JEPI vs. JEPIX | Which is Best For You?

If you are looking for a fund that tracks a basket of stocks and uses a covered call strategy to generate income and pay out monthly dividends, you might have come across JEPI and JEPIX.

These two funds are essentially the same, except JEPI is an exchange-traded fund (ETF) while JEPIX is a mutual fund.

JEPIX has a higher expense ratio as well, but otherwise, the funds are nearly identical.

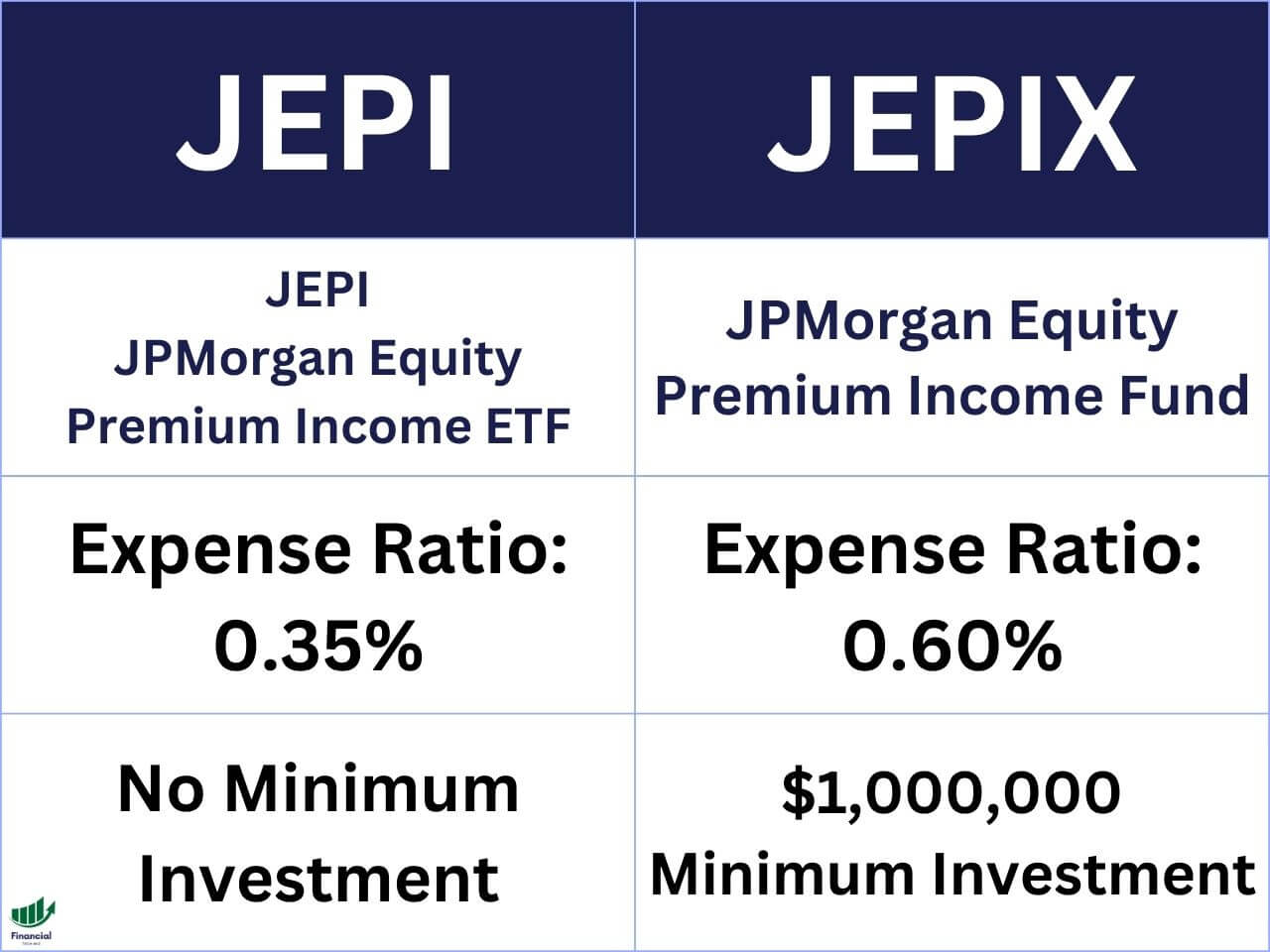

JEPI vs. JEPIX Minimum Investment

One of the main differences between JEPI and JEPIX is the minimum investment required to buy them.

JEPI has no minimum investment, which means you can buy as many or as few shares as you want. If your broker offers fractional shares, you can invest with as little as $1.

JEPIX, on the other hand, has a minimum investment of $1,000,000, making it only available to high net worth investors or institutional clients.

JEPI vs. JEPIX Dividend

Both JEPI and JEPIX pay monthly dividends to their shareholders, which can provide a steady stream of income.

The dividend yield of both funds varies between 6% – 12% depending on the market conditions and the performance of the underlying stocks.

However, these yields are not guaranteed and will always fluctuate.

JEPI vs. JEPIX Fees & Expenses

| Fund | Expense Ratio |

| JEPI | 0.35% |

| JEPIX | 0.60% |

Another difference between JEPI and JEPIX is the fees and expenses that they charge to their investors.

JEPIX has a higher expense ratio than JEPI, which means it costs more to run the fund. JEPI has an expense ratio of 0.35%, while JEPIX has an expense ratio of 0.60%.

This means that for every $10,000 invested in each fund, JEPI would charge $35 while JEPIX would charge $60 per year.

JEPI vs. JEPIX Total Return Performance

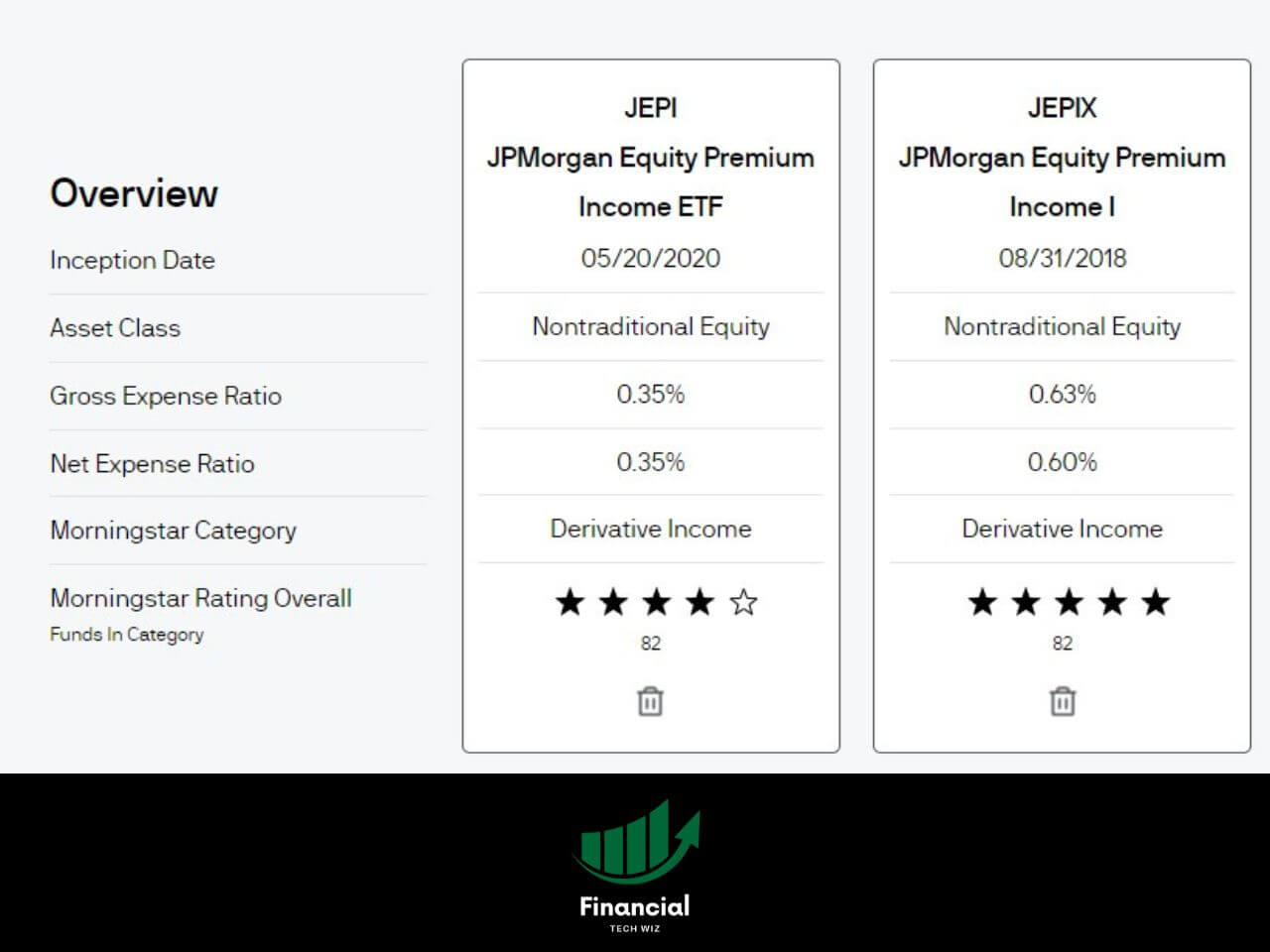

Despite the differences in fees and expenses, both JEPI and JEPIX have generated nearly identical returns since their inception.

The slight difference in performance may be attributed to the difference in fees and expenses, as well as the timing and execution of the covered call strategy.

Comparing ETFs With TradingView

When comparing ETFs, it is crucial that you are comparing the total return to include dividend payments. TradingView allows you to compare several stocks and ETFs at once on a single chart adjusted for dividends.

You can simply sign up for a free TradingView account and type the stock ticker you want to compare. Next, click the plus sign next to the ticker at the top left of the chart to add symbols to compare.

Finally, ensure you click the ‘ADJ’ at the bottom to adjust the returns for dividends!

As you can see in the TradingView chart below, you can compare multiple funds and ETFs on a single chart, making your research much easier. Feel free to compare any ETFs you’d like using the widget.

JEPI vs. JEPIX Holdings

Both JEPI and JEPIX have nearly identical allocations and holdings, as they both track the same basket of stocks from the S&P 500 index.

Other ETF Comparisons

If you are interested in comparing other ETFs that use a covered call strategy or offer high dividend yields, you can check out our other articles, such as:

The Financial Tech Wiz ETF Comparison Tool

You can use the ETF comparison tool below to compare over 2,000 ETFs and mutual funds with data I manually collected:

JEPI vs. JEPIX | Bottom Line

JEPI and JEPIX are both funds that track a basket of stocks from the S&P 500 index and use a covered call strategy to generate income and pay out monthly dividends.

They are essentially the same fund, except JEPI is an ETF while JEPIX is a mutual fund.

JEPI has no minimum investment, while JEPIX has a minimum investment of $1,000,000.

JEPIX has a higher expense ratio than JEPI, which means it costs more to run the fund.

Both funds pay monthly dividends, but the yield varies depending on the market conditions and the performance of the underlying stocks.

If you are looking for a fund that offers a high dividend yield and a covered call strategy, you might want to consider JEPI or JEPIX, depending on your investment goals and preferences.

However, you should also be aware of the risks and limitations of this strategy, such as the potential for lower capital appreciation, higher volatility, and tax implications.

If you want to learn more about JEPI and JEPIX or compare them with other funds, you can sign up for TradingView, a platform that allows you to track all markets from a single place easily.

You can also use TradingView to create charts, indicators, alerts, and more to enhance your trading and investing experience. If you sign up using my affiliate link, you can get a discount on your subscription.

Disclaimer: Financial Tech Wiz is an affiliate of TradingView and will be compensated if you sign up and purchase a TradingView subscription using our link.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!