VOOG vs. VOOV – Which is Best For You?

Discover my comparison of VOOG vs. VOOV to determine which is best for you. I have compiled all of the information about these funds across the internet in this article to make your research easier.

VOOG vs. VOOV Key Characteristics

You can use the table below to compare the key characteristics of these funds:

| Metrics | VOOG | VOOV |

|---|---|---|

| 1-Year Annual Return | 29.90% | 22.11% |

| 5-Year Annual Return | 16.11% | 13.99% |

| Expense Ratio | 0.10% | 0.10% |

| Dividend Yield | 0.87% | 1.69% |

| Number of Holdings | 239 | 401 |

You can compare these funds in real time using the TradingView chart below. Ensure to click the “ADJ” button at the bottom right of the chart to adjust the data for dividends! While TradingView doesn’t support mutual funds, you can change them to the ETF equivalent to see the returns in real-time.

Overview of VOOG

The Vanguard S&P 500 Growth ETF, trading under the ticker symbol VOOG, is an exchange-traded fund managed by Vanguard. This ETF is designed to track the performance of the S&P 500 Growth Index, which represents the growth segment of the S&P 500 Index. This ETF is suitable for investors seeking concentrated exposure to large-cap U.S. growth stocks.

Overview of VOOV

VOOV, the Vanguard S&P 500 Value ETF, is an exchange-traded fund managed by Vanguard. This ETF is designed to track the performance of the S&P 500 Value Index, which represents the value segment of the S&P 500 Index. The primary objective of VOOV is to provide investors with exposure to large-cap U.S. stocks that are considered to be value-oriented.

Performance Comparison of VOOG vs. VOOV

The total return performance including dividends is crucial to consider when analyzing different investment funds.

As of 1/15/2024, VOOG has a one year annualized return of 29.90%, while VOOV has a five year annualized return of 22.11%.

VOOG vs. VOOV Dividend Yield

Both VOOG and VOOV pay dividends to their shareholders from the earnings of their underlying stocks. The dividend yield is a measure of how much a company pays in dividends relative to its share price.

As of 1/15/2024 the dividend yield of VOOG is 0.87%, while the dividend yield of VOOV is 1.69%.

VOOG vs. VOOV Expense Ratios

The expense ratio is a measure of how much an ETF charges its investors for managing the fund. It is expressed as a percentage of the fund’s assets per year.

The expense ratio is one of the most important factors to consider when choosing an ETF because it directly affects your returns over time. The lower the expense ratio, the more money you get to keep from your investment.

As of 1/15/2024 VOOG has an expense ratio of 0.10%, while VOOV has an expense ratio of 0.10%.

VOOG vs. VOOV Holdings

A fund’s holdings are the basket of individual securities that it owns and tracks. It is crucial for investors to analyze a fund’s holdings because they are effectively what you are investing in by purchasing the fund.

As of 1/15/2024 VOOG holds 239 securities, while VOOV holds 401.

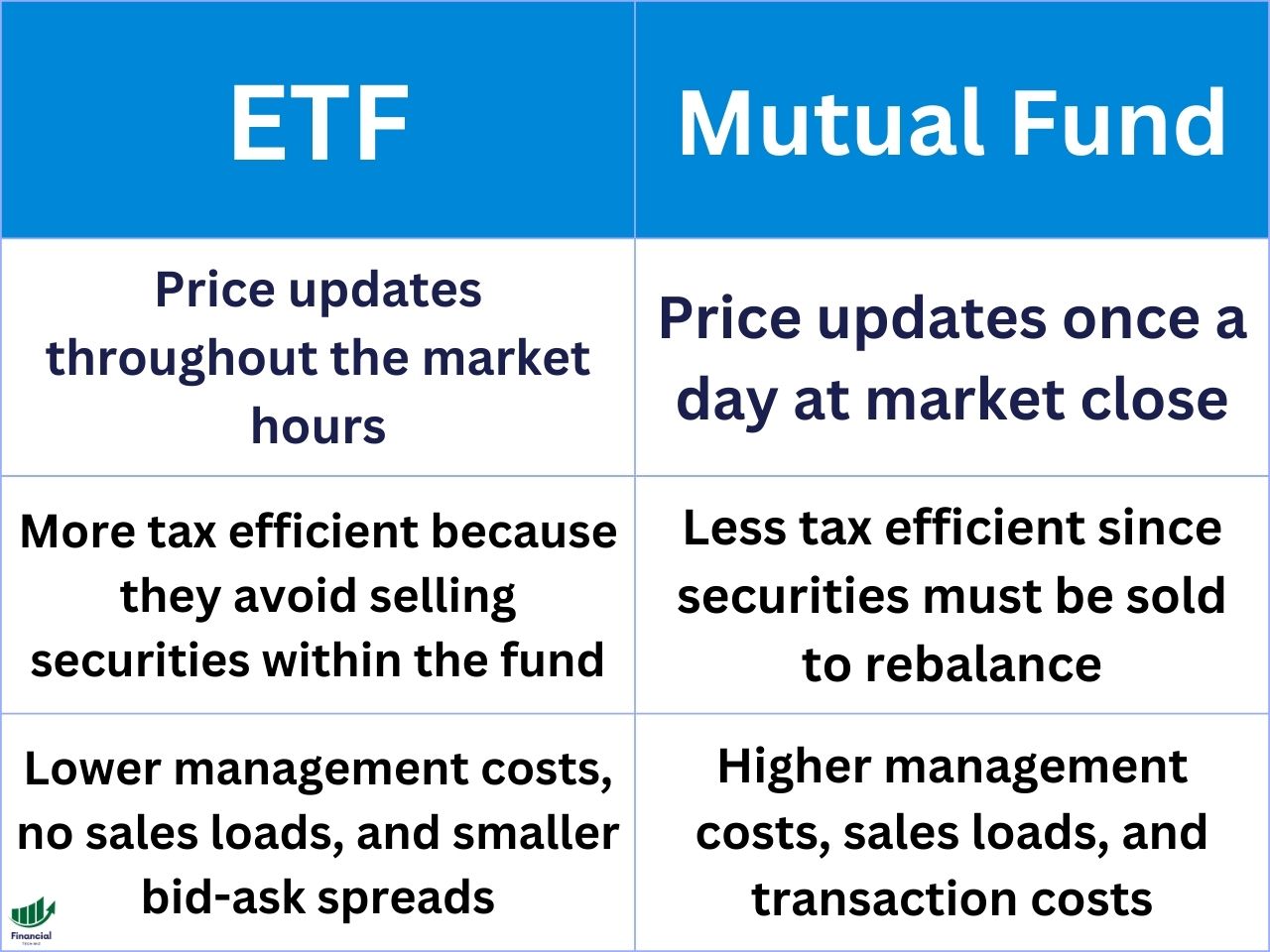

Mutual Funds vs. ETFs

When comparing investment funds, you may be confused about the difference between an ETF and a mutual fund. Keep in mind, an index fund is a specific type of mutual fund. ETFs are tradeable during the stock market hours, while mutual funds only update once per day.

Mutual funds are pooled investment vehicles that are managed by a fund company or an investment advisor. They issue and redeem shares directly to investors at the end of each trading day based on their net asset value (NAV). Investors can buy and sell mutual fund shares through the fund company or a broker.

ETFs are also pooled investment vehicles that are managed by a fund company or an investment advisor. However, they trade like stocks on an exchange throughout the trading day at market prices that may differ from their NAV. Investors can buy and sell ETF shares through a broker.

Some of the advantages and disadvantages of mutual funds vs ETFs are:

- Mutual funds may offer more convenience and flexibility for investors who want to invest a fixed amount of money or set up automatic investments or withdrawals.

- Mutual funds may require a larger minimum investment.

- ETFs may incur bid-ask spreads and premiums or discounts to their NAV, which can affect their trading efficiency and performance.

- Mutual funds may be less tax-efficient than ETFs, as they may distribute more capital gains to their shareholders due to their redemption mechanism.

- ETFs may be more tax-efficient than mutual funds, as they may avoid realizing capital gains through their creation and redemption mechanism.

VOOG vs. VOOV – Bottom Line

Ultimately, both VOOG and VOOV are solid investment choices. The choice between the two ultimately depends on the exposure you want and the amount of risk you are willing to take.

Hopefully, the information in this article helps you decide which is better for your portfolio. To continue your research, check out our other fund comparison articles as well!

Comparing ETFs With TradingView

When comparing ETFs, it is crucial that you are comparing the total return to include dividend payments. TradingView allows you to compare several stocks and ETFs at once on a single chart adjusted for dividends.

You can simply sign up for a free TradingView account and type the stock ticker you want to compare.

Exclusive Deal: 30-Day FREE Premium Access + Bonus Credit

Don’t Miss Out – Sign up for TradingView Now!

- Advanced Charts

- Real-Time Data

- Track all Markets

Next, click the plus sign next to the ticker at the top left of the chart to add symbols to compare.

Finally, ensure you click the ‘ADJ’ at the bottom to adjust the returns for dividends!

TradingView is the best way to compare multiple funds and ETFs on a single chart, making your research much easier. Feel free to compare any ETFs you’d like using the widget at the top of this page. Alternatively, sign up for a free TradingView account and use the main website for a better experience. You can also watch the video below to learn how to compare funds with TradingView:

Other ETF Comparisons

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!