Options Charts | How to Chart Options in Real Time

If you trade options, having access to a real-time options chart can help you determine optimal entry and exit prices. You can view real-time options charts on Thinkorswim and Tastytrade, so let’s dive into how.

How to Chart Options on ThinkorSwim (TOS)

ThinkorSwim is a widely-used platform known for its versatility and customizable features. Follow these steps to chart options on ThinkorSwim:

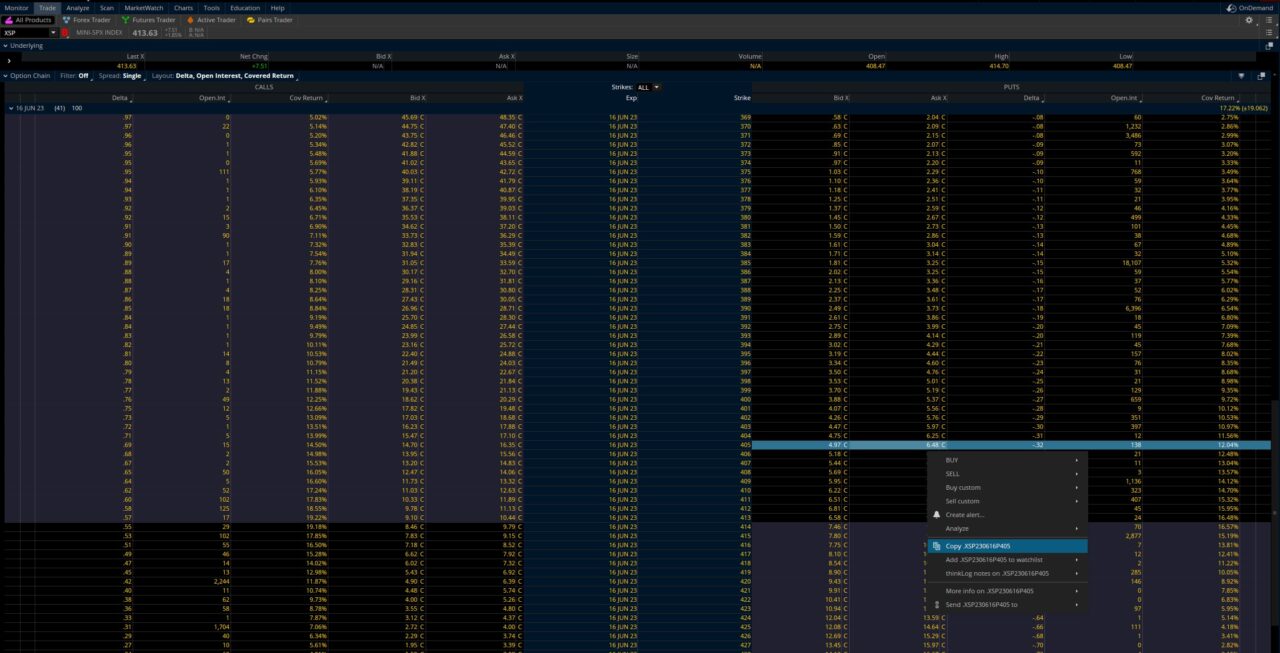

- Go to the trade tab

- Next, open the option chain and pick a stock, expiration, and strike price you want to chart

- Right-click the option, and click copy

- Go to the chart tab, paste the copied text, and the option chart will appear

How to Chart Options on Tastytrade

Tastytrade is another popular platform that offers options charting capabilities. Here’s how you can chart options on Tastytrade:

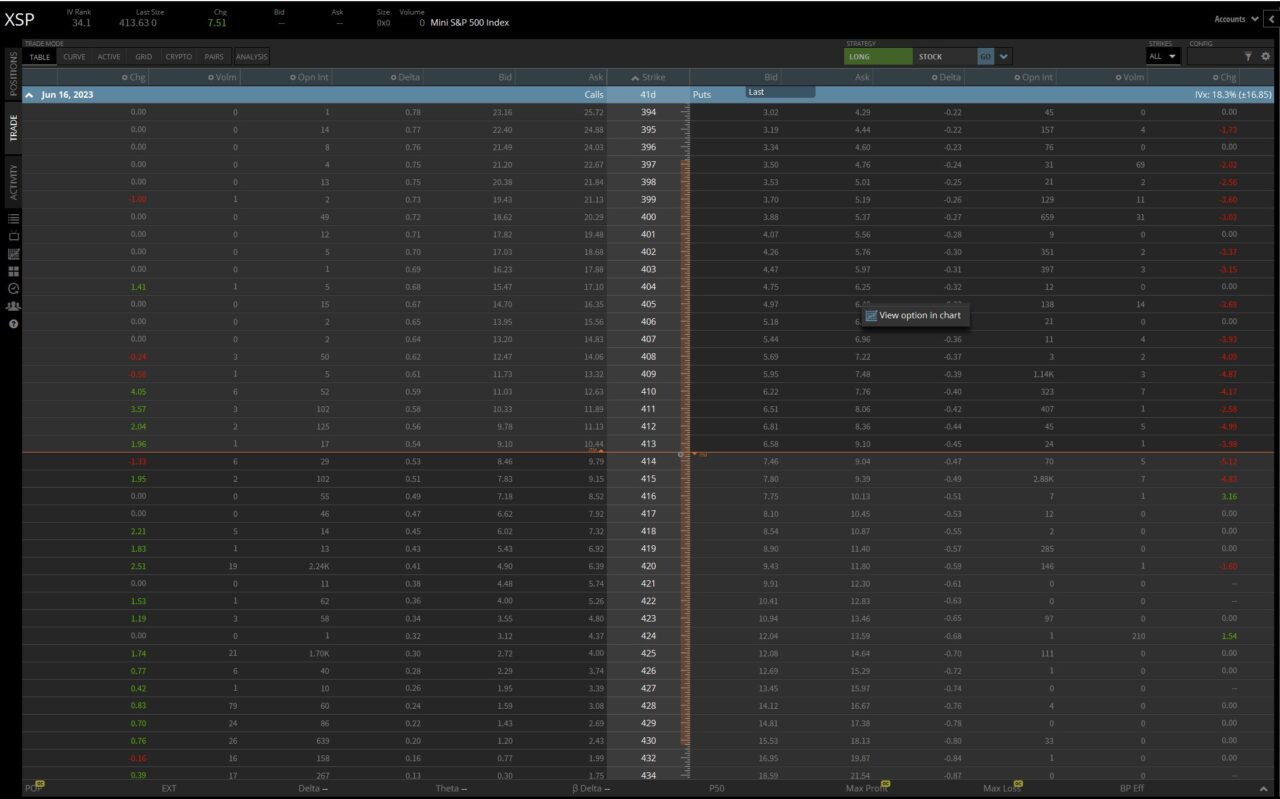

- Go to the trade tab

- Enter a stock, pick an expiration date and strike price of an option you want to chart

- Right-click the option and click view option in chart

How to View Options Charts on TradingView

TradingView is a widely-used charting platform known for its extensive range of tools and indicators. However, it is not possible to chart options on TradingView as of 2023.

Comparing Options Charting Platforms

To choose the most suitable options charting platform for your trading needs, it’s essential to compare their features and capabilities. Let’s take a closer look at ThinkorSwim, Tastytrade, and TradingView:

- ThinkorSwim: Known for its versatility and customizable features, ThinkorSwim offers in-depth options charting capabilities. It provides a wide range of technical analysis tools and allows for extensive customization.

- Tastytrade: Tastytrade is a platform specifically designed for options traders. It offers comprehensive options charting features and focuses on simplifying the options analysis process.

Consider your trading style, preferences, and the specific features offered by each platform when choosing the options charting platform that best suits your needs.

Best Practices for Options Charting

To make the most of options charts, consider the following best practices:

- Conduct thorough research: Familiarize yourself with the basics of options trading and technical analysis. Stay updated with market trends and news that may impact options prices.

- Utilize multiple time frames: Analyze options charts across multiple time frames

to gain a comprehensive understanding of the trends and patterns. This allows you to identify both short-term and long-term opportunities.

- Combine options charts with other indicators: Enhance your options analysis by incorporating other technical indicators such as moving averages, volume indicators, and oscillators. This provides additional confirmation and insights into potential trade setups.

- Keep track of your trades: Maintain an options watchlist to monitor and track the performance of the options you are interested in. This helps you stay organized and identify promising opportunities more efficiently.

- Learn from experience: Practice analyzing options charts and gain experience over time. Observe how different patterns and indicators play out in real market conditions. This will help you refine your charting skills and improve your trading decisions.

Remember, options charts serve as a valuable tool in your trading arsenal, but they should be used in conjunction with other forms of analysis and research.

Additional Resources

For more in-depth information on related topics, check out these articles:

- Heikin-Ashi Candles: Learn about Heikin-Ashi candles and how they can be used in technical analysis.

- Best TradingView Indicators: Discover some of the top indicators available on TradingView and how to effectively use them in your analysis.

- Best Time Frame for Intraday Trading: Explore different time frames and their suitability for intraday trading strategies.

- Best Charting Software for Stocks: Get insights into the top charting software options for stock traders.

By exploring these additional resources, you can deepen your knowledge and expand your understanding of options charting and related topics.

This article contains affiliate links I may be compensated for if you click them.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!