Why I Have Conviction in my SPX Options Trading Strategy

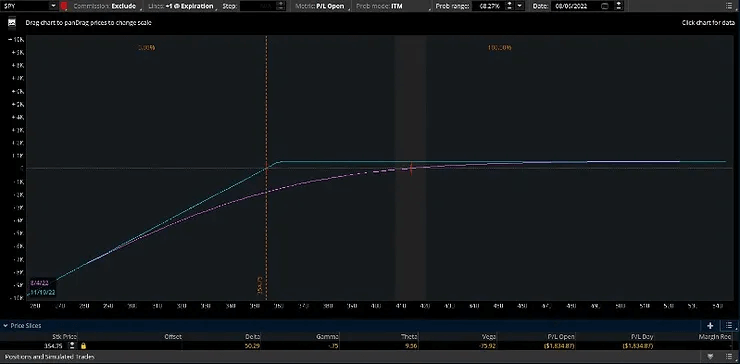

A strategy is useless if you lack conviction. What exactly is my SPX trading strategy? I replicate a long SPY portfolio by selling put options on either /MES, SPY, or SPX. Depending on the week, I use a SPY puts strategy and will generally sell to open about 1–2 contracts which are dependent on my…