Iron Condor vs. Iron Butterfly: What is the Difference?

If you are learning about selling options and are unsure whether the iron condor or iron butterfly is best, you have come to the right place.

Both of these strategies are similar, but there are some differences you must understand before deciding which one you should employ.

What Are Iron Condors and Iron Butterflies?

Iron condors and iron butterflies are delta-neutral options trading strategies. Both are option selling strategies as well, meaning you are short volatility. The jade lizard strategy is similar to an iron condor as well.

Since the strategies are delta-neutral, they will generate a profit when the underlying stock does not move in either direction. Additionally, if volatility drops after you sell an iron condor or iron butterfly, you will generate a profit due to the decrease in options pricing.

Iron Condor vs. Iron Butterfly

While both strategies have similarities, you must understand the differences to determine when it’s best to use each strategy.

Iron condor

- OTM short strikes

- Less extrinsic value collected from OTM strikes

- Collect less premium than the iron butterfly

- Wider profit range

Iron Butterfly

- ATM short strikes

- Max extrinsic value is at the ATM strikes

- Collect more premium than the iron condor

- Tighter profit range

What Is the Most Important Terminology Needed to Understand Iron Condor and Iron Butterflies?

One of the most crucial option terminologies you must know about these strategies is the difference between ATM (at the money) and OTM (out of the money) options. The ATM strike on an options chain is closest to the current share price.

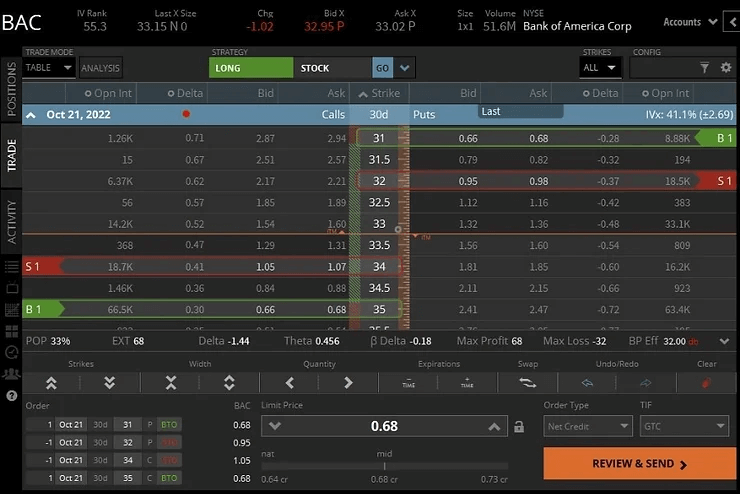

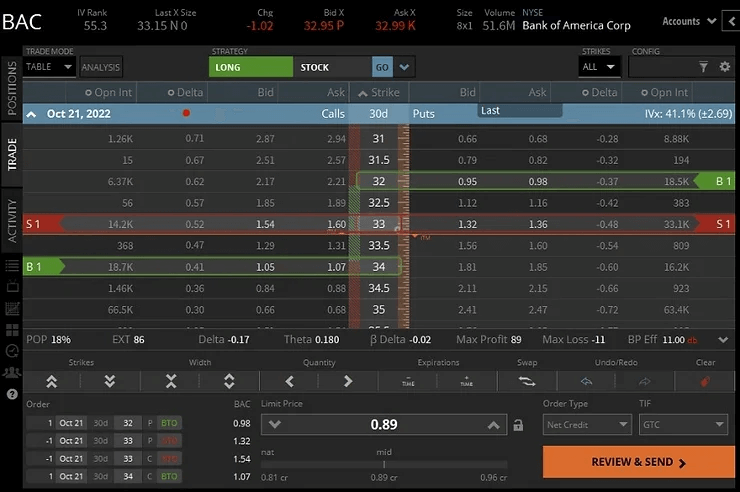

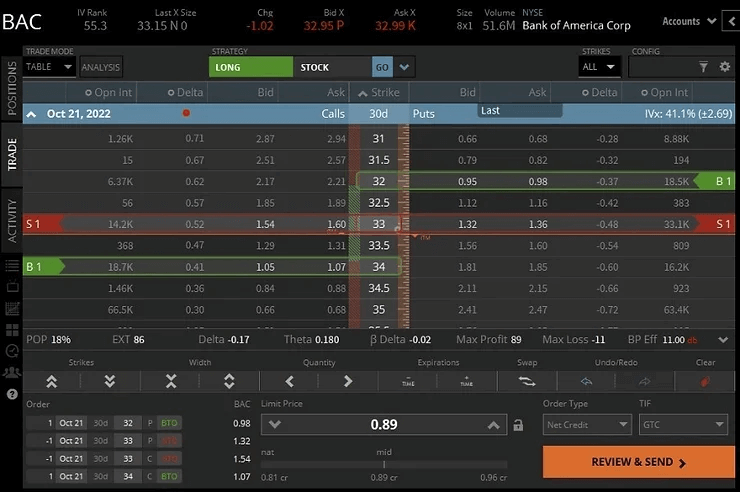

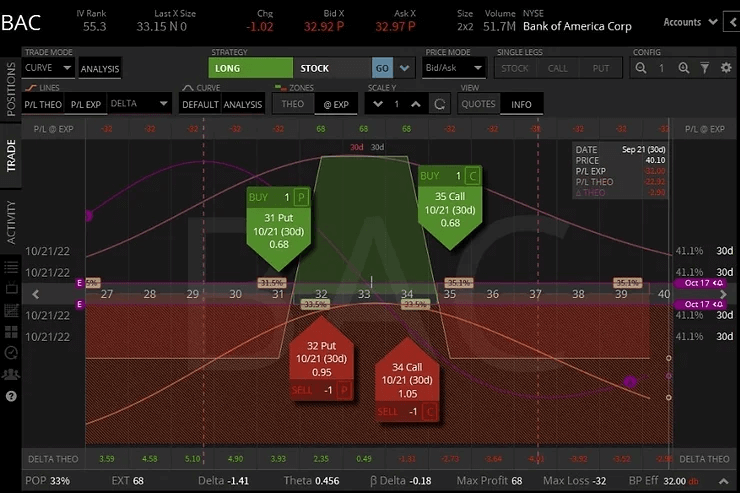

In the images above, you can see that $BAC is trading at 33.15 per share. Therefore, the ATM strikes for both the put and call would be $33.

What Iron Butterflies and Iron Condors Have in Common

The main similarity that iron butterflies and iron condors have in common is they are both delta-neutral and short volatility. After selling an iron butterfly or iron condor, you want the stock price not to move at all, so theta decays at the options and generates a profit.

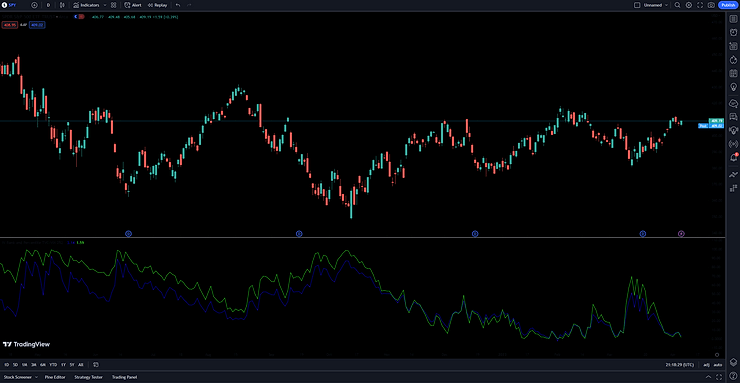

Additionally, both strategies generate a profit when volatility drops after you sell one. You can check a stock’s implied volatility rank (IVR) by adding the custom indicator to TradingView.

Both strategies are defined risk

Another significant difference between the iron condor and iron butterfly is that they both have long options and are defined risk trades. Without the protection legs, an iron butterfly is a short straddle. An iron condor without long protection legs is called a short strangle.

The short straddle and short strangle are naked strategies, meaning they come with unlimited theoretical risk. However, since a stock can move up infinitely, call options do not have a cap on how high they can go.

Since calls have significant upside risk, some traders will employ a jade lizard strategy and sell a naked put with a call credit spread.

How an Iron Butterfly is Different From an Iron Condor

An iron butterfly differs from an iron condor since it has ATM short strikes. Since there is more extrinsic value present with ATM options, you will collect more premium than an iron condor.

Additionally, each trade’s profit zone differs quite a bit. For example, the iron butterfly has a narrow range the stock can move within, while the iron condor has a larger one.

The iron condor is slightly more conservative since you are selling strikes that are further away from the strike price.

Iron Condor vs Iron Butterfly: What Strategy is Better?

Like everything in the stock market, it is hard to decipher which strategy is better than another. So instead, it is essential to know when using one over the other is better.

Traders use various tactics to determine when it is best to use one strategy over the other, including technical analysis. Therefore, the strategy you choose should depend on your trading style and analysis of the underlying stock.

Some traders may prefer the larger profit zone of an iron condor, while others may enjoy the higher premium collected with an iron butterfly.

Example of an Iron Condor vs. an Iron Butterfly

One of the main differences between the iron condor and iron butterfly is how wide the profit zone is. For example, in the image below, you can see an iron butterfly on $BAC. The green area is the profit zone, so if the stock stays in this area each day, you will make money.

However, if the stock moves quickly in one direction, then the iron butterfly will show a loss. As a result, most traders who use the iron butterfly will take profit early, usually at 25% of the premium collected.

Taking profit before expiration is beneficial because you will increase your win rate by taking it off early. Taking profit early does leave 75% of the premium on the table. However, your profit may disappear if you hold past 25% profit, depending on how the stock moves.

When to Use an Iron Butterfly vs. an Iron Condor

The iron butterfly is better to use when implied volatility seems insanely high. Since the profit zone is smaller than an iron condor, implied volatility must work for you. However, if the stock starts moving too far in either direction and volatility stays elevated, you don’t have much of a buffer like an iron condor.

An iron condor is best used when implied volatility is elevated, but you think the stock will move in a larger range. Since you are selling OTM strikes with iron condors, the stock can move in either direction a bit further, making it a slightly more conservative strategy.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!