Buy to Open vs. Buy to Close: You Must Know the Difference

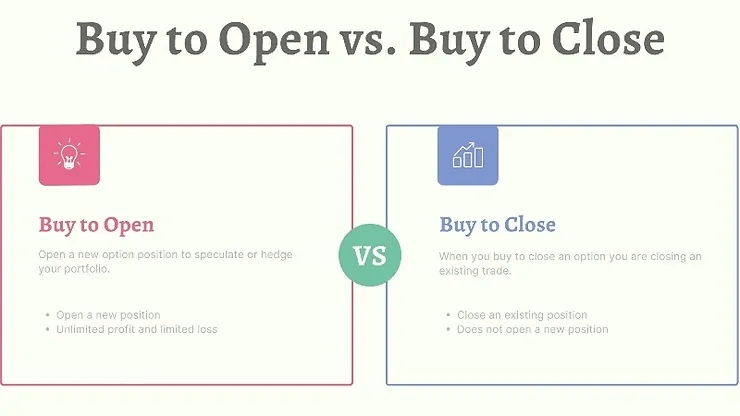

Buy to open vs. buy to close orders tell your broker if you are attempting to open or close an options trade.

This article will discuss when you should use each and why it is essential to understand the difference.

We have a similar article you can read that discusses sell to open vs. sell to close orders.

What is Buy to Open

When you buy to open an option contract, you are opening a new option position.

Since you are buying the option, you are betting on the price of the contract increasing.

Additionally, you are betting that implied volatility will increase when you buy options.

Example of a Buy to Open Trade

If you are bullish on AAPL stock, you can buy to open a call option to bet the call option will increase in value.

Most traders will buy to open LEAPs contracts or contracts that expire in one year or longer.

Since LEAPs have a long time until expiration, the stock does not need to increase immediately, giving you more time to be correct.

Advantages of Buying to Open

The main advantage of buying to open options is that you have unlimited profit potential and limited loss potential.

When you buy an option, your max loss is limited to the premium you pay, and the contract has unlimited profit potential.

Even though the risk to the reward is significantly in your favor when you buy options, there are also drawbacks.

Disadvantages of Buying to Open

One of the main disadvantages of buying to open contracts is that your probability of profiting is low, meaning you will lose more trades than you win.

Additionally, time is working against you since theta lower options prices as time passes. Therefore, if you buy an option and the underlying stock doesn’t move, your contract will bleed away due to theta decay.

What is Buy to Close

When you buy to close an option contract, you tell your broker that you want to close an option you sold to open.

Therefore, you should only use this order type when attempting to close an existing position in your account.

Example of a Buy to Close Trade

An excellent example of using a buy to close order is when you want to take profit on a covered call you sold.

When you sell to open a covered call, you can either let it expire or buy to close it before the expiration date.

Many traders prefer to buy to close covered calls before expiration to lock in profit and sell another covered call for more premium, a strategy known as rolling your position.

Buy to Open vs. Buy to Close: When to Use Each

Now that you understand what buy to open and buy to close entail, you should understand when to use each order type.

When Should You Buy to Open?

Buying to open a contract is an excellent way to speculate on a stock rising or to hedge your current investment portfolio.

Buying to open a call option entails that you believe a stock will increase in price, and you can control 100 shares of stock for much cheaper than purchasing the shares outright.

Buying to open a put option is either a speculative bet on a stock moving down or a way to limit your loss potential on a stock investment.

When Should You Buy to Close?

You should only use a buy to close order when you want to close an existing position.

If you have existing cash-secured puts or covered calls open, you can use a buy to close order to close the position before their expiration date.

Buy to Open vs. Buy to Close: Bottom Line

Options traders must understand the difference between buying to close and buying to open to ensure the broker understands the position they are trying to take.

For example, if you are trying to buy a call option to speculate on a stock moving up, you want to ensure that you are using a buy to open order.

If you currently have a covered call position that you want to close, you should use a buy to close order to close it out.

If you mix these up, your broker may get confused and make an incorrect position in your account.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!