | $25K | $29.40 |

| Rithmic Evaluation | $50K | $33.40 |

| Rithmic Evaluation | $75K | $37.40 |

| Rithmic Evaluation | $100K | $41.40 |

| Rithmic Evaluation | $150K | $59.40 |

| Rithmic Evaluation | $250K | $103.40 |

| Rithmic Evaluation | $300K | $131.40 |

| Rithmic Static | $100K | $27.40 |

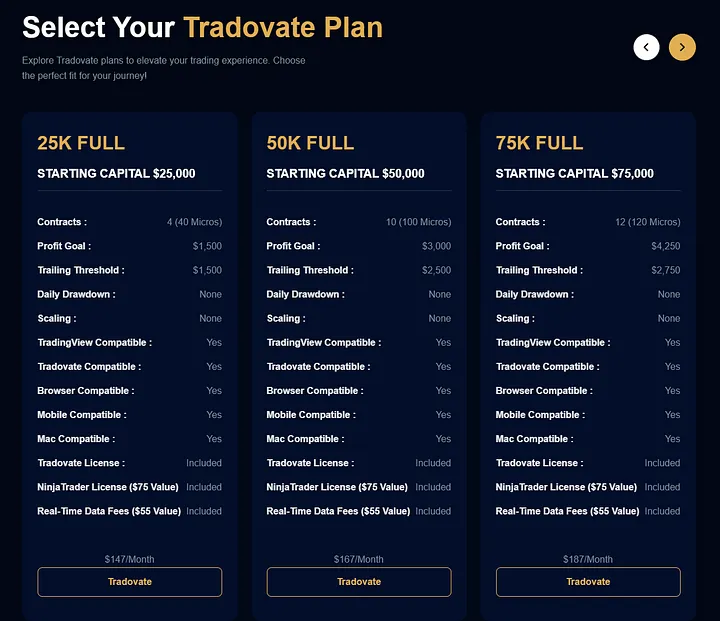

Apex Trader Funding Tradovate Account Pricing

A Tradovate evaluation account at Apex Trader Funding costs $31.40-$135.40 per month, depending on the account size you choose. Here is a table comparing all of the Tradovate pricing options:

| Account Type | Account Size | Monthly Fee |

|---|---|---|

| Tradovate Evaluation | $25K | $33.40 |

| Tradovate Evaluation | $50K | $37.40 |

| Tradovate Evaluation | $75K | $41.40 |

| Tradovate Evaluation | $100K | $45.40 |

| Tradovate Evaluation | $150K | $63.40 |

| Tradovate Evaluation | $250K | $107.40 |

| Tradovate Evaluation | $300K | $135.40 |

| Tradovate Static | $100K | $31.40 |

Apex Trader Performance Account Fees Explained

Apex Trader Funding offers two payment options for Performance Accounts (PA): monthly or lifetime fees. For Rithmic PA, the monthly fee is $85, while Tradovate PA is $105. Lifetime fees vary based on account size, ranging from $130 to $340 for Rithmic and $150 to $360 for Tradovate.

Once you pass an Evaluation Account, you’ll receive instructions to sign PA contract documents and make a payment. Importantly, the payment option you choose (monthly or lifetime) for a specific PA account cannot be changed later, and there are no exceptions to this rule. After signing the agreements, you can access the payment link through your ATF.com Dashboard in the Signatures tab.

Apex Trader Funding

Top Features

- 100% Profit Split Up to $25K!

- Manage Up to 20 Funded Accounts!

- Trade Freely, No Daily Loss Limits!

Apex Trader Funding Rithmic Performance Account Fees

For traders who prefer not to commit to a lifetime fee, Apex Trader Funding offers a monthly option of $85 for Rithmic accounts. However, if you’re looking to save in the long run, here’s a breakdown of the one-time lifetime fees for various Rithmic PA account sizes:

| Account Size | PA Activation Account Lifetime Fee |

|---|---|

| 25k | $130 |

| 50k | $140 |

| 75k | $180 |

| 100k* | $220 |

| 150k | $260 |

| 250k | $300 |

| 300k | $340 |

Apex Trader Funding Tradovate Performance Account Fees

For traders using Tradovate on Apex Trader Funding, there’s a monthly option of $105, or you can opt for a one-time lifetime fee that varies based on account size. Here’s a breakdown of the lifetime fees for different Tradovate PA account sizes:

| Account Size | PA Tradovate Activation Account Lifetime Fee |

|---|---|

| 25k | $150 |

| 50k | $160 |

| 75k | $200 |

| 100k | $240 |

| 150k | $280 |

| 250k | $320 |

| 300k | $360 |

Who is Apex Trader Funding Best For

Apex Trader Funding is ideal for futures traders seeking to amplify their trading potential without personal financial risk. It caters to both newcomers and seasoned professionals who can consistently execute profitable strategies while managing risk effectively.

The platform particularly suits active traders who thrive on market volatility, appreciate the freedom to trade news events (given it aligns with your strategy and is explainable), and aim to grow multiple accounts simultaneously. Those who value a straightforward evaluation process and are focused on rapid account growth will find Apex’s model especially appealing. If you want to see another funded futures platform option check out my comparison of Apex vs. TopStep.

Apex Trader Funding Risk Management Rules

Apex Trader Funding (ATF) allows traders to trade up to the maximum contracts for their plan, with no daily max drawdown limit. Each plan has a specific trailing drawdown that varies; for example, a $50K plan starts with a drawdown of $2,500 below the initial balance.

In funded accounts, the trailing drawdown stops when the liquidation threshold reaches $100 above the initial balance (e.g., $50,100 for a $50K plan). Static accounts have a fixed drawdown that does not change. The trailing drawdown always follows the highest profit point by the specified amount, and it is crucial to monitor this in real time to avoid failing the evaluation.

- No daily max drawdown limit

- Trailing drawdown varies by plan (e.g., $2,500 for a $50K plan)

- Trailing drawdown stops at $100 above the initial balance in funded accounts

- Static accounts have fixed drawdown limits

Apex Trader Funding Profit Sharing Rules

Apex Trader Funding offers 100% of the first $25,000 in profits and 90% thereafter, with payouts available twice monthly and no caps on earnings.

- 100% of the first $25,000 in profits

- 90% of profits thereafter

- Payouts available twice monthly with no caps on earnings

Tradeable Assets on Apex Trader Funding

- Equity Futures

- Foreign Exchange Futures

- Agricultural Futures

- Energy Futures

- Interest Rate Futures

- Metals Futures

- Crypto Futures

Apex Trader Funding Supported Trading Platforms

- Tradovate

- Rithmic

- NinjaTrader 8

- ATAS

- Bookmap

- Quantower

- Jigsaw Trading

- Finamark

- Edge Clear EdgePro X

- MotiveWave

- VolFix

- Wealthcharts

- TradingView Charting

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!