Barchart vs. StockCharts | Exploring Charting Platforms

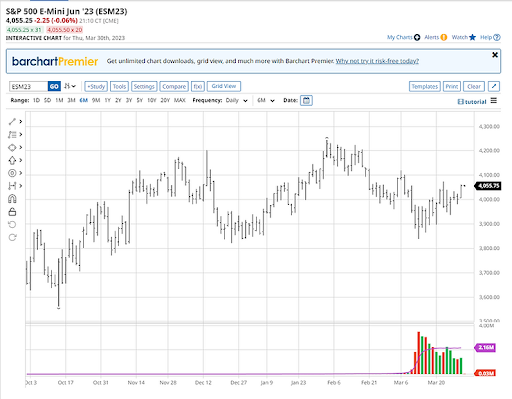

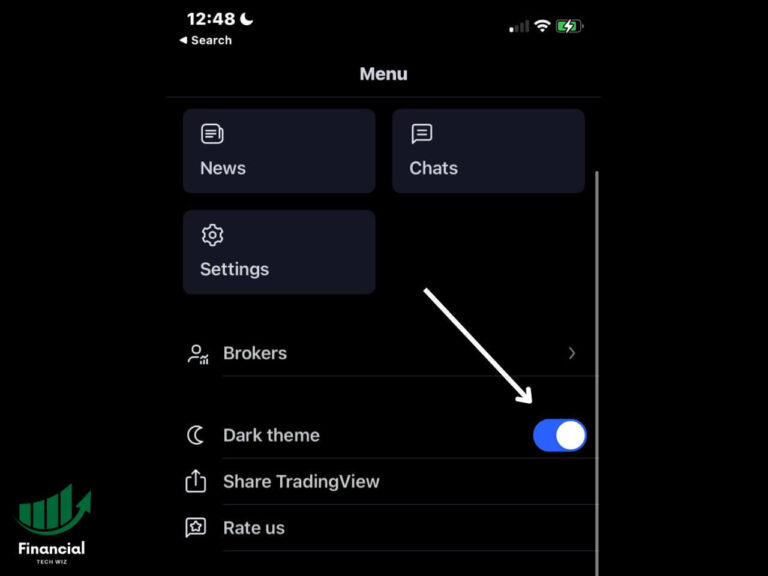

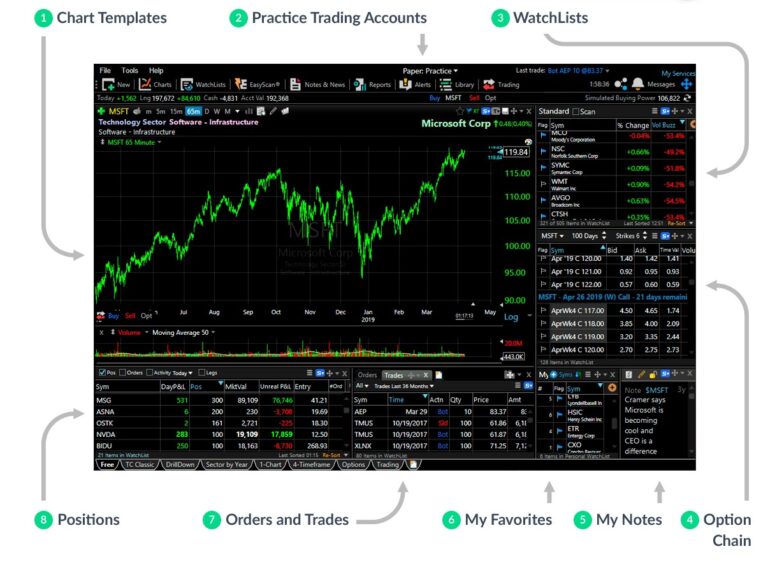

Barchart and StockCharts offer a range of features catering to different types of traders and investors. Let’s dive in to understand each platform’s unique strengths and how they stack up against each other. You can also check out my article on the best charting software, which includes both Barchart and StockCharts, Barchart: Real-time Data and…