What is the Most Successful Options Strategy

Options trading may seem complex, but there are various basic options strategies investors can use to enhance their portfolio’s returns.

Many investors jump into options trading with a lack of knowledge of the most successful options strategy.

To stand a chance of making consistent income, you must focus on selling option premium.

You can buy put options as stock insurance to hedge your portfolio, but this is not the most successful options strategy due to factors like theta working against you.

The Best Options Strategies

Selling options is the most successful options strategy, and there are backtests performed by the CBOE to prove this point. The first strategy on the list is selling puts and the cash-secured put.

Selling Cash-Secured Puts

When you sell a cash-secured put, you are paid a cash premium for promising to buy 100 shares of stock at the put’s strike price.

For example, if you sell a $100 strike put on $AAPL, you are promising to buy 100 shares of $AAPL at $100 per share and collect a cash premium.

There are various backtests on selling put options, showing that selling puts provides similar returns to the S&P 500 index with less volatility.

You can also use the S&P 500 futures options to sell premium with span margin.

If you want a broker built for options traders, consider signing up for a tastytrade brokerage account.

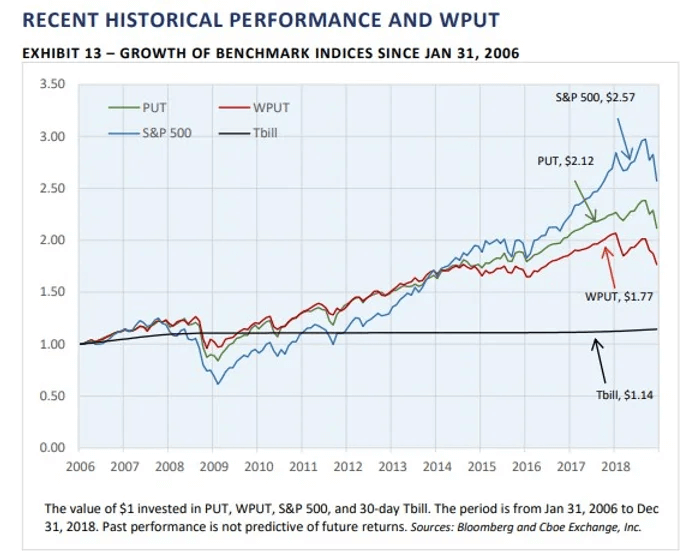

The image above shows the ticker symbols $PUT, $WPUT, and $SPY.

$PUT is the CBOE put write index that sells ATM one-month options and invests the proceeds into T-Bills.

$WPUT sells weekly put options and rolls each week.

$SPY is the S&P 500 index. This chart also uses total return, so the $SPY line includes dividends.

While the $SPY returns are higher, this is because of the massive bull run that has occurred since 2009.

However, it is critical to notice that selling puts drastically outperformed the market in the 2008 financial crisis.

The stock market does not always rally, and selling put options will give you similar returns with less risk in the long run.

Selling Covered Calls

The covered call strategy is when you own 100 shares of a stock and promise to sell them by writing a call option.

For example, if you own 100 shares of $AAPL at $100 per share, you can sell a $110 call option and promise to sell these shares at $110.

You will get paid a premium to do this, and in the worst case, you are forced to sell your shares at a profit and collect a premium.

If you cannot afford 100 shares of a stock, you can utilize the poor man’s covered call strategy.

Selling covered calls comes with the same risk profile as selling cash-secured puts. The difference is that you must own shares to sell covered calls.

Therefore, investors who already own shares of stock can easily sell covered calls to generate income in their portfolios.

You can also combine the cash-secured put and covered call strategy, which is the wheel option strategy.

Delta-Neutral Options Strategy: Iron Condor

The iron condor is a delta-neutral options strategy, meaning you want the stock to trade sideways after selling an iron condor.

Iron condors attract beginner options traders because it may seem like the iron condor will make money regardless of how the stock moves.

However, bullish premium-selling strategies are generally better since the stock market has a positive drift and goes up in the long term.

The jade lizard options strategy is similar to the iron condor, except without a long put.

Delta-Neutral Options Strategy: Put Broken Wing Butterfly

A put broken wing butterfly strategy is one of the least risky put selling strategies.

A put broken wing butterfly is created by selling a bullish put spread and buying a bearish put spread to hedge.

Since the bullish put spread is further OTM, it will decay quicker than the bearish put spread, providing steady returns with low volatility.

Pros and Cons of Options Trading

When deciding whether you want to employ options trading in your portfolio, consider the following pros and cons. These will primarily be based on option selling strategies and not buying options.

Pros:

- Better risk-adjusted returns than holding index funds

- Your capital is more liquid

- You can trade 1256 contracts for tax advantages

Cons:

- Tax treatment is worse than long-term investing

- Commission fees

- Active management is required

Learn the Most Successful Options Strategy

There are various options available if you want to learn how to trade the most successful options strategies.

Read Options Trading Books

If you read the best options trading books, you can learn from the greatest traders ever.

Knowledge is power, and reading books is one of the best ways to improve your knowledge about trading options.

Learn Technical Analysis

Technical analysis involves studying chart patterns using indicators and volume. Using technical analysis with your options trading will allow you to find optimal entry and exit points using charts.There are free charting tools like TradingView that allow you to start today with just an internet connection. If you sign up using our affiliate link, you can get a free trial and a discount on your subscription.

– Free trading journal template & cheat sheet PDFs

– Access our custom scanners and watchlists

– Access our free trading course and community!