Anchored VWAP Strategies You Can Use

The anchored VWAP is a popular trading indicator that can help you identify support and resistance areas based on various reference points.

What is the Anchored VWAP?

The anchored VWAP stands for anchored volume-weighted average price. It is a trading indicator that provides the average price of a security from a specific starting point (the “anchor”), factoring in price and volume. It is used to confirm trends and identify areas of support and resistance on the chart.

The main difference between the anchored VWAP and the traditional VWAP is the traditional VWAP resets daily. On the other hand, the anchored VWAP is always calculated based on where you set the anchor point.

Similar to the regular VWAP, the anchored VWAP takes price and volume into account to determine the average price that which the asset is bought and sold most frequently. This is useful to determine what is considered “fair value” for an asset based on a specific timeframe and anchor point.

Anchored VWAP Strategy – How to Use the Anchored VWAP

It is most common to use the anchored VWAP on longer timeframes like the daily chart. However, you can use it on any time frame, depending on your trading style and objectives.

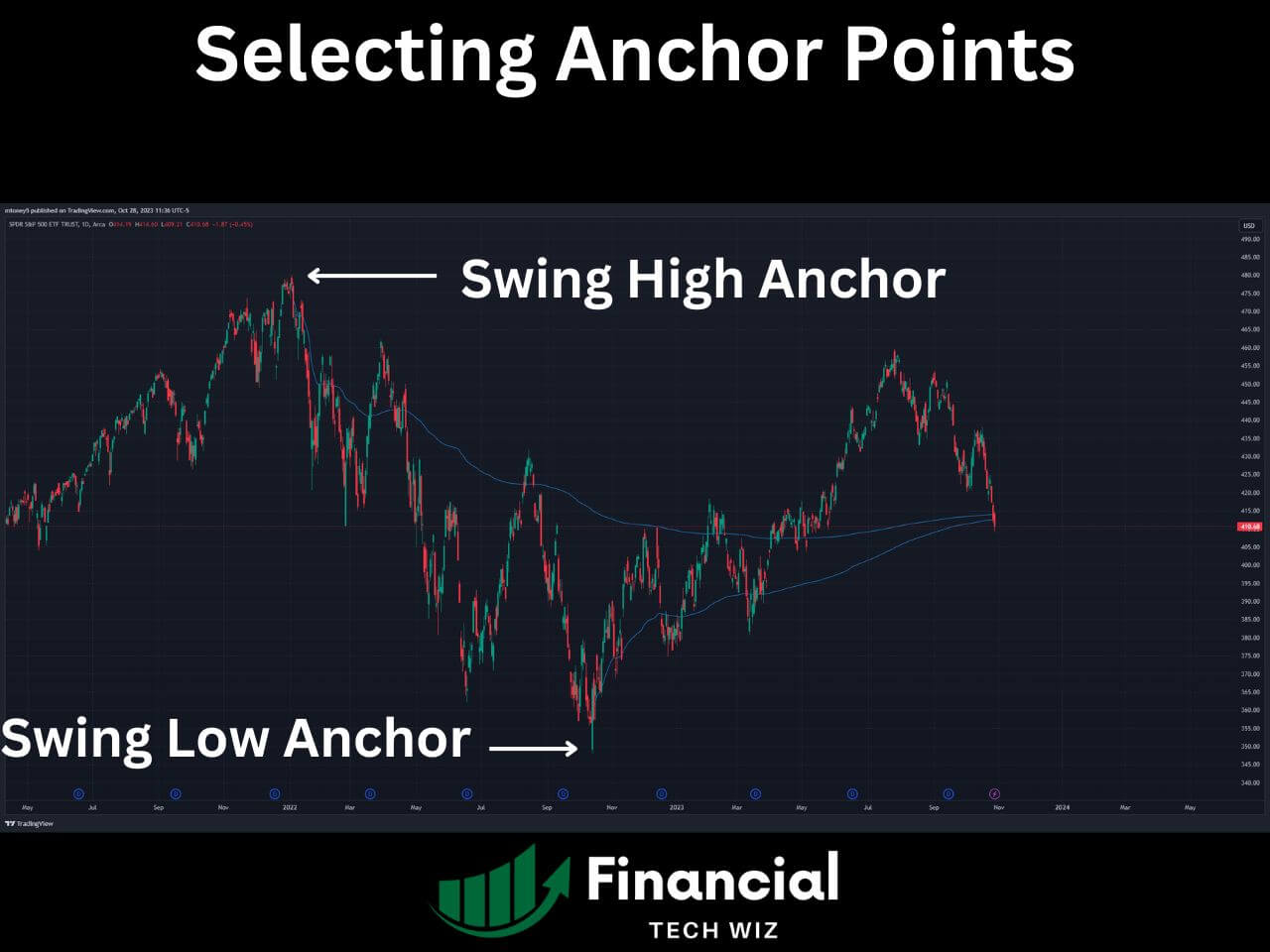

How to Pick the Anchor Point

You should pick an anchor point at key areas on the chart, such as the highest or lowest point of the price action, a gap, a breakout, a reversal, or any other significant event. The anchor point should mark a change in market sentiment or behavior that you want to measure.

For example, if we look at a chart of SPY, we can see a bottom in October of 2022 and a peak in January 2022. We can set the anchor point at either the bottom or the top. As shown in the image below, when we plot both anchored VWAPs, they are at nearly the same price, making the level more significant in this case.

How to Determine Entry and Exits

Depending on each specific situation, the anchored VWAP can allow you to determine trading opportunities in a few ways.

For example, if you set the anchor point to a swing low, and the stock is trading above the anchored VWAP, you can wait for the price to drop back to the anchored VWAP and buy it using the anchored VWAP as a support level.

However, if the price continues lower below the anchored VWAP, this may signal a trend change, and you may want to use a stop loss.

You can also trade continuations with the anchored VWAP. For example, if a stock recently broke above its anchored VWAP, this may signal a trend shift to a new uptrend.

The anchored VWAP will change from resistance to support, and you can buy the stock and set a stop loss below the anchored VWAP.

What Charting Platforms Offer the Anchored VWAP?

The best charting tools that offer the anchored VWAP include TradingView, thinkorswim, and TrendSpider. You can use it with a free account on TradingView, free as a Schwab or TD Ameritrade customer with thinkorswim, or with TrendSpider.

TradingView is a web-based platform that offers advanced charting tools, technical indicators, drawing tools, and social features. You can access thousands of markets and instruments across stocks, forex, crypto, futures, and more. You can get a free trial and a discount when you use our affiliate link to sign up for a new TradingView account.

thinkorswim is a desktop-based platform that offers powerful trading tools, analytics, and education for active traders. You can trade stocks, options, futures, forex, ETFs, and more with thinkorswim.

TrendSpider is an automated technical analysis platform that uses artificial intelligence to scan charts for patterns, trends, indicators, and candlestick formations. You can also backtest your strategies, set alerts, and monitor multiple time frames with TrendSpider.

You can get a free trial of TrendSpider when you use our affiliate link to sign up. Additionally, you can use the TrendSpider discount code FTW25 to get 25% off!

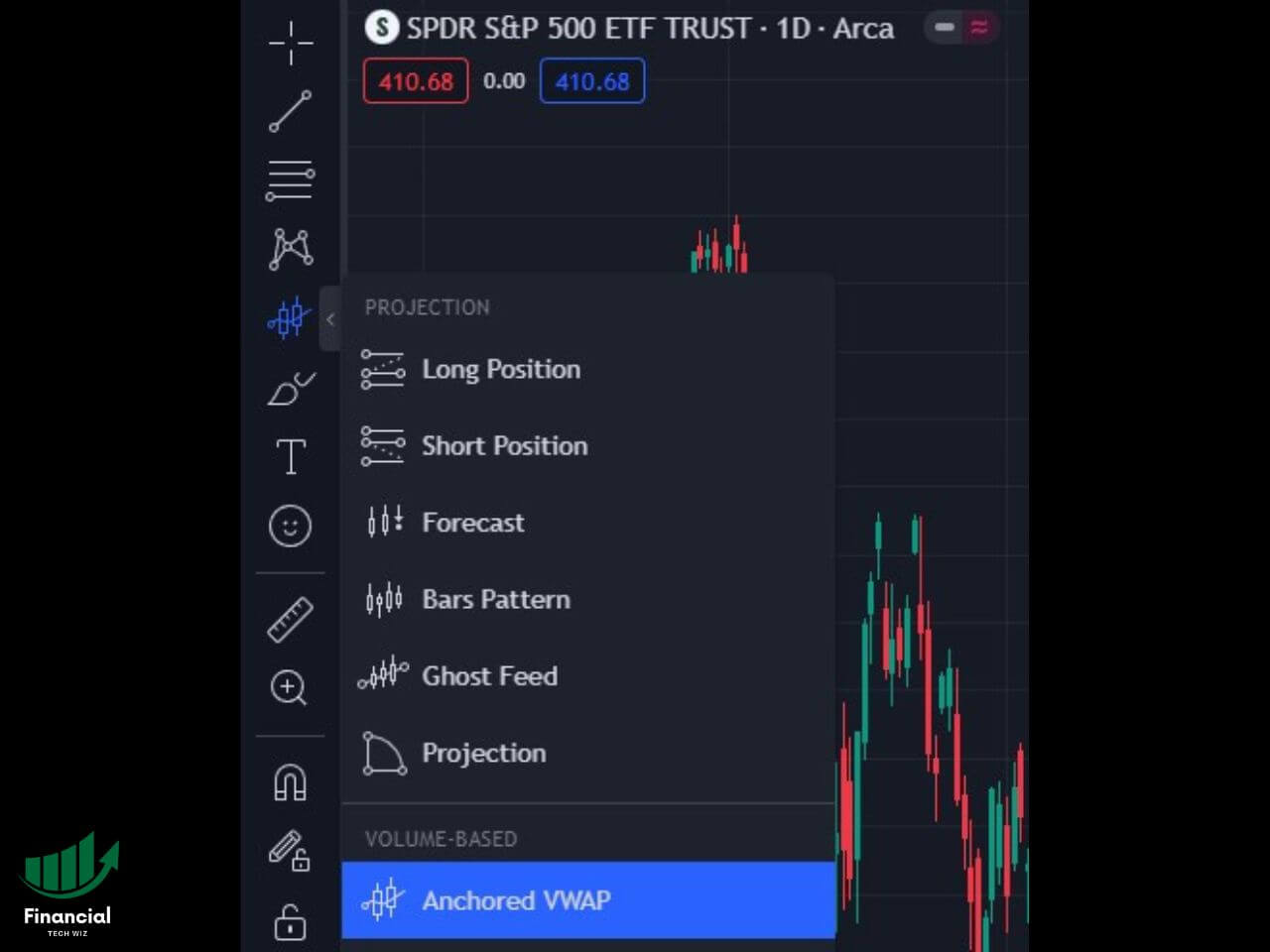

How to Use the Anchored VWAP on TradingView

The anchored VWAP on TradingView is a drawing tool that you can access from the left toolbar. It is the fifth tool from the top on the left part of the chart. Once you click on it, you will see the anchored VWAP tool under the volume-based section.

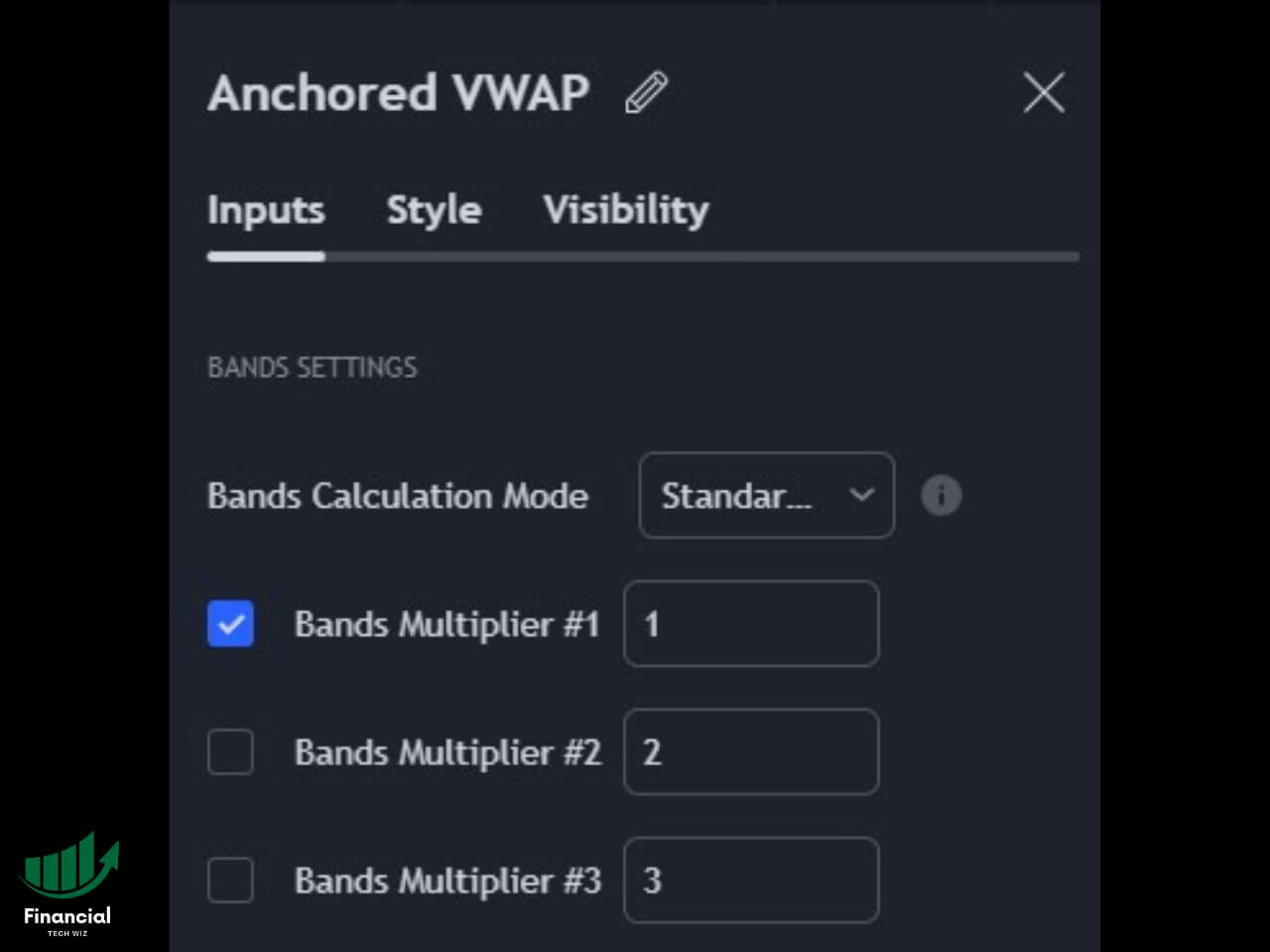

To use it, you simply click on the candlestick that you want to use as the anchor point. This will plot the anchored VWAP and two additional band multipliers.

These band multipliers are customizable and signify 1, 2, or 3 standard deviations above and below the anchored VWAP.

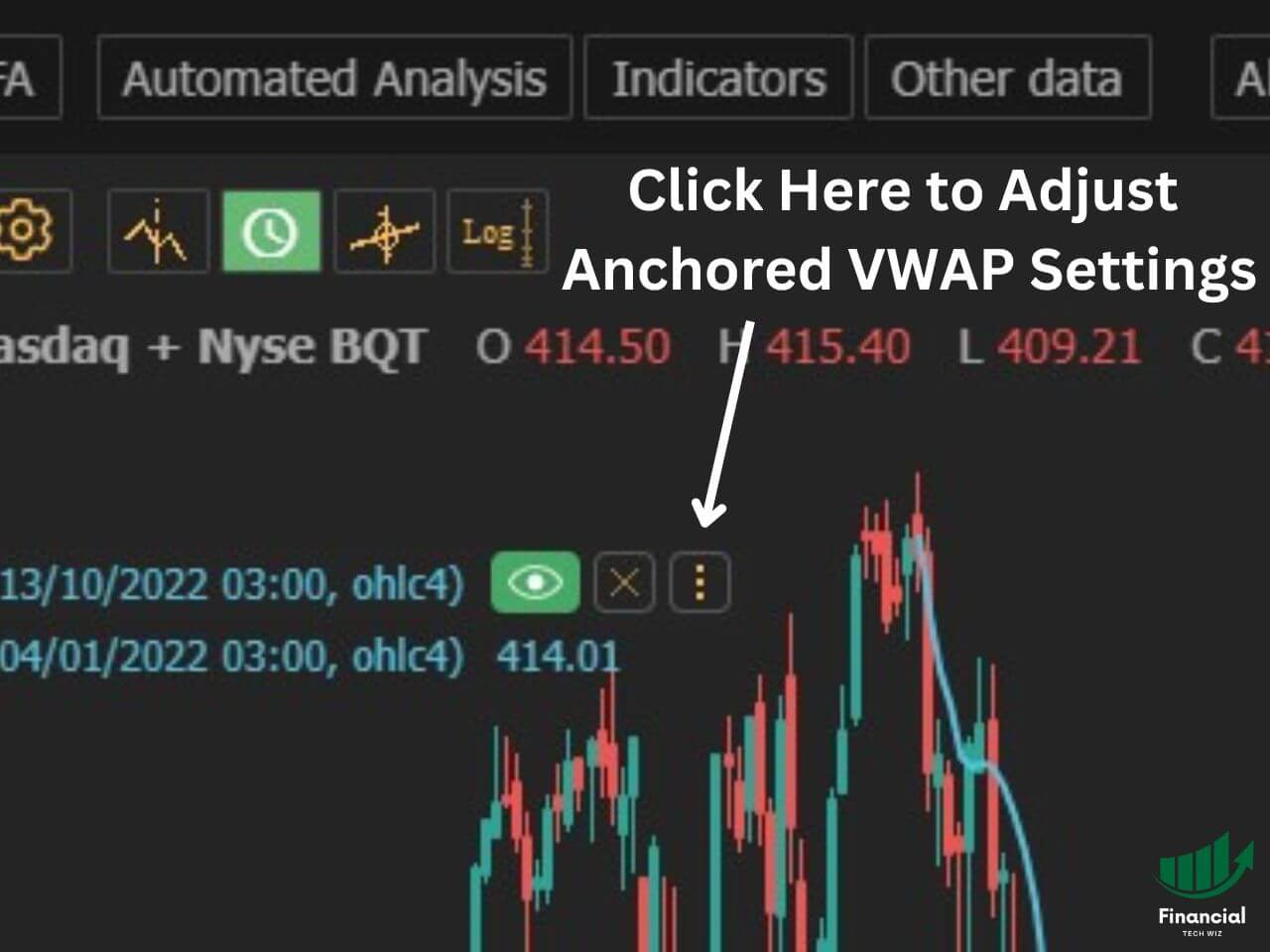

You can remove these by clicking on the anchored VWAP, clicking the settings icon, and unchecking the band multiplier boxes.

You can also watch my video about using the anchored VWAP on TradingView below:

How to Use the Anchored VWAP on TrendSpider

To use the anchored VWAP on TrendSpider, you must first pull up a chart of your desired instrument and time frame.

Then, you can right-click on the candlestick that you want to use as the anchor point and select “create an anchored indicator,” then select anchored VWAP.

You can also adjust the color, style, and thickness of the line by clicking on the three dots that appear when you hover over the anchored VWAP in the indicator list at the top left of your chart.

You can also add multiple anchored VWAPs from different anchor points to compare them.

How to Use the Anchored VWAP on thinkorswim

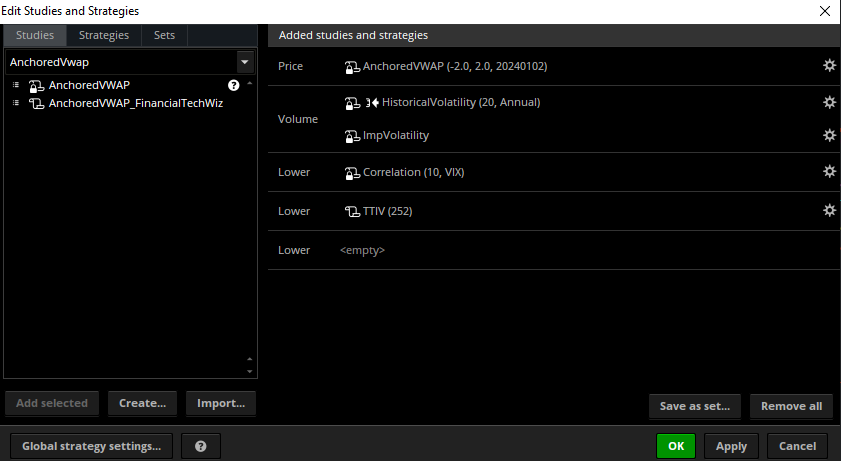

To use the anchored VWAP on thinkorswim, navigate to a chart, then click the beaker icon to open studies. Search for “AnchoredVWAP” and then click add selected. Click apply, and the study will be added to your chart.

You can also adjust the anchor date, color, style, and other settings by clicking on the gear icon in the studies tab.

Anchored VWAP vs. VWAP Compared

The traditional VWAP is only used intraday, primarily for day traders, while the anchored VWAP allows you to determine the volume-weighted average for a longer time period than just one day.

The traditional VWAP can help you gauge whether you are getting a good deal on your trades based on the average price of that day. The anchored VWAP can help you gauge whether you are getting a good deal on your trades based on the average price since a certain event or date.

For example, if you want to know whether you are buying or selling at a fair price relative to the market sentiment since the last earnings report, you can use the anchored VWAP with the anchor point set at the earnings date.

If you want to know whether you are buying or selling at a fair price relative to the market sentiment since the beginning of the year, you can use the anchored VWAP with the anchor point set on January 1st.

The traditional VWAP can also be used as a dynamic support and resistance level within a trading day, as prices tend to bounce off or break through it. The anchored VWAP can be used as a dynamic support and resistance level over a longer time frame, as prices tend to bounce off or break through it as well.

Raindrop charts are another great way to view the VWAP for the first and second part of the day.

Anchored VWAP – Bottom Line

The anchored VWAP is a useful trading indicator that can help you identify support and resistance levels based on various reference points. You can use it to confirm trends, spot reversals, gauge market sentiment, and enter or exit trades.

If you want to try out this indicator for yourself, you can get a free trial of either TradingView or TrendSpider using our affiliate link.

When you use our affiliate link, you will also get a discount on their premium plans. You can read our articles on how to get a TradingView free trial and how to get a TrendSpider discount using our coupon code FTW25 at checkout.

Disclaimer: Financial Tech Wiz is an affiliate of TradingView and TrendSpider, and will be compensated if you purchase a TrendSpider or TradingView subscription using our affiliate link or discount code.

– Free trading journal template & cheat sheet PDFs

– Custom scanners, watchlists, & market commentary

– Access our free trading course and community