thinkorswim Alternatives Compared

thinkorswim is a popular trading platform acquired by Charles Shwab in 2020 through their acquisition of TD Ameritrade. It is the prime choice for many to trade various financial instruments such as stocks, forex, options, and futures; however, some lackluster features may make you consider other alternatives.

- Web-based platform

- Downloadable app and mobile app

- Free version with limitations

$15 Discount

- Web-based platform

- Mobile app

- Included real-time data

25% off Coupon code: FTW25

- Downloadable desktop platform

- Real-time data: $8-$50/month

- Charges commissions for stock & option trading

Get $25 Off

Best thinkorswim Alternatives

TradingView

TradingView is an all-in-one trading platform for traders at all levels. Whether you trade stock, forex, crypto, futures, or other assets, you can use TradingView to execute trades, manage risk, and perform in-depth technical analysis. You can also develop and customize your own trading algorithms in Pine script.

TradingView vs thinkorswim

TradingView is far better regarding user interface, cloud-based accessibility, and cross-device compatibility. TradingView also integrates with multiple financial instruments like crypto, stocks, forex, etc., giving it an edge in versatility.

Pros of TradingView

- User-Friendly Interface: Easy to navigate for both beginners and experienced traders.

- Cloud-Based Access: Access charts from any device without installing software.

- Advanced Charting Tools: Customizable charts, indicators, and drawing tools are offered.

- Active Community: A large community for sharing ideas, strategies, and insights.

Cons of TradingView

- FOMO: While the social community is great, it can lead to FOMO (Fear of Missing Out)

- Broker Integration: It may lack integration with some brokers.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

TrendSpider

TrendSpider is an advanced trading platform that emphasizes automating trading strategies with AI tools. It offers customizable charting, real-time market scanning, and predictive AI-driven strategies. The trading system caters to a wide trading community by offering tools for discretionary trading and long-term investing.

TrendSpider vs thinkorswim

TrendSpider takes the lead over ThinkorSwim when it comes to AI-powered automation, cloud-based access, and advanced charting tools. On the other hand, ThinkorSwim provides a traditional, comprehensive trading experience that requires software installation to access most features.

Pros of TrendSpider

- AI-Powered Automation: Leverages machine learning and AI for automation.

- Customizable Charts: Offers deep technical analysis tools with customizable indicators.

- Cloud-Based Access: Allows traders to access their platform from any device without software installation.

Cons of TrendSpider

- Learning Curve: Its advanced features can be complex for beginners.

- Price: The subscription fees for premium features can be expensive.

- Limited Broker Integration: Fewer broker options for direct trading compared to other platforms.

Who is TrendSpider Best For?

TrendSpider is best for traders who love automating their trading strategies using expert advisors. Its robust backtesting features allow traders to analyze the performance of their algorithms with nearly 100% efficiency.

TrendSpider Special Offer!

Exclusive Deal: 25% Discount with Code FTW25

Elevate Your Trading – Join TrendSpider Today!

- AI-Powered Analysis

- Automated Technical Analysis

- 16 charts per layout

TC2000

TC2000 is hailed as a day trading platform best suited for those who prefer customizable watchlists, margin trading options, and advanced charting tools. The platform has an EasyScan for screening out stocks and options but lacks in level II market data and may charge additional software/data fees.

TC2000 vs thinkorswim

While TC2000 offers powerful charting tools, it lacks the advanced features of thinkorswim, such as access to level II market data and direct access routing.

Pros of TC2000

- Powerful Charting and Analysis: TC2000 offers advanced charting features, including customizable watchlists, technical indicators, and drawing tools.

- Low Margin Rates: Offers competitive margin rates, with 4:1 intraday margin for most securities.

- Cross-Platform Support: Available on Windows, Mac (via Parallels), and Chromebook.

Cons of TC2000

- Commissions & Fees: $1 per stock trade plus $0.65 per options contract, and extra costs for real-time data.

- No Futures or Futures Options: Limited to stocks, ETFs, and options, lacking futures and futures options trading.

- Expensive Data & Software Costs: Real-time data costs between $8-$50/month, adding to the overall expense.

Who is TC2000 Best For?

TC2000 is good for stock and options traders who prefer a user-friendly, customizable platform but are not afraid to pay a little more for extra features such as smart routing. For those concerned with costs, TradingView can be a better alternative.

TC2000 Special Offer!

Exclusive Deal: $25 Off Your First Month

Limited Time Offer – Join TC2000 Today!

- Powerful Charting

- EasyScan Technology

- Custom Indicators

Trade Ideas

Trade Ideas is an AI stock scanning platform with a built-in Holly AI system responsible for scanning the market to identify high-potential trades. It scans the stock market by filtering through volume, price movement, and gap percentage. Traders requiring a premium platform to track trends and opportunities can use the platform for $89-$179 monthly.

Trade Ideas vs thinkorswim

Trade Ideas focuses more on AI analysis in the stock market and provides trading signals that make it exclusive to a certain group of traders. On the other hand, thinkorswim focuses more on charting tools, options trading, and educational tools, making it a better option for a wide range of trading styles.

Pros of Trade Ideas

- AI-driven trade signals: Holly AI identifies high-potential trades based on historical data.

- Real-time scanning and alerts: Traders can quickly spot trending stocks and potential opportunities.

- Live trading room: Traders can learn from professionals and interact in real-time.

Cons of Trade Ideas

- No mobile app: Limited flexibility for traders who want to trade on the go.

- Outdated user interface: It can be overwhelming for beginners or those used to modern, streamlined platforms.

- Limited charting tools: A fewer technical indicators than platforms like thinkorswim.

Who is Trade Ideas Best For?

Trade Ideas is best for traders looking to actively day and swing trade the markets with the help of artificial intelligence. Its best for market participants who prefer speed and automated trade signals.

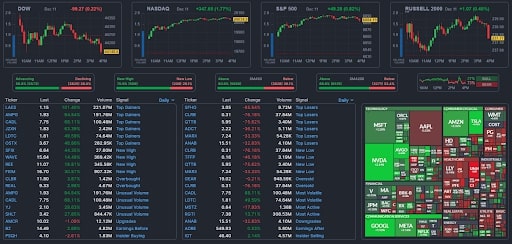

Finviz

Finviz is a screening and charting platform that costs $24.96(Yearly subscription) or $39.50(Monthly subscription) per month. A free version with various features for technical and fundamental analysis is also available. The trading community appreciates the interface’s user-friendliness, powerful screener, and multi-instrument coverage.

Finviz vs ThinkorSwim

Finviz is known for its user-friendly interface and various customizable filters, while ThinkorSwim offers more robust, in-depth charting and real-time data. While Finviz (Paid version) excels in quick stock screening and visual analysis, ThinkorSwim is ideal for active traders seeking complex tools and real-time execution.

Pros of Trade Ideas

- Screening: Variety of screening options for filtering stocks.

- Artificial Intelligence: Advanced AI-driven scanning and heat maps.

- Alerts: Customizable alerts and strategies to match individual trading styles.

Cons of Trade Ideas

- Real-time quotes: The free version does not offer real-time quotes.

- Geography: More focused on the US market.

- Stocks Coverage: Covers a smaller number of stocks compared to other platforms.

Who is Finviz Best For?

Finviz is best for retail market participants who require an easy-to-use stock screen for quick analysis. It’s ideal for traders who don’t prefer a steep learning curve to filter out the best stocks.

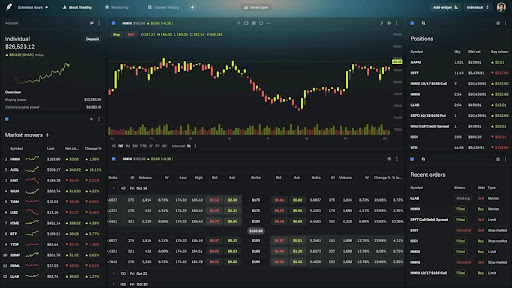

Robinhood Legend

Robinhood Legend is a new browser-based trading platform. It includes all the nitty gritty of trading software, including charting tools, real-time data, and one-click trading. New features are being rolled out gradually to improve the overall trading experience.

Robinhood Legend vs thinkorswim

thinkorswim has a deeper and more advanced trading experience for professional traders in contrast with Robinhood Legend, which caters to novice traders. While both are free to use with a funded account, thinkorswim requires an additional payment to access advanced features.

Pros of Robinhood Legend

- Customizable Layouts: Users can personalize their trading dashboard with multiple widgets and charts.

- One-Click Trading: Facilitates quick trade execution directly from charts or watchlists.

- Commission-Free Trades: Offers commission-free trading for stocks, ETFs, and equity options.

Cons of Robinhood Legend

- Limited Advanced Features: While customizable, it lacks some high-level technical analysis and research tools.

- Limited Assets: It may not offer various instruments like mutual funds or currencies.

- Web-Based Only: Robinhood Legend is only available on desktop browsers.

Who is Robinhood Legend Best For?

Robinhood Legend is best for stock and options traders who do not need to deal with deep technical analysis. Traders who don’t like trading fees would enjoy the platform due to its commission-free stocks, ETFs, and equity options.

What is the Best Free thinkorswim Alternative?

Robinhood Legend can be considered as one of the thinkorswim alternatives. It offers commission-free trades and a simple, customizable stock and options trading interface. Although it requires a funded Robinhood account but is free to use once set up. Another solid option is TradingView, which has a free tier with advanced charting tools, though more features require a paid subscription.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

FAQ About thinkorswim Alternatives

Is thinkorswim owned by Schwab?

Yes, thinkorswim was originally founded by Tom Sosnoff. It was later acquired by TD Ameritrade, which was then bought by Schwab in 2020.

Is thinkorswim free to use?

Yes, thinkorswim is free, but a funded TD Ameritrade account is required to access the platform and its features.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!